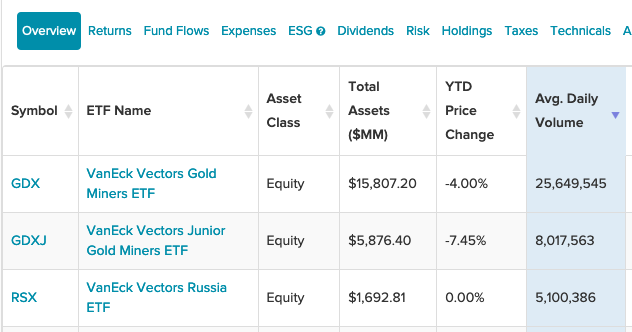

A double dose of gold and Russia are the ETF themes that have been seeing heavy average daily volume in VanEck’s suite of ETFs. Check out the three ETFs below.

VanEck Vectors Gold Miners ETF (GDX): GDX seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE® Arca Gold Miners Index®. The index is a modified market-capitalization weighted index primarily comprised of publicly traded companies involved in the mining for gold and silver. The fund offers:

- The Nation’s First Gold Miners ETF: An industry driven by demand across regions and segments of the market

- Pure Play with Global Scope: Companies must derive at least 50% of total revenues from gold mining and related activities to be added to the Index

- Convenient Customization: Customize overall commodity exposure with targeted allocation to gold mining companies

VanEck Vectors Junior Gold Miners ETF (GDXJ): GDXJ seeks to replicate as closely as possible the price and yield performance of the MVIS® Global Junior Gold Miners Index. The index includes companies that generate at least 50% of their revenues from gold and/or silver mining/royalties/streaming or have mining projects with the potential to generate at least 50% of their revenues from gold and/or silver when developed. GDXJ boasts:

- One-Traded Access to Junior Gold Miners: An industry that includes smaller exploratory or early development phase companies that are responsible for many gold reserve discoveries worldwide

- Pure Play with Global Scope: Companies must derive at least 50% of total revenues from gold or silver mining and related activities to be added to the Index

- Convenient Customization: Customize overall commodity exposure with targeted allocation to junior gold mining companies

VanEck Vectors Russia Small-Cap ETF (RSXJ): RSXJ seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Russia Small-Cap Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index.

The index includes securities of Russian small-capitalization companies. It will normally invest at least 80% of its total assets in securities of small-capitalization Russian companies. Summarily, RSXJ gives investors a:

- Small Cap Focus: Small-caps may offer greater exposure to domestic growth, less exposure to global cyclicals.

- Value Opportunity: Russia’s equity market is currently offering deep discounts when compared to other emerging markets.

- Pure Play: Fund companies must be incorporated in or derive at least 50% of total revenues from Russia to be added to the index.

For more news and information, visit the Tactical Allocation Channel.