Another week has gone, and it’s foreign equities that led in the week’s top-performing ETFs. Investors looked abroad to both commodities centers and events like Turkey’s election in their ETFs. Turkey’s initial elections concluded over the weekend, but with a runoff expected, ETFs may be looking at Turkey investing. Investors can use both Brazil and Turkey ETFs to play both a jump in commodities and in Turkey’s interest.

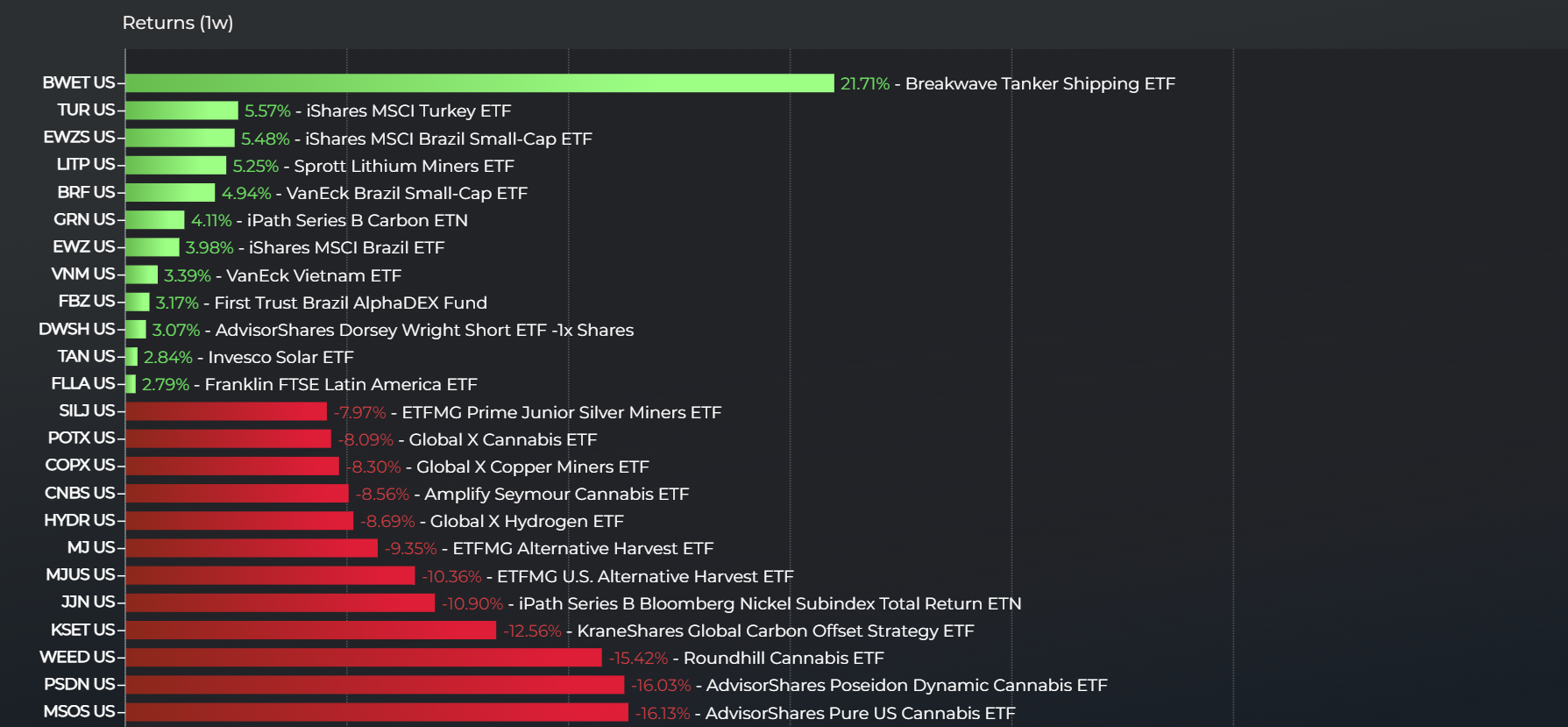

Commodities, Brazil, and Turkey interest led among the top returning ETFs according to Logicly.

The Breakwave Tanker Shipping ETF (BWET) produced the strongest returns over the last week according to Logicly, returning 21.7% since last Monday. BWET’s strength suggests an uptick in commodities interest, and combined with Brazil and Turkey’s interest, buoys the ongoing case for EM equities. Amid ongoing debt ceiling drama and recessionary concern, foreign equities have presented an intriguing alternative to an overvalued U.S. market.

See more: “Rising Emerging Markets ETF AVEM Hits $3 Billion“

The iShares MSCI Turkey ETF (TUR) and the iShares MSCI Brazil Small-Cap ETF (EWZS) followed some way behind BWET. The duo saw similar returns, up 5.6% and 5.5% over the last week. Turkey investing interest stems from the prospect of a new government healing the economy — but Brazil’s election has passed. Interest in Brazil may stem from ongoing commodities demand elsewhere.

Three other Brazil ETFs hit the top ETF ranks over the last week, including one broader Latin America strategy. The VanEck Brazil Small-Cap ETF (BRF) returned 5%, while the Franklin FTSE Latin America ETF (FLLA) finished last with 2.8%.

Among commodities, lithium stood out. The Sprott Lithium Miners ETF (LITP) returned 5.3%. while the Invesco Solar ETF (TAN) returned 2.8%. Vietnam also made an appearance in the list of foreign markets ETFs in the VanEck Vietnam ETF (VNM) up 3.4%. Taken together, iShares and VanEck stood out in the top ETFs, with the latter’s single-nation ETF roster showing admirable strength.

Looking ahead, investors may want to continue to eye commodities demand as well as the potential of emerging markets.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.