In Brief

- The emergency authorization of a vaccine in the United States is a major turning point but it will not provide a shortcut to an immediate recovery.

- The pandemic is again visible on the demand side – the labor-market recovery is stalling and consumption is muted.

- The Fed most likely shares this view and stands ready to react should conditions deteriorate in the short run.

December 2020 might prove a pivotal turning point in modern history. Shortly after the UK gave emergency authorization to a Covid-19 vaccine – the first country to do so in the Western world – the U.S. Food and Drug Administration (FDA) followed suit. The first vaccine shots have, thankfully, been made – both in the UK and the United States. But we believe this marks only the beginning of the end of the pandemic. There is still a long road ahead, and a challenging one.

The initial amount of vaccine shots available will be fairly limited. Most of the population may have to wait until the middle or end of 2021. Other promising vaccine candidates, currently awaiting authorization, will not change this. Furthermore, it is probably safe to assume that a large-scale project like the roll out of a new vaccine is likely to encounter some hiccups on the way. The logistical challenge involved in inoculating much of the U.S. population is huge. There is also a question mark about people’s willingness to be vaccinated. Recent surveys, however, suggest that 50-70% of the population is willing to be vaccinated – an improvement from surveys earlier in the year.[1]

Those numbers are important, but vaccination will not solve the crisis unless sufficient people are willing and able to be vaccinated. Herd immunity is the ultimate goal. It is achieved when a large enough proportion of the population is immune – either by vaccination or because of a previous, cured infection, so that the virus cannot spread any further. The percentage share of the population that needs to be immunized is determined by the virus’s reproduction number.[2] The fact that it can vary over time and region and be heavily influenced by changes in people’s behavior is often forgotten.[3] Social distancing, for example, drastically reduces the reproduction number and therefore the threshold needed to achieve herd immunity.

This implies that restrictive measures should remain in place, at least to some degree, until broad distribution of the vaccine is achieved. Recent estimates suggest that the threshold for herd immunity with SARS-CoV-2 is in the region of 60% to 70%.[4] The coming months, when cold weather increases the reproduction rate, will be particularly challenging.[5] The implication of all this for us is that economic recovery might well take some time.

The challenging times might already have begun in November. The labor market in particular is showing unmistakable signs of moderation. Despite the positive surprise of another decline in the November headline unemployment rate to 6.7% from 6.9%, only 344,000 new jobs were created in the private sector. Again, the high sensitivity of the service sector to the dynamics of the pandemic has been the main driver – hiring in services, e.g. restaurant workers and retail sales help, dropped to 289,000 from 770,000. Weaker hiring in manufacturing and a fall in jobs in the government sector completed the downbeat picture.

The household survey shows that employment actually declined slightly in November by 74,000 workers, the first negative number since May. And the pace of reduction in unemployment also lost steam, declining only moderately by 326,000 to 10.7 million, with long-term unemployment again increasing moderately to 3.9 million. The participation rate, flip-flopping for a while now, decreased again to 61.5% as the number of people looking for jobs from outside the labor force increased by 448,000 to 7.1 million.

Weaker labor markets usually lead to less consumption, and that was the case this time. Retail sales in November dropped unexpectedly by 1.1% month-on-month. Unlike in April and May, when pandemic stimulus payments arrived, non-store retailing was fairly flat as well. Eventually – income statistics already suggested this in October – fading government support is going to show up in the hard economic data. Currently round about 12 million Americans are dependent on extended unemployment payments. Looking ahead, we expect this trend to continue for a while before we see a reversal – most likely during the first quarter of 2021.

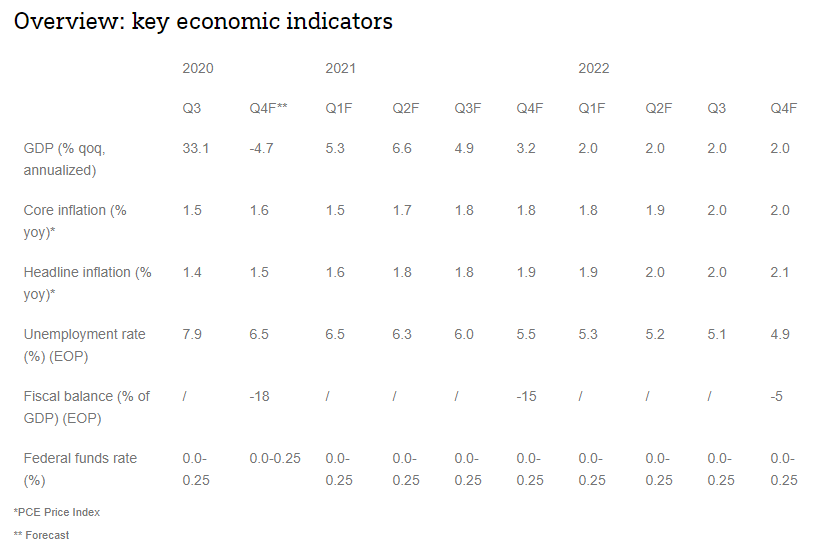

This view might well be largely shared by the U.S. Federal Reserve (Fed). The Fed Chair, Jerome Powell, emphasized in the December Federal Open Market Committee (FOMC) meeting that the outlook remains highly uncertain.[6] While welcoming the emergence of vaccines, he downplayed their likely impact in the very short term. He expects that vaccines should enable the economy to perform strongly only in the second half of 2021. The updated Summary of Economic Projections therefore do not indicate a change of Fed policy in the medium run. Despite more optimism on growth and employment in 2020 and 2021, inflation is forecasted to remain below the 2% target. Only by 2023 are inflation and unemployment forecasts at levels that most likely reflect what the Fed would currently see as a full recovery. One noteworthy element in the projections is the wide range of growth expectations for 2021 among the participants. At least one participant expects 2021 not to be an easy year at all. A growth rate of only 0.5% for 2021 implies sustained downside risks in the first quarter of 2021. Overall, however, most participants judge the risks to gross-domestic-product (GDP) growth broadly balanced, though some still see them weighted to the downside – a significant improvement compared to the September projections. Our take, given the short-term uncertainties, is that the Fed remains in a reactive mode, standing ready to act should financial conditions deteriorate. An increase of asset purchases or maturity extension remains on the cards if the situation requires it, as Powell hinted during the FOMC press conference on December 16.

Originally published by DWS, 12/18/20

1 . https://www.kff.org/coronavirus-covid-19/report/kff-covid-19-vaccine-monitor-december-2020/ or https://apnews.com/article/ap-norc-poll-us-half-want-vaccine-shots-4d98dbfc0a64d60d52ac84c3065dac55

2 . See our “A short primer on epidemics – you better know your enemy” in the March issue

3 . https://www.nature.com/articles/d41586-020-02009-w and http://metrics.covid19-analysis.org/

4 . https://www.nature.com/articles/d41586-020-02948-4

5 . The research estimates the seasonality based on what is known from endemic representatives of the coronaviruses, see: https://smw.ch/article/doi/smw.2020.20224

6 . https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20201216.pdf

All opinions and claims are based upon data on 12/17/20 and may not come to pass. This information is subject to change at any time, based upon economic, market and other considerations and should not be construed as a recommendation. Past performance is not indicative of future returns. Forecasts are not a reliable indicator of future performance. Forecasts are based on assumptions, estimates, opinions and hypothetical models that may prove to be incorrect. Source: DWS Investment Management Americas Inc.

R-080419-1 (12/20)