Today, October 13, might belong to Amazon Prime Day, but it’s been prime time for bond ETFs since March. The Federal Reserve’s decision to shore up the bond market has since sparked a heightened interest in bonds of all varieties, resulting in $170 billion in inflows.

“Things were looking pretty bleak back in March for bond exchange-traded funds,” a Bloomberg article published on Yahoo Finance noted. “The Covid-19 selloff created a liquidity crunch that drove their prices to trade at deep discounts to the value of the underlying assets. Skeptics questioned whether these products could ever be trusted again.”

“Then the Federal Reserve stepped in. On March 23, it announced that that it would begin buying corporate debt ETFs,” the article added. “This ignited a wave of front-running investments and served as a stamp of approval for the market sector.”

As such, Federal Reserve chairman Jerome Powell is on the list of people to thank this Thanksgiving for bond investors.

“A thank-you note to Jerome Powell may be in order,” the article said. “Flows into U.S. fixed-income products this year have surpassed the total for all of last year. New funds are coming down the pipeline. And investors are increasingly using corporate bond ETFs to bet on an economic recovery and hedge against what could be a volatile post-election season.

“The events from the onset of the pandemic have only accelerated the growth of fixed-income ETFs,” said Matthew Bartolini, head of SPDR Americas Research at State Street Global Advisors.

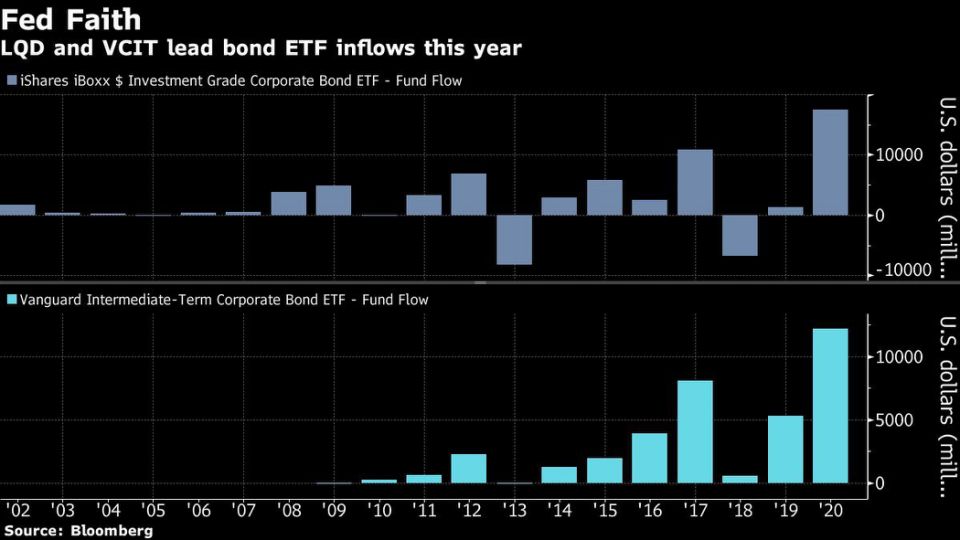

Topping the list of inflows in 2020 are the iShares iBoxx $ Invmt Grade Corp Bd ETF (LQD) and the Vanguard Interm-Term Corp Bd ETF (VCIT).

“So far this year, inflows to bond funds total $170 billion, compared with $154 billion in all of 2019, according to data compiled by Bloomberg,” the article added.

A Twist on High Yield Exposure

Fixed income investors may want to get exposure to debt with a twist via funds like the VanEck Vectors Fallen Angel High Yield Bond ETF (BATS: ANGL). ANGL seeks to replicate as closely as possible the price and yield performance of the ICE BofAML US Fallen Angel High Yield Index, which is comprised of below investment grade corporate bonds denominated in U.S. dollars that were rated investment grade at the time of issuance.

ANGL essentially focuses on debt that has fallen out of investment-grade favor and is now repurposed for high yield returns with the downgraded-to-junk status. Buying household corporate bond ETFs was to be expected by the Fed when they implemented their bond purchasing program earlier this year, but they mixed up their moves nicely with high yield debt purchases like ANGL.

For more market trends, visit ETF Trends.