Exchange-traded funds (ETFs) thus far in 2019 have received close to $120 billion of flows in the United States, 62% of those flows went to fixed income and of the equity flows, 75% went to smart beta

According to David Mann Head of Global ETF Capital Markets at Franklin Templeton, said this latest influx of capital into smart beta can be traced to a shift in investor behavior and fund performance.

“I had predicted inflows into smart beta ETFs would reach $100 billion this year, and although we don’t seem to be at a pace to hit it, I think the percentage of equity assets flowing into smart beta is very impressive,” wrote Mann. “As to why this is happening, a couple possibilities come to mind. The first is that investors have acknowledged there are other index rules besides simply letting market price determine the weight of the stock. The second is that many of these smart beta funds have performed very well over the past few market cycles.“

Smart beta funds can incorporate a number of strategies in order to achieve returns, including active and passive methodologies. Thus far, the growth of passive funds is outnumbering their active counterparts.

Passive Outdoes Active

According to the latest Morningstar report for U.S. mutual fund and exchange-traded fund (ETF) fund flows, passive funds notched their best month year-to-date during the month of June with inflows of $69 billion across all category groups. The market share for passive funds now accounts for 40 percent compared to a year ago when it was 37.4 percent.

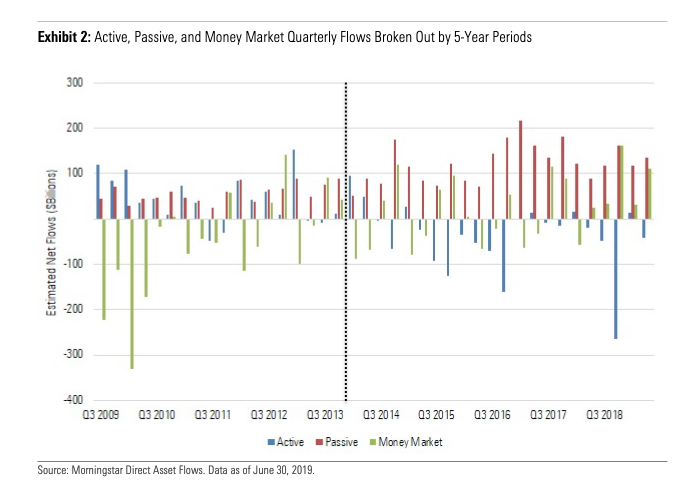

It’s an uptrend that’s recently hit its stride in just the past five years, according to the report. In the meantime, June wasn’t kind to active funds, which lost $22.5 billion after a volatility-laden May that, in turn, saw a number outflows in passive and active equity funds.

“Passive demand has been growing for years, but as we have noted before, passive flows accelerated significantly five years ago, a that trend has continued,” the report noted. “To a large degree, the past 10 years were a tale of two decades. In the five years following the 2007–09 crisis, passive funds collected an impressive $1.16 trillion”

“Passive flows more than doubled to $2.56 trillion during the past five year,” the report added further. “Yes, they likely benefitted from $956 billion in active-fund outflows. But, even if all those active outflows went to passive vehicles, that still left $1.6 trillion of additional inflows. Neither did that demand come from cash leaving money-market funds, as those vehicles had inflows of nearly $590 billion during the decade’s second half.”

Morningstar’s report about U.S. fund flows for June is available here. Highlights from the report include:

- In June, long-term open-end mutual funds and ETFs rebounded with $46.0 billion in inflows after nearly $2.0 billion in outflows in May. Despite last month’s dip, long-term flows were strong during 2019’s first half, totaling $224.0 billion, slightly ahead of 2018’s $219.0 billion.

- Passive funds had their best month year-to-date, collecting $68.6 billion in June while active funds lost approximately $22.5 billion to outflows.

- Taxable-bond funds recovered from May’s weak demand with $37.4 billion in inflows. Among active taxable-bond funds, multisector-bond fund Pimco Income, which holds a Morningstar Analyst Rating™ of Silver, dominated with $1.9 billion in June inflows. It finished the first half of 2019 with $13.7 billion in inflows, more than twice that of runner-up Lord Abbett Short Duration Income.

- Among all U.S. fund families, iShares led in June with $34.6 billion in inflows, which benefitted from strong demand for its equity factor ETFs. Bronze-rated iShares Russell 1000 Value had the largest inflows of $5.0 billion, while iShares Russell 1000 Growth wasn’t far behind with inflows of $4.0 billion in June. For both funds, those figures were their best monthly inflows ever.

For more trends in smart beta, visit our Smart Beta Channel.