Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, James Comtois and Nick Peters-Golden discussed the pros and cons of biotech ETFs right now.

James Comtois, staff writer, VettaFi: Greetings, Nick! I’m not sure if you’ve noticed, but Moderna’s stock has risen 614% over the past five years. Seeing this reminds me of two things. First, I probably should have been a chemist rather than a financial writer. And second, biotech ETFs have the potential to offer truly outsized returns for investors.

Check out the Nasdaq Biotechnology Index. It’s up nearly 44% for the three years ended May 5. That’s well above the S&P 500’s 6% during the same period.

Biotech-focused NBI has outperformed SPX YTD.

Source: YCharts

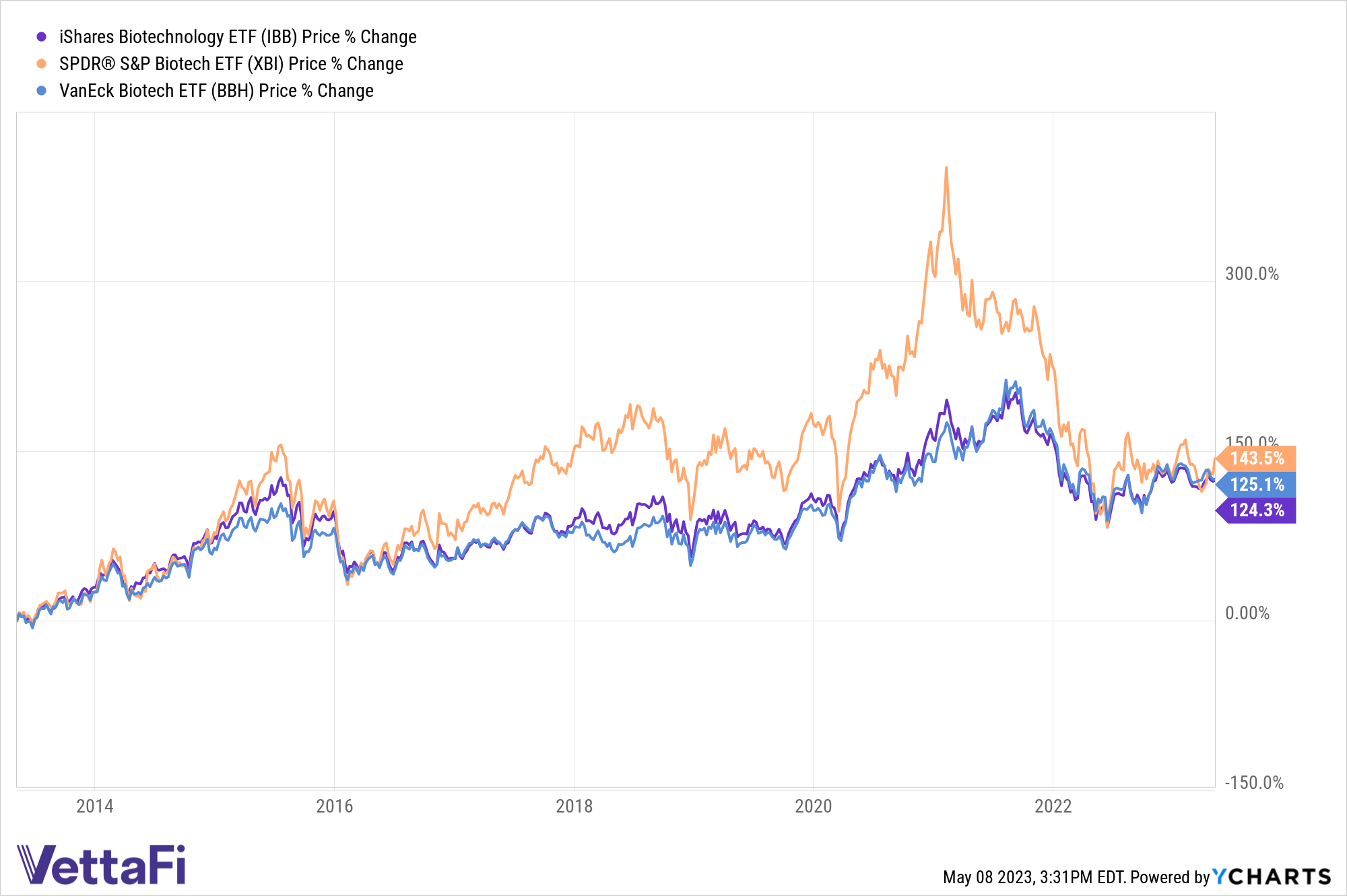

Also, several biotech ETFs are seeing significant long-term outperformance. The iShares Biotechnology ETF (IBB), the SPDR S&P Biotech ETF (XBI), and the VanEck Biotech ETF (BBH) saw triple-digit percentage increases over the past decade.

The three biotech ETFs IBB, XBI, and BBH have seen more than 100% price change over the last decade.

Source: YCharts

Small, biotechnology companies that specialize in just one product can become huge industry juggernauts almost instantly. And biotech is one of the few sectors in the market where this can happen. Case in point: Moderna became a household name virtually overnight.

See more: “ALPS’ Biotech ETF SBIO Week’s Top Performer“

So, how about you, Nick? Do you think biotech ETFs are the shot in the arm that portfolios need? Or do you see them as bad medicine?

High Failure Rate

Nick Peters-Golden, staff writer, VettaFi: Hi James! I’m very excited to chat about biotech ETFs with you. They’ve been picking up some interesting engagement on the ETF Database here. However, I would urge our readers to be cautious towards the space. It has significant benefits for society, but in 2023, it may not be the best place to invest.

Let’s dig into the biggest challenge of biotech: the failure rate. According to some sources, it can be as high as 90%. And in other studies, half of drugs released since 2004 failed to live up to sales forecasts. It’s the biggest hurdle for biotech firms. Quite a few collapse in the course of their work. Whether that’s due to missing FDA approval for a key product or running out of money in R&D, it’s a risky business.

So the challenges for biotech firms are numerous. Forecasting R&D costs and cash flow, hiring in the early stages of a firm’s life, and crafting a long-term road map are just some of the asks.

The difficulties of biotech ETF investing aren’t limited to the people running the firms, either. So it’s hard for investors and analysts to predict where these firms will go. They’re so different from other types of tech or growth investing – mainly because of how little revenue they see. That makes them harder to assess on normal metrics like cash flow models, for example.

Biotechs are at the frontier of R&D, but generally, unless they’re acquired or happen to be one of the few that explode in value, they don’t tend to offer investors significant revenue or income. That means very rare dividends, too.

Perhaps the biggest problem that should strike fear into the hearts of investors is the FDA itself. For our purposes discussing biotech, the FDA is, at best, an impartial, but very slow, adjudicator of which drugs go to market. At worst, it’s subject to regulatory capture, not nearly as interested in fairness or protecting consumers as it is in fighting ideological, left or right-wing battles.

That’s a significant negative externality for an already complicated space. Color me skeptical of these risks paying off.

Strong, Sustainable Demand

Comtois: I will concede that investing in biotech can be very, very risky. There are a lot of companies that go belly-up or turn out to be total scams. That’s why ETFs are a great vehicle for the biotech sector. Biotech ETFs often include well-established industry giants along with emerging companies at the forefront of medical research and development. The diverse basket of securities that ETFs provide can mitigate volatility and risk. They can also increase the chances of investing in the right companies.

Biotech ETFs also target an industry that will be around for quite a while. The world’s population is getting older. By 2030, 1 in 6 people in the world will be at least 60 years old. By 2050, the number of people aged 60 years and older will double to about 2.1 billion globally. There’s a steady demand for advancements in breakthrough drug and medical treatments from a growing and aging global population. Plus, the pandemic has sadly taught us that we still need to solve a lot of medical issues because of COVID.

So, as long as we need breakthrough drug treatments – which appears to be forever – this industry will keep growing.

Is the Market Environment Hostile to Disruptive Tech?

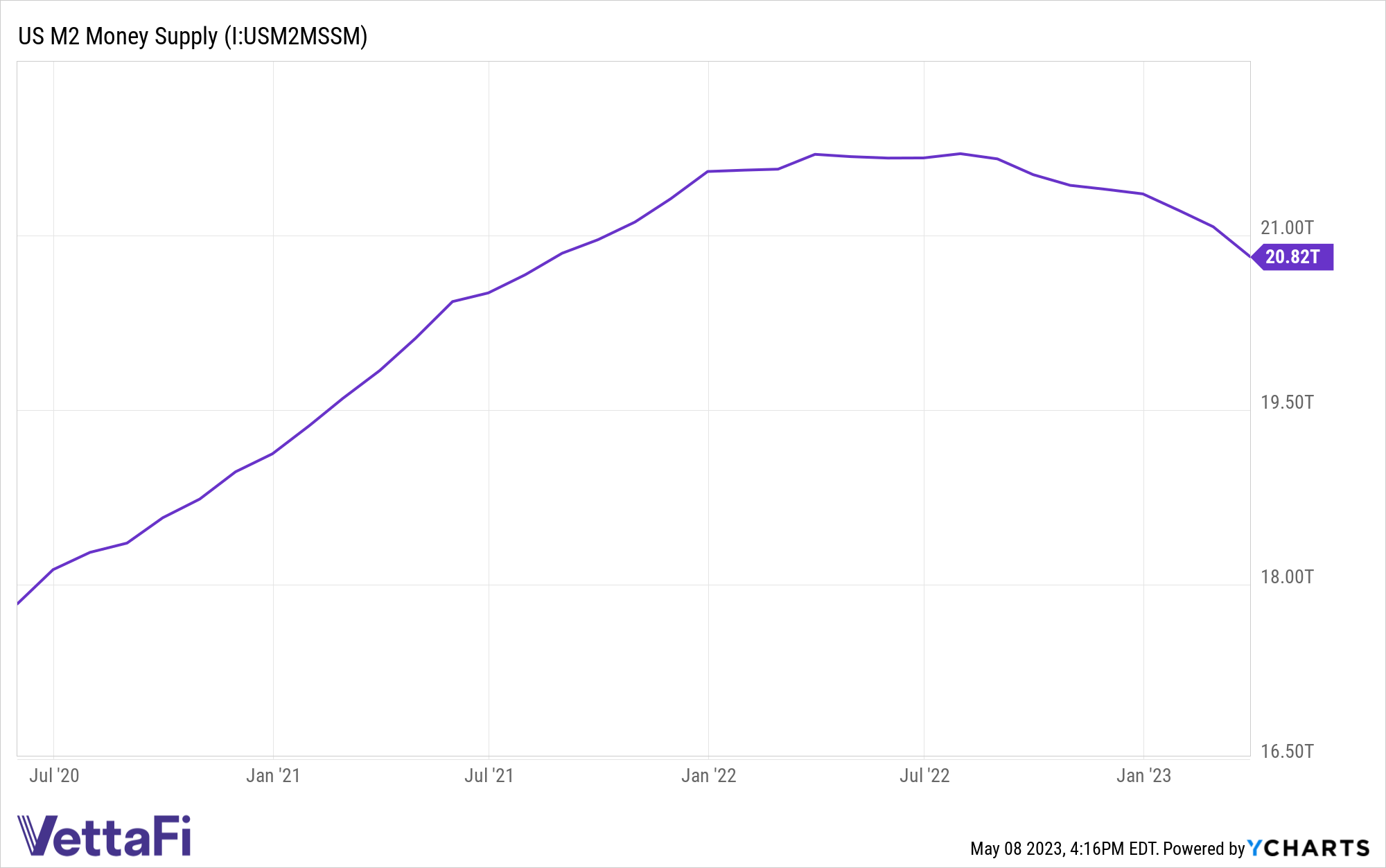

Peters-Golden: Here’s another concern: this isn’t the same market environment that saw disruptive innovation spaces like biotech do so well. The Fed has raised rates faster than it has in decades, and it’s sucked up all that cash that was available for young firms. There’s a reason that the metaverse, NFTs, and, frankly, crypto have boomed in the last few years – because there was liquidity for it.

M2 supply is dropping precipitously and no longer offering the liquidity on which disruptive tech thrived.

Source: YCharts

Now the M2 supply is crashing as rates are rising. That means less liquidity for those names, a point of research over at Richard Bernstein Advisors (RBA). RBA’s research focuses on macro-driven research rather than stock picking. They’re laser-focused on profit acceleration and deceleration, emphasizing that this is not the environment for sectors like biotech. RBA has claimed that “speculation” was a key driver for interest in the fringiest growth tech areas.

For more: “Bernstein: Market “Purely Based on Speculation“

You can see the impact of interest rate hikes in the bank crisis. Many small biotechs relied on Silicon Valley Bank (SVB), but its collapse has highlighted how much cash has dried up for young drug-making firms. Many of these biotech names are staring down what some call the “Series A cliff.”

According to data from SVB itself, 356 biotech firms raised Series A financing between July 1, 2020 and December 31, 2021. Just 102 drug firms announced that they would be engaging in a Series B round in 2022, by contrast. The Series B round according to a former exec at SVB has often been the time for broader investment interest to come in to boost initial venture money at biotech firms. Add in interest rate hikes, and that cliff looks like Dover.

Rising rates have also impacted the cost of refinancing debt for existing biotech firms. Just as the cost of refinancing home loans has risen, so too has the cost of debt risen for tech firms. As biotechs negotiate and renegotiate their debt, those rates are going to make it even tougher for them to survive.

High M&A Potential

Comtois: Rising rates impacting the cost of refinancing debt for biotech firms is indeed a major headwind. It also exacerbates the divide between the big winners and losers in this space. However, there are ways to mitigate this risk. As I mentioned before, ETFs reduce volatility and hedge one’s bets.

But there’s another tailwind. The biotech sector has a high potential for M&A.

M&A in this sector is climbing as larger companies repeatedly acquire small biotech companies that develop breakthrough medicines. Some of the most influential medicines, including the cancer-treating Keytruda and the anti-inflammatory agent Enbrel, are arguably thanks to M&A.

And that’s a huge benefit to investors. When larger companies buy smaller ones to access their breakthrough products, it can lead to huge gains for shareholders of the acquired companies.

It All Comes Back to Clients

Peters-Golden: But at the end of the day, investors and advisors have to ask themselves what they want from biotech ETFs. Are you a true believer in James’ case that biotech has an especially high upside, with all those positive externalities? Or are you just looking to provide your client or your portfolio with solid growth or tech exposure?

If the former, take James’ advice, certainly. But I imagine a great many biotech ETF-curious investors and market watchers are in the latter category. I can’t knock anyone for still wanting to get growth exposure especially with big tech carrying the S&P 500 so far this year. Let’s look at some of the alternative ways to get that exposure that mitigates the risks I mentioned above.

First off, consider using a quality screen when looking to growth. The American Century STOXX U.S. Quality Growth ETF (QGRO) is turning five years old this year and offers just that. QGRO tracks the iSTOXX American Century USA Quality Growth and charges a 29 basis point fee. It’s also returned 3.2% over the last six months with $404 million in AUM.

For something more specifically tech-minded, one should also look to the iShares U.S. Technology ETF (IYW), which has not only added $781 million YTD but also returned 25.1% YTD according to VettaFi. IYW charges 39 basis points and has $10.4 billion in AUM, too.

Finally, looking outside the tumultuous, rising rate-impacted U.S. economy, how about a foreign equities ETF? The WisdomTree Global ex-U.S. Quality Dividend Growth Fund (DNL) charges 42 basis points to track the WisdomTree Global ex-U.S. Quality Dividend Growth Index and has added $28 million over the last month according to VettaFi, returning 12.4% on a YTD basis.

All three present interesting, bulky alternatives to biotech ETFs. Investors and advisors looking for growth-style returns without biotech risk may want to consider them for shortlists.

Do Your Homework

Comtois: Biotech investing offers the potential for outsized returns. But you need to do your homework. There are a lot of startup firms that go nowhere. Plus, there’s a ton of scientific jargon to wade through that the average investor or analyst, for that matter, can’t be expected to understand.

This is probably why it’s safer to go with ETFs. If you can find an actively managed biotech ETF, like the ARK Genomic Revolution ETF (ARKW), even better. And while they target a risky sector, biotech ETFs can provide huge rewards.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.