Coronavirus fears keep rising in conjunction with bond prices, which is making the fixed income market a tricky one to navigate. One way to approach the current landscape is to implement a barbell strategy by way of ETFs.

Since bond prices move conversely to yields, the interest rate on safe haven Treasury notes have taken a dive as evidenced in the latest moves in the long end of the yield curve. The 30-year note fell below 2% to hit fresh new lows amid a safe haven scramble as coronavirus continues to infect the markets.

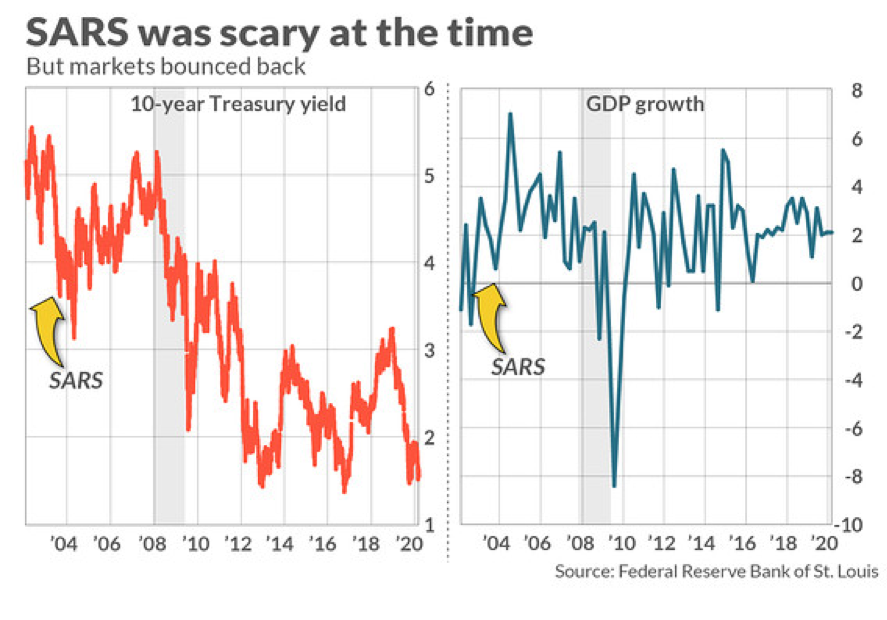

It reminds a lot of market analysts about the SARS epidemic in the early 2000s.

“I’m using the SARS episode as a framework to try to position where rates and the economy could be when the news cycle for the coronavirus has peaked,” Kevin Flanagan, head of fixed-income strategy at WisdomTree, told MarketWatch in an interview. “We picked a great day to have this discussion. Today without a doubt you began to see the first signs in the US of the economy being impacted. The question is, what happens when we do have a peak in the number of cases? How quickly does that snap back? Will it be a V shaped recovery or U-shaped?”

“A V-shaped recovery would be what we got from SARS. GDP went from a low of 0.6% in the fourth quarter of 2002 and then snapped back to 7% the next year,” Flanagan added. “The 10-year Treasury fell 105 bps during SARS. When all was said and done, we ended 25 basis points higher than the level when SARS news first hit.” A Barbell Strategy via Two Bond ETFs

A Barbell Strategy via Two Bond ETFs

To get the right exposure to bonds in this tricky market, Flanagan suggests a barbell strategy using short- and long-term exposure via a pair of ETFs:

- WisdomTree Floating Rate Treasury Fund (NYSEArca: USFR): seeks to track the price and yield performance, before fees and expenses, of the Bloomberg U.S. Treasury Floating Rate Bond Index (the “index”). The index is designed to measure the performance of floating rate public obligations of the U.S. Treasury.

- WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (NYSEArca: AGGY): seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Barclays U.S. Aggregate Enhanced Yield Index (the “index”). The index is designed to broadly capture the U.S. investment grade, fixed income securities market while seeking to enhance yield within desired risk parameters and constraints.

Per a MarketWatch report definition, a barbell strategy “involves short- and long-duration securities, avoiding medium-term bonds. That minimizes volatility as the yield curve shifts when rates are on the rise, and allows investors to capture the upside in short-maturity bonds as yields move higher.”

For more market trends, visit ETF Trends.