Senior Director, Global Research & Design, S&P Dow Jones Indices

In recent years, one noticeable development in the corporate bond market has been the rapid growth of the BBB bond market in terms of its absolute amount and relative share of investment-grade corporate bonds. We wrote a blog on this topic in May 2019 detailing the growth of the BBB bond market and its impact on the credit fundamentals of the overall investment-grade bond sector. As of May 2020, BBB corporate bonds grew by 214% to USD 3.6 billion over the past 10 years, while their share in overall investment-grade bonds increased from 38% to 54%.

Prior to the recent market turmoil due to COVID-19, the rapid increase of BBB bonds had already raised concerns among investors that the high-yield bond market might have difficulty absorbing a wave of potential downgrades with a credit market correction. Some investors have been paying closer attention to the rating outlooks for BBB bonds to monitor their overall credit quality. In this blog, we review the historical composition of BBB bonds with negative credit outlooks and the annual transition of bonds that started the year with BBB ratings but were downgraded to join the high-yield bond index by year-end. The BBB bond and high-yield bond universes are represented by the S&P U.S. Investment Grade Corporate Bond BBB Index and S&P U.S. High Yield Corporate Bond Index, respectively.

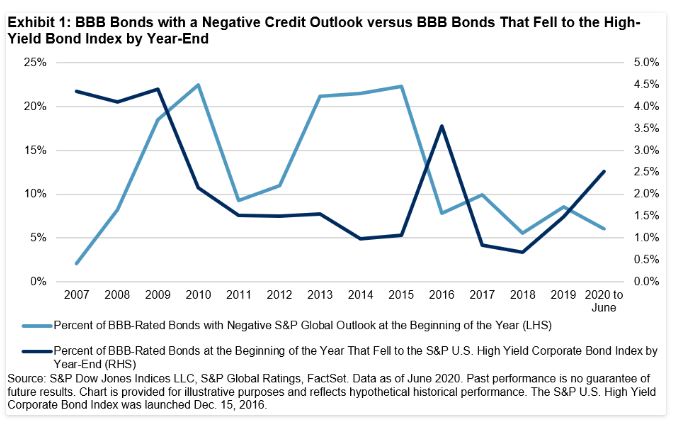

Exhibit 1 compares (1) the share of BBB bonds with a negative S&P Global ratings outlook at the beginning of the year and (2) the share of BBB bonds that were downgraded to join the high-yield bond index by year-end. Historical data since 2007 shows that, as expected, BBB bonds with a negative rating outlook were not always downgraded to a high-yield rating within a year’s time (2010-2015). However, as of June 16, 2020, 2.5% of BBB bonds had been downgraded to high-yield bonds since the beginning of the year, higher than the average of 1.0% over the past three years.

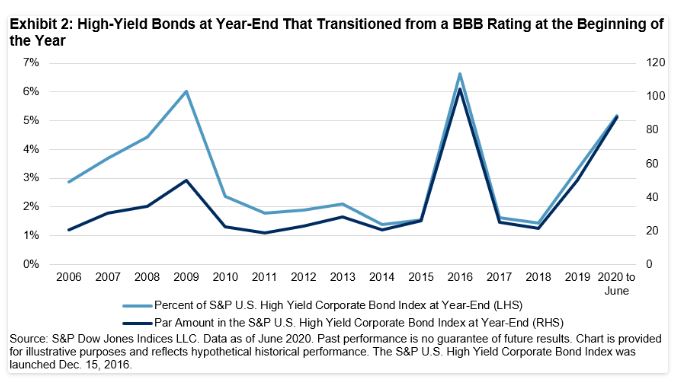

Exhibit 2 shows the annual transition of BBB bonds to the S&P U.S. High Yield Corporate Bond Index from the beginning of the year to the end of the year. The share of BBB bonds that were downgraded to below an investment-grade rating has been on the rise since 2019. As of June 16, 2020, 5.2% of the S&P U.S. High Yield Corporate Bond Index came from the S&P U.S. Investment Grade Corporate Bond BBB Index as of the end of 2019, the highest since 2009 and 2016. These fallen angel bonds from the BBB rating alone have added USD 88 billion of supply to the high-yield bond universe so far this year.

The credit market has seen a significant widening of spreads during the COVID-19 selloff. With the Fed’s aggressive measures of purchasing corporate bonds and ETFs, credit spreads have retraced 83% and 72% of the recent widening in the investment-grade and high-yield bond markets, respectively, as of June 16, 2020. However, as Fed Chairman Jerome Powell warned this week, a full U.S. economic recovery will not occur until the pandemic has been brought under control, and significant uncertainty remains about the timing and strength of the recovery. A slow economic recovery combined with plunging oil prices should keep pressure on credit quality and rating downgrades. Rating downgrades in BBB bonds particularly could contribute meaningfully to the supply of high-yield bonds and need to be closely monitored.