Whether you’re just out of school and starting to invest for the very first time or you’re retired and looking to live off of the wealth you’ve acquired, most people would agree that stocks should, in some form, be a part of your portfolio.

Young folks should be building their core portfolio around high quality dividend-paying stocks that have the potential to outperform the market over time. Retirees can use the steady, predictable income from these companies, while adding a little punch to their portfolio to keep ahead of inflation. Finding a fund that can deliver on both of these objectives, while charging one of the lowest expense ratios in the industry, is a recipe for an ETF that you can buy and hold forever!

The fund I’m referring to is the Schwab U.S. Dividend Equity ETF (SCHD).

SCHD follows the Dow Jones U.S. Dividend 100 Index, which provides exposure to high dividend yielding stocks with a history of consistently paying dividends and demonstrating relative fundamental strength. All index eligible stocks must have sustained at least 10 consecutive years of dividend payments. Note that the requirement isn’t for 10 consecutive years of dividend GROWTH, just 10 consecutive years of payments. In reality, this is a minor detail since most names that qualify for SCHD are indeed dividend growers and the financial strength screens help ensure that dividend payments are secure going forward.

Methodology

The index starts by identifying the companies meeting initial eligibility requirements (10 years of dividend payments along with size and liquidity screens). Those securities get ranked by dividend yield in descending order with the top half of that list eligible for selection.

Potential constituents get evaluated by four fundamental criteria:

- Cash flow to total debt

- Return on equity

- Indicated dividend yield

- Five-year dividend growth

Since 5-year dividend growth rate is a consideration, it’s likely that companies need to be dividend growers in order to qualify, even though it’s not specifically a requirement. The four rankings are equal weighted to create a composite score, and the eligible securities are ranked based on this composite score. The 100 top-ranked stocks by the composite score are selected to the index, subject to the following buffer rules that favor current constituents during the annual review. There is some flexibility in the inclusion criteria that allows current constituents to remain in the index as long as they remain in the top 200 according to the composite score. This allows SCHD to limit some of the turnover and tax issues that might occur had it chosen to strictly choose just the top 100 at each rebalance.

Once the final 100 names are selected, they are weighted using a modified market cap approach that limits individual holdings to no more than 4.5% of the index and no industry to more than 25%.

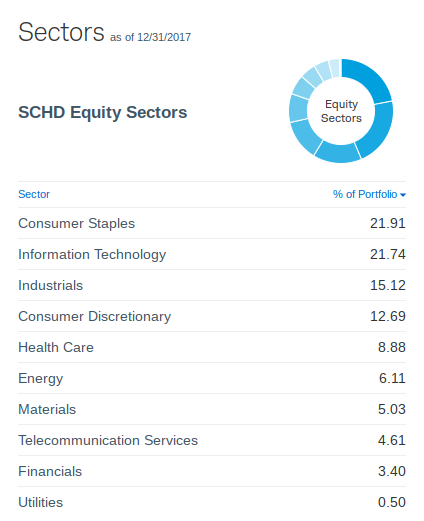

The resulting portfolio ends up looking like this:

![]()

Not too many surprises here, as the portfolio is filled with mature, stodgy businesses from traditionally conservative growth sectors, such as consumer goods/services and industrials. The small allocation to the financial sector is probably at least partially a result of catching the tail end of the post-financial crisis period that comes from looking back over the past 10 years, not to mention the fact that financials don’t measure up particularly well to the broader market when comparing ROE or dividend yields.

One of the things that might be a little more surprising is the lack of utility and REIT names in the portfolio.

Where are the utilities and REITs?

The answer to why there’s no real estate in the portfolio is pretty straightforward. The underlying index excludes them right off the bat before any screening even takes place. It’s difficult to say why specific utility names are missing, but they’re likely coming up short on the ROE and cash flow to debt screens. Despite their high yields, utilities tend to carry high debt levels and generate pretty low ROEs.

I find the fact that SCHD has virtually nothing invested in utilities and real estate to be both a good and a bad thing. On the plus side, these two sectors are very interest rate sensitive. If interest rates continue to climb over the next couple of years, as expected, the dividend payments from those stocks start to look less attractive as income seekers look more to fixed income for yield. It’s reasonable to think that these two sectors would underperform, dragging the performance of any ETF holding these stocks down as well. Since SCHD is avoiding these sectors, there shouldn’t be that additional downward pressure.

On the other hand, utilities and real estate tend to be the two highest yielding areas of the market. Real estate was considered important enough to the overall economy that S&P Dow Jones Indices and MSCI in 2016 decided to elevate real estate companies to their own sector in the GICS classification system. Omitting real estate and utilities altogether eliminates exposure to two very important sectors of the economy, while reducing the fund’s dividend yield potential.

If you’re looking to round out your portfolio, you’ll need to add ETFs in these two sectors. In my ETF rankings that I make available to my ETF Focus subscribers, my top rated funds for these two sectors are the Vanguard Utilities ETF (VPU) and the Schwab U.S. REIT ETF (SCHH). Both of these would make ideal satellite holdings to a core SCHD position.