ETF Trends caught up with John Patrick Lee, CFA, Product Manager at VanEck to discuss video gaming and esports investing opportunities.

Were there any adverse effects of the COVID-19 pandemic on video gaming and esports, or were there only positive effects?

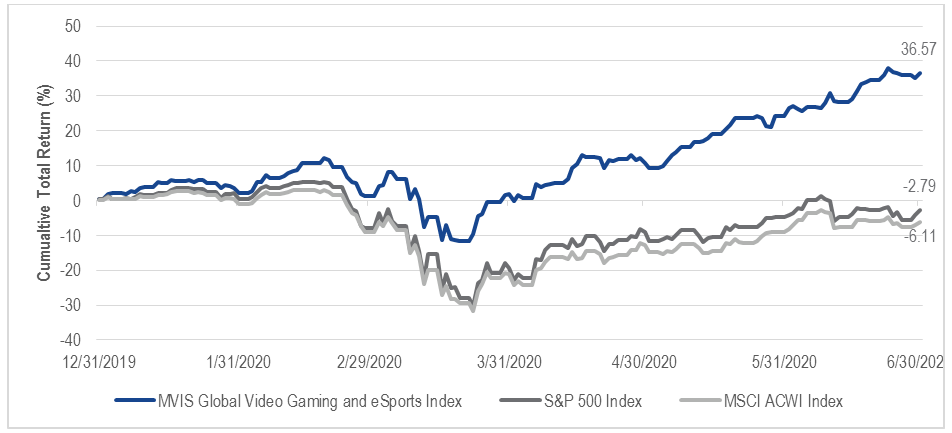

As widely reported in the media, video game stocks have weathered the storm and outperformed the broad market as defined by the S&P 500 and MSCI ACWI Indexes, thus far in 2020.

Video Game Stocks Outperforming Broad Market YTD

Source: Morningstar. Data from 12/31/19 – 6/30/2020. Past performance is not a guarantee of future results.

Video game engagement has broken records across a variety of metrics since the virus shutdown began. Esports recently set a world record for live TV audience with the eNASCAR races that were held in place of regular, live races.[1] However, some esports leagues and tournaments have been put on hold. For instance, the League of Legends Mid-Season Invitational was cancelled due to travel restrictions put in place around the world.

After taking into consideration all aspects of the video gaming and esports ecosystem, we believe the effects of COVID-19 have been a net positive for both video gaming and esports. People around the world have been turning to video games to entertain themselves and each other online, and we view the spike in engagement as an acceleration of trends that have been in place for years.

The growth of the video games industry benefits game publishers, but who and what kind of business model benefits from esports?

We believe that video game publishers will benefit the most from the esports phenomenon, though keep in mind that esports revenues are still much smaller than video game industry revenues.

Video game publishers are uniquely positioned to benefit for a number of reasons:

- First, the publisher owns the rights to the game. That means that any time an esports competition is held, the publisher is paid for the rights to play the game in competition.

- Second, publishers have been launching their own leagues, such as the Call of Duty League (owned by Activision) or the Fortnite World Cup (owned by Epic). Any profits made by the league goes straight to the publisher.

- Third, media rights are set to become the largest esports revenue stream by 2022. If the publisher owns the rights to the game as well as the league’s media rights, it effectively owns the majority of all esports revenues.

- Finally, popular esports leagues or events may create a halo effect for a game and help boost sales. When a 16-year old from Pennsylvania wins $3 million dollars at the Fortnite World Cup, that generates headlines and social media chatter, which leads to more players in the game.

Besides video game publishers, what other types of companies may benefit from the growth of the video game industry?

The MVIS Global Video Gaming and eSports Index employs a pure-play rule, which means that a company must generate more than 50% of its revenues to be initially eligible for index inclusion. Starting with that framework, here are some different companies that are involved in the industry:

Semiconductors: Certain semiconductor companies, like Nvdia and AMD, generate revenues by building the graphics processing units (GPUs) that underpin the gaming experience. These chips are used in PC computers, consoles and cloud gaming platforms and facilitate a seamless gaming experience.

Streaming websites: Video game fans and content creators use streaming websites to post video game content and to follow their favorite content creators. Twitch.tv (owned by Amazon) is the most popular video game streaming website in the U.S, while China’s biggest streaming sites are Huya, DouYu and Bilibili.

Hardware: To play video games competitively, the majority of gamers use high-end hardware, including keyboards and headphones. Some hardware companies, like Turtle Beach, are heavily favored in the gaming and esports community and would be considered pure-play.

Investing in Video Gaming and Esports

Determining which games will become hits is difficult, so investors may wish to invest in a diversified basket of video gaming and esports stocks. Such an approach may allow investors to express a view on the sector without having to know which specific stock will outperform over the future. The index methodology which guides VanEck Vectors® Video Gaming and eSports ETF (ESPO) provides exposure to companies in the video gaming and esports industries.

Currently, the MVIS® Global Video Gaming and eSports Index is heavily tilted towards video game publishers (including the publicly traded companies that operate the largest esports leagues) and semiconductor companies. As the esports industry matures, smaller esports names, such as streamers like HUYA and Modern Times Group, could grow to become a meaningful part of the Index. In the interim, the index captures the esports phenomenon as part of the broader evolution of video gaming, creating awareness of the industry’s potential to reshape how people spend their time and entertainment dollars.

To learn more about ESPO and the high growth potential of the global video gaming and esports industry, visit vaneck.com/esports/.

Esports: Competitive gaming at a professional level and in an organized format (a tournament or league) with a specific goal (i.e., winning a championship title or prize money) and a clear distinction between players and teams that are competing against each other.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in the ETF, please click here https://www.vaneck.com/etf/equity/espo/holdings/.

Disclosure Information

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

An investment in the Fund may be subject to risks which include, among others, investing in the video gaming and esports companies, software, internet software & services and semiconductor industries, equity securities, communication services and information technology sectors, small- and medium-capitalization companies, issuer-specific changes, special risk considerations of investing in Asian, Japanese and emerging markets issuers, foreign securities, foreign currency, depositary receipts, market, operational, cash transactions, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund’s returns. Small- and medium-capitalization companies may be subject to elevated risks.

MVIS Global Video Gaming and eSports Index is the exclusive property of MV Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MV Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. The VanEck Vectors Video Gaming and eSports ETF is not sponsored, endorsed, sold or promoted by MV Index Solutions GmbH and MV Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

Index returns are not Fund returns and do not reflect any management fees or brokerage expenses. Certain indices may take into account withholding taxes. Investors can not invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. Index returns assume that dividends have been reinvested.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright©2018 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P®is a registered trademark of S&P Global and Dow Jones®is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

The S&P 500 Index or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies.

The MSCI ACWI Index is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world. The MSCI ACWI is maintained by Morgan Stanley Capital International (MSCI) and is comprised of stocks from 23 developed countries and 24 emerging markets.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus , which contains this and other information, call 800.826.2333 or visit vaneck.com/etfs. Please read the prospectus and summary prospectus carefully before investing.

[1] https://www.foxnews.com/auto/foxs-virtual-texas-nascar-esports-record