Direct indexing allows an investor to purchase exchange-traded funds (ETFs) without commingling their capital allocation with over investors. This strategy was typically limited to large investors coming to the table with boatloads of capital, but technology is starting to make the option more accessible.

Per a research report entitled “The Advisor’s Case for Smart Beta Direct Indexing,” a direct investing strategy was “largely impractical because of high brokerage costs and arcane portfolio accounting systems. That being said, over the last few years dramatic technological advances have improved the robustness, speed, and capacity of systems and lowered the asset levels necessary to make direct indexing accessible to investors.”

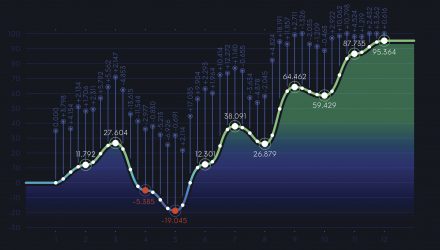

In today’s market landscape, the need for smart beta is more compelling as the extended bull run comes to a close. Investors need to deploy their capital more strategically and with the help of technology, direct indexing could be a prime option.

“As direct indexing becomes increasingly available to investors given rapid advances in technology, advisors are uniquely positioned to assess whether this opportunity fits into their clients’ portfolios, and if so, to maximize its potential,” the report said.

There are, however, some obstacles that lie in direct indexing. For example, the approach itself raises the number of individual holdings in a client’s portfolio, and any large increase in line items will command more time, effort, and resources to address concerns regarding company-specific risks

Tax loss harvesting, reaping the tax benefits from investment losses to offset capital gains, is one of the advantages of direct indexing, but not all clients are in need of it. If the portfolio is expected to yield limited taxable gains, this benefit is of no use as well as if the portfolio is tied to a tax-deferred account like an IRA.

Still, even as technology expands, there are still challenges to tackle prior to investors embracing direct indexing whole-heartedly.

“Even as technology rapidly evolves and transaction costs sink, making it easier to engage in direct indexing, trading numerous securities in a portfolio is more complex and time consuming than investing one time in a wrapped product,” the report noted. “Greater operational complexity could also exacerbate errors; for instance, it may be hard to identify and correct a tax-related error in the algorithm widely applied across a portfolio and thus to reduce the error’s impact on the portfolio and the related tax consequences.”

Click here to read the full report.