It’s one thing for a company to maintain their dividends, especially given the effects of the pandemic, but it’s another to actually grow those dividends over time. The Vanguard Dividend Appreciation Index Fund ETF Shares (VIG) does precisely that.

VIG seeks to track the performance of a benchmark index that measures the investment return of common stocks of companies that have a record of increasing dividends over time. The fund employs an indexing investment approach designed to track the performance of the Nasdaq US Dividend Achievers Select Index, which consists of common stocks of companies that have a record of increasing dividends over time.

The adviser attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

Overall, VIG:

- Seeks to track the performance of the NASDAQ US Dividend Achievers Select Index (formerly known as the Dividend Achievers Select Index).

- Provides a convenient way to track the performance of stocks of companies with a record of growing their dividends year over year.

- Follows a passively managed, full-replication approach.

Under the Hood of VIG

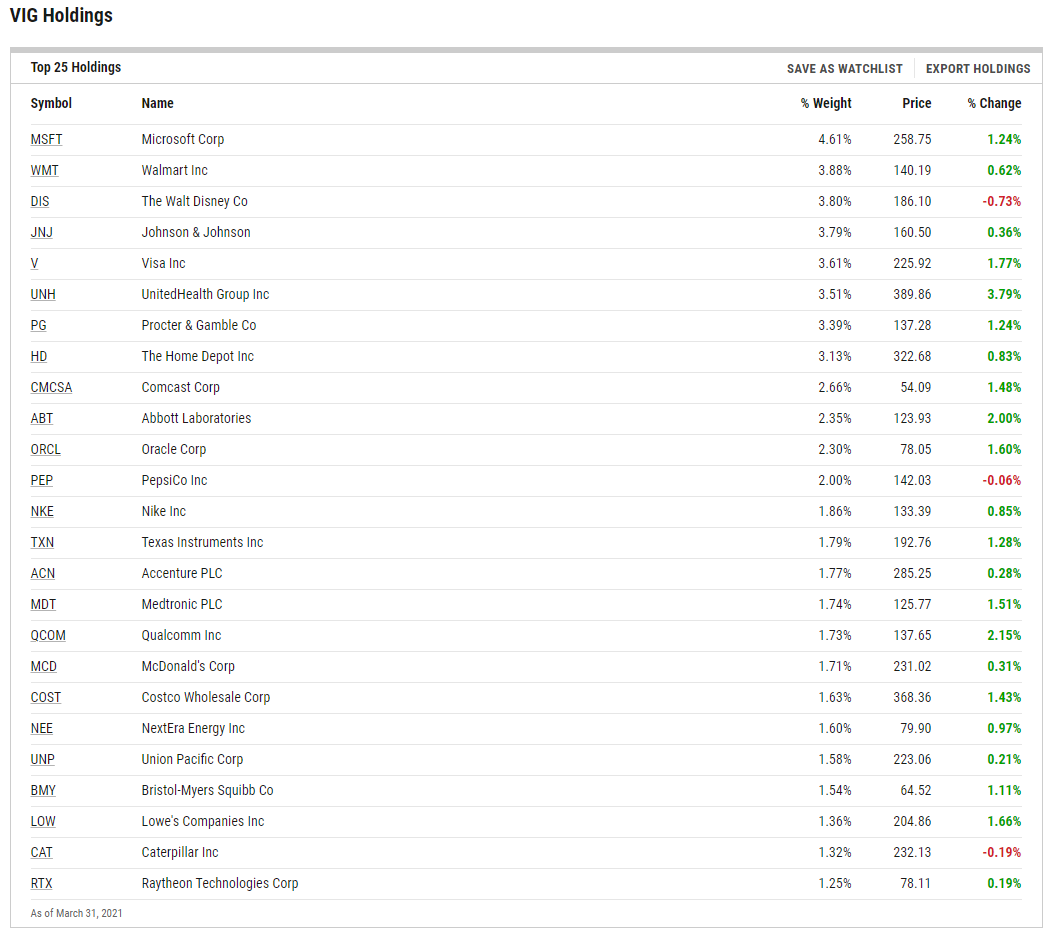

VIG’s top 10 holdings include companies with price stability as well as dividend growth over time. Names include Microsoft, Walt Disney, and Walmart to name just a few.

Given that list of names, VIG’s portfolio skews towards a blend of large cap equities. Investors get exposure to this growing dividend methodology at a paltry 0.06% expense ratio.

“Investors with a longer-term horizon should consider the importance of large cap growth stocks and the benefits they can add to any well-balanced portfolio, including dividends,” an ETF Database analysis suggested. “VIG is linked to an index consisting of roughly 180 holdings and exposure is tilted most heavily towards consumer staples, health care, and industrials.”

“Securities are chosen for inclusion in the fund based on their history of increasing dividends; only companies that have increased payouts for at least ten consecutive years are included in the fund,” the analysis added further. “Thanks to this focus, VIG only invests in companies that are most likely to continue to pay out dividends in the future making it a solid pick for dividend focused investors even if the diversification is a little lacking.”

For more news and information, visit the Smart Beta Channel.