Value’s getting the red carpet treatment, but investors shouldn’t shun the growth factor or the Vanguard Growth Index Fund ETF Shares (VUG).

For growth seekers, VUG tracks the performance of a benchmark index that measures the investment return of the CRSP US Large Cap Growth Index. The fund employs an indexing investment approach designed to track the performance of index, a broadly diversified index predominantly made up of growth stocks of large U.S. companies.

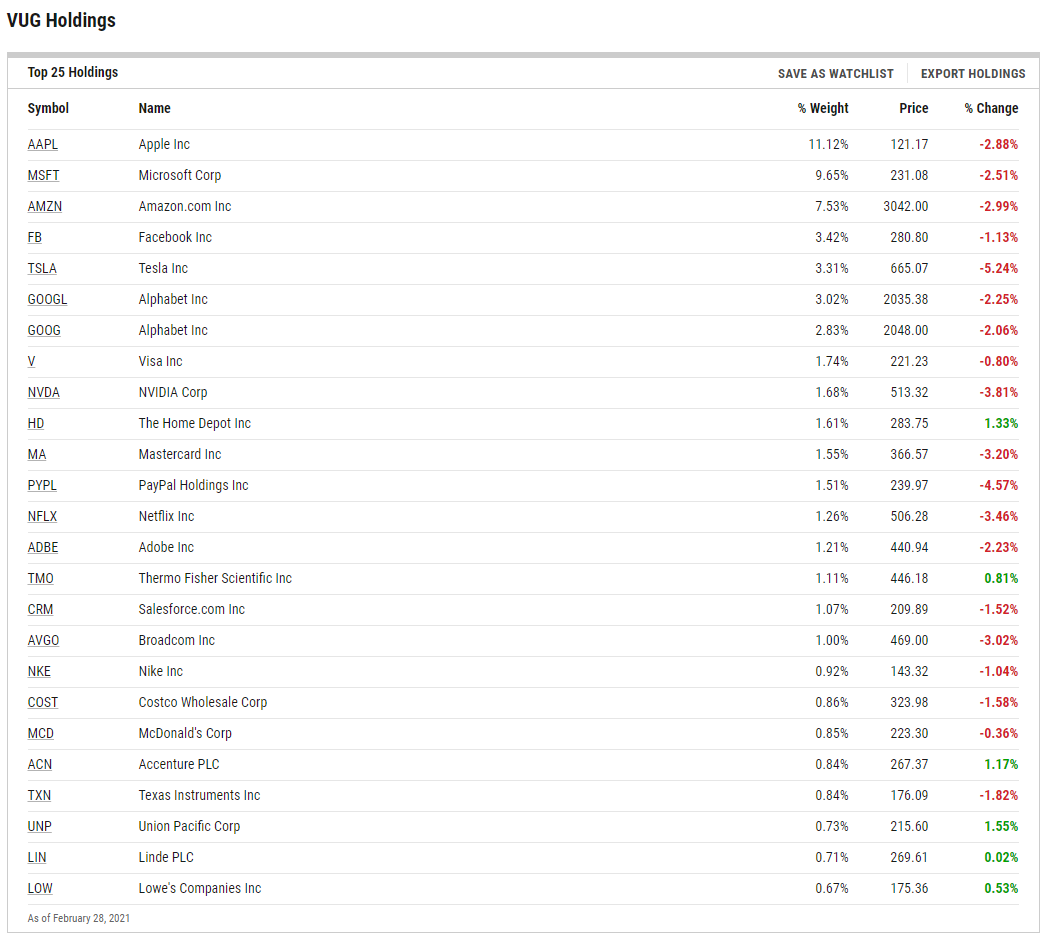

The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index. VUG’s expense ratio comes in at a low 0.04%.

“Investors with a longer-term horizon ought to consider the importance of growth stocks and the diversification benefits they can add to any well-balanced portfolio,” an ETF Database analysis said. “Companies within the growth segment offer tremendous profit potential since they are still in the early stages of their life cycle, which in turn also raises the risk level associated with this asset class. Growth stocks may also appeal to those seeking capital appreciation versus dividend income, as these companies re-invest earnings.”

The strength of the growth factor is highlighted in VUG’s 10-year performance, which shows a gain of 320%.

A Multi-Million Dollar Proposition

VUG was featured in a Lake Geneva Regional News article that highlighted growth funds as a means to maximize portfolio gains over time. As the article noted, VUG has familiar names like Amazon, Apple, Microsoft, and Google, which have fueled the last decade’s bull run.

“Since its inception in 2004, this ETF has earned an 11% average annual rate of return. At that rate, here’s how you could become a multimillionaire:”

- Invest $500 per month for 35 years = $2 million in total savings

- Invest $900 per month for 30 years = $2.2 million in total savings

- Invest $300 per month for 40 years = $2.1 million in total savings

“It takes time to accumulate a significant amount of money with ETFs, but that patience will pay off. Keep in mind, too, that these investments require very little upkeep. All you need to do is invest consistently, then sit back and wait for your investments to grow.”

For more news and information, visit the Smart Beta Channel.