SPHD isn’t positioned to do very well in 2018, but long-term investors shouldn’t shy away.

SPHD has delivered alpha of 400 basis points above the S&P 500 and 600 points above the Large Value group over the fund’s history. The fund’s 30-day yield is now more than double that of the S&P 500. SPHD’s combination of low volatility, high yield and superior risk-adjusted returns still make it an ideal core holding, despite an expense ratio that’s a bit high.

Full disclosure right off the bat. I own shares of the PowerShares S&P 500 High Dividend Low Volatility ETF (SPHD). I have for years, and it remains one of my favorite dividend ETFs. But the market just hasn’t been kind to funds, such as SPHD, lately. In an environment that favors growth and momentum names, funds that focus on more mature, boring large-cap dividend payers have been left behind.

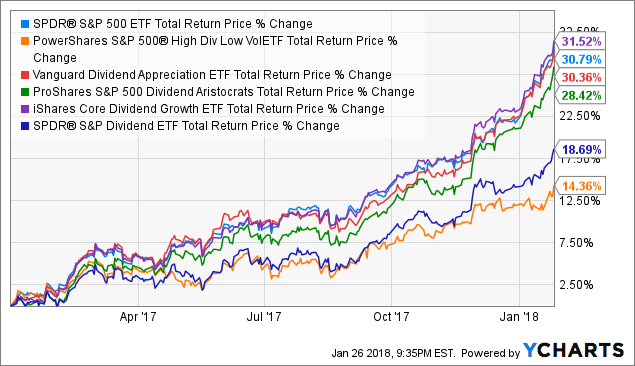

![]() The only group of dividend payers that has managed to keep up with the S&P 500 lately has been the dividend aristocrats. Since the end of 2016, the Vanguard Dividend Appreciation ETF (VIG), the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) and the iShares Core Dividend Growth ETF (DGRO) – all funds that invest in companies with long track records of paying and growing their dividends – has largely matched the S&P 500’s returns, although the SPDR S&P Dividend ETF (SDY) is a notable laggard.

The only group of dividend payers that has managed to keep up with the S&P 500 lately has been the dividend aristocrats. Since the end of 2016, the Vanguard Dividend Appreciation ETF (VIG), the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) and the iShares Core Dividend Growth ETF (DGRO) – all funds that invest in companies with long track records of paying and growing their dividends – has largely matched the S&P 500’s returns, although the SPDR S&P Dividend ETF (SDY) is a notable laggard.

SPY Total Return Price data by YCharts

And then there’s SPHD at the bottom. Granted, other high dividend funds, such as the Vanguard High Dividend Yield ETF (VYM) and the iShares Core High Dividend ETF (HDV) have similarly struggled to keep up, but SPHD has performed the most poorly of the biggest dividend ETFs. So how does a fund that trounced the S&P 500 in each of three straight years from 2014 to 2016 suddenly go from the top of the mountain down to the bottom of the trash heap? I’ve got a few ideas.