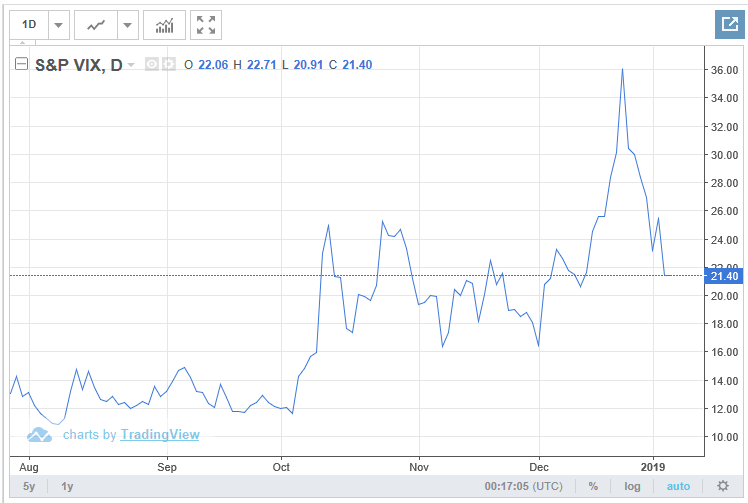

In 2018, volatility certainly meted out its fair share of punishment to end the year after a decade-long bull run saw major indexes like the S&P 500 reach historic levels. The growth-fueled investments provided by FAANG stocks can no longer be the default play for investors in 2019 as a more risk-off sentiment is permeating the markets.

Investors can look to alternatives like international market exposure, which present a value proposition in lieu of understanding the risks. However, exchange-traded funds (ETFs) using a multi-factor approach to international markets can help address those risk and provide a low volatility safe haven, such as the Hartford Multifactor Emerging Markets ETF (NYSEArca: ROAM), Hartford Multifactor Developed Markets (ex-US) ETF (NYSEArca: RODM) and the Hartford Multifactor Global Small Cap ETF (NYSEArca: ROGS).

Volatility Reigning in U.S. Markets

A once-stubborn Federal Reserve that was unwavering in its rate-hiking policy is now starting to take note of the markets, especially after looking at a challenging 2018. The Dow fell 5.6 percent, while the S&P 500 lost 6.2 percent and the Nasdaq Composite fell 4 percent.

The central bank didn’t show much dynamism in 2018 with respect to monetary policy, obstinately sticking with a rate-hiking measure with four increases in the federal funds rate. That appears to have changed given the current market landscape as Fed Chair Jerome Powell is now preaching patience and adaptability.

“As always, there is no preset path for policy,” Powell said. “And particularly with muted inflation readings that we’ve seen coming in, we will be patient as we watch to see how the economy evolves.”

However, with a plethora of advisors telling investors it’s best to stay invested as opposed to being on the sidelines with cash, defensive options that mute or limit the amount of volatility have been highly sought after. One of those alternatives is investing overseas.

International Exposure for Defense and Value

Investing with a defensive and value-oriented mindset is particularly important when it comes to investing abroad. The trade wars between the U.S. and China have no doubt racked international markets whether developed or emerging.