May’s volatility brought investors back to reality despite a 2019 that began with U.S. equities having a strong start to the year, but now economic indicators like Morgan Stanley’s Business Conditions Index are forecasting June gloom.

The index identifies turning points in the economy, and fell by 32 points during the month of June to a level of 13 after hitting a level of 45 in May. This represents the largest one-month decline and the lowest level since December 2008 when the capital markets were in the thick of a financial crisis.

“The decline shows a sharp deterioration in sentiment this month that was broad-based across sectors,′ economist Ellen Zentner said in a note to clients. “Fundamental indicators point to a broad softening of activity, but analysts did not widely attribute the weakening to trade policy.”

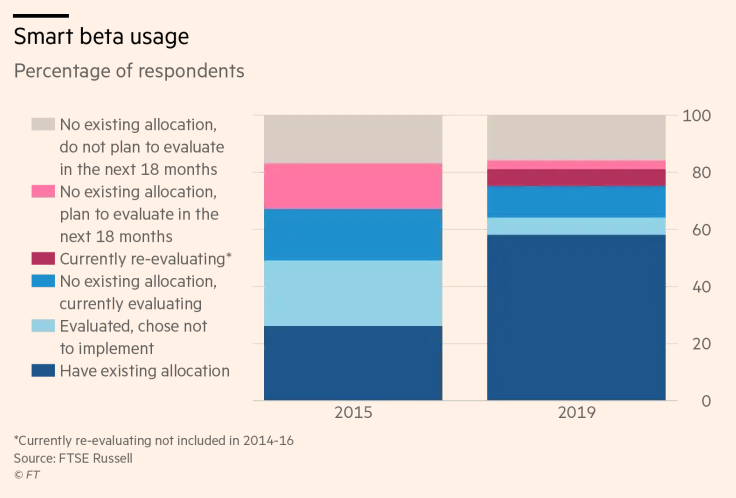

May certainly reminded investors that they need to be strategic when it comes to investing in 2019 as volatility took hold of the capital markets as the U.S.-China trade deal that was supposed to happen morphed into an impasse. That said, more investors are beginning to realize the importance of incorporating smart beta strategies into their portfolios according to a survey conducted by index and analytics provider FTSE Russell.

58 percent of investors have an allocation to smart beta, based on the survey of 178 asset owners. It’s more than double the amount in 2015 when the same survey yielded only a 26 percent usage by investors.

“Investors are becoming more comfortable with smart beta as they have developed an increased understanding of these strategies and more confidence in their track records,” said Rolf Agather, research and innovation managing director at FTSE Russell.

With smart beta usage on the rise, one of the challenging aspects advisors face with this more cautious investor is the plethora of options available, especially in the exchange-traded fund (ETF) space. Where are the opportunities in ETFs given the current market landscape and how can smart beta-factor strategies work in a portfolio?

A market-capitalization-weighted index provides clients with exposure to a particular market based on security prices, without considering any true company fundamental to judge its value. However, the Great Recession of 2008 roiled investors with deep declines that they were not anticipating, as a result of overexposure to potentially overpriced stocks relative to their true value.

As such, things began to change, with many financial advisors shifting to smart beta strategies in the past 10 years. The first aspect to touch upon was the limitations of a market cap weighted index, which would then warrant the need for smart beta and factor strategies.

Just when it was safe for investors to delve back into U.S. equities in 2019, trade wars in May reminded investors that volatility was still lurking in the shadows of the capital markets and getting tactical was not to be ignored, especially when it comes to ETFs. Smart beta strategies can certainly assist with smoothening out the volatility as opposed to simply avoiding it–practically impossible in the capital markets.

Smart beta ETFs to consider:

- Natixis Seeyond International Minimum Volatility ETF (NYSEArca: MVIN)

- VictoryShares US 500 Volatility Wtd ETF (NASDAQ: CFA)

- Oppenheimer Russell 1000 Dynamic Multifactor ETF (Cboe: OMFL)

For more market trends, visit ETF Trends.