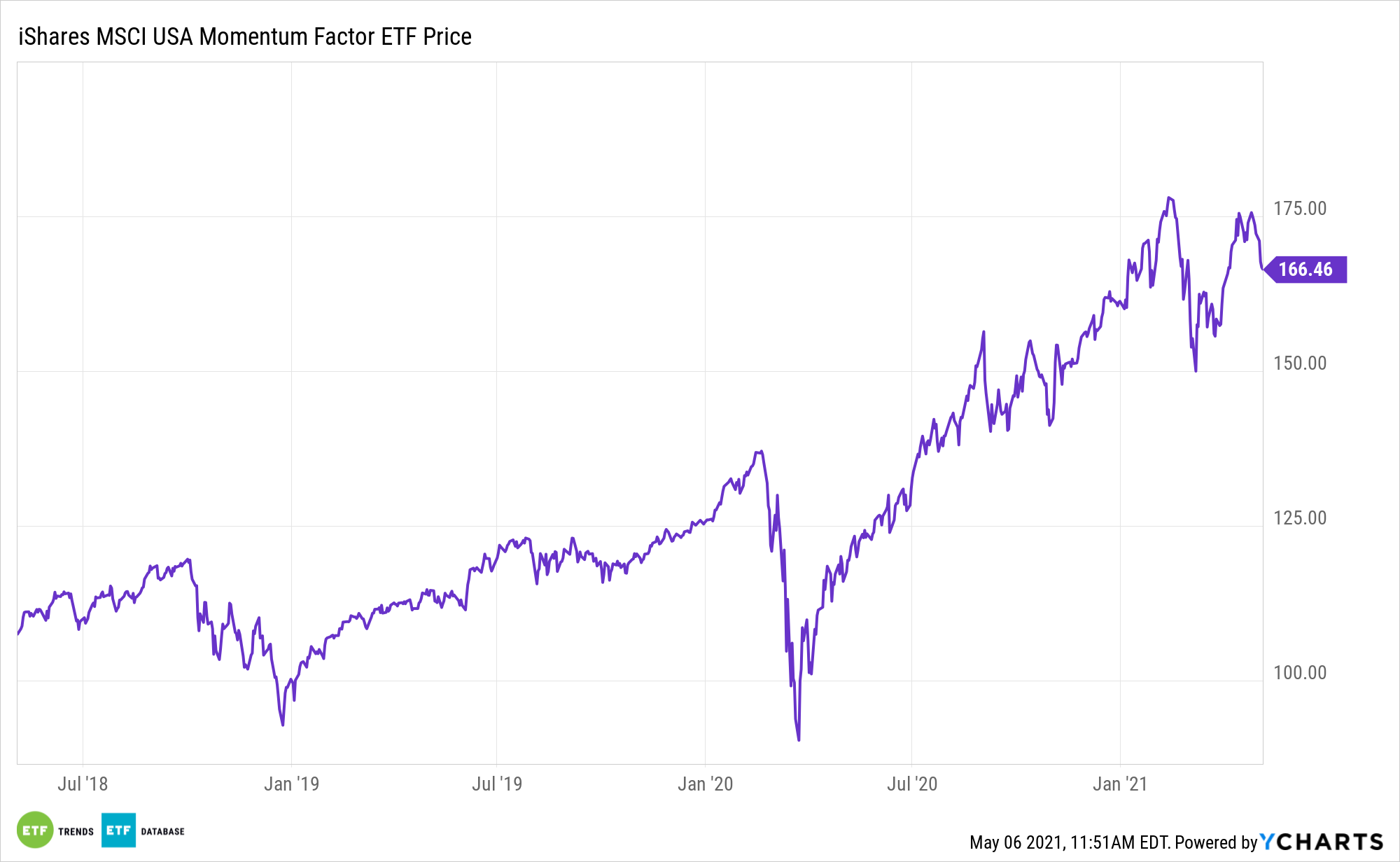

The iShares Edge MSCI USA Momentum Factor ETF (MTUM) is already up over 40% the past year, but more strength could be ahead as it shifts its focus to energy and financials exposure.

MTUM seeks to track the investment results of the MSCI USA Momentum Index. MTUM generally will invest at least 90% of its assets in the component securities of the underlying index and may invest up to 10% of its assets in certain futures, options and swap contracts, cash and cash equivalents.

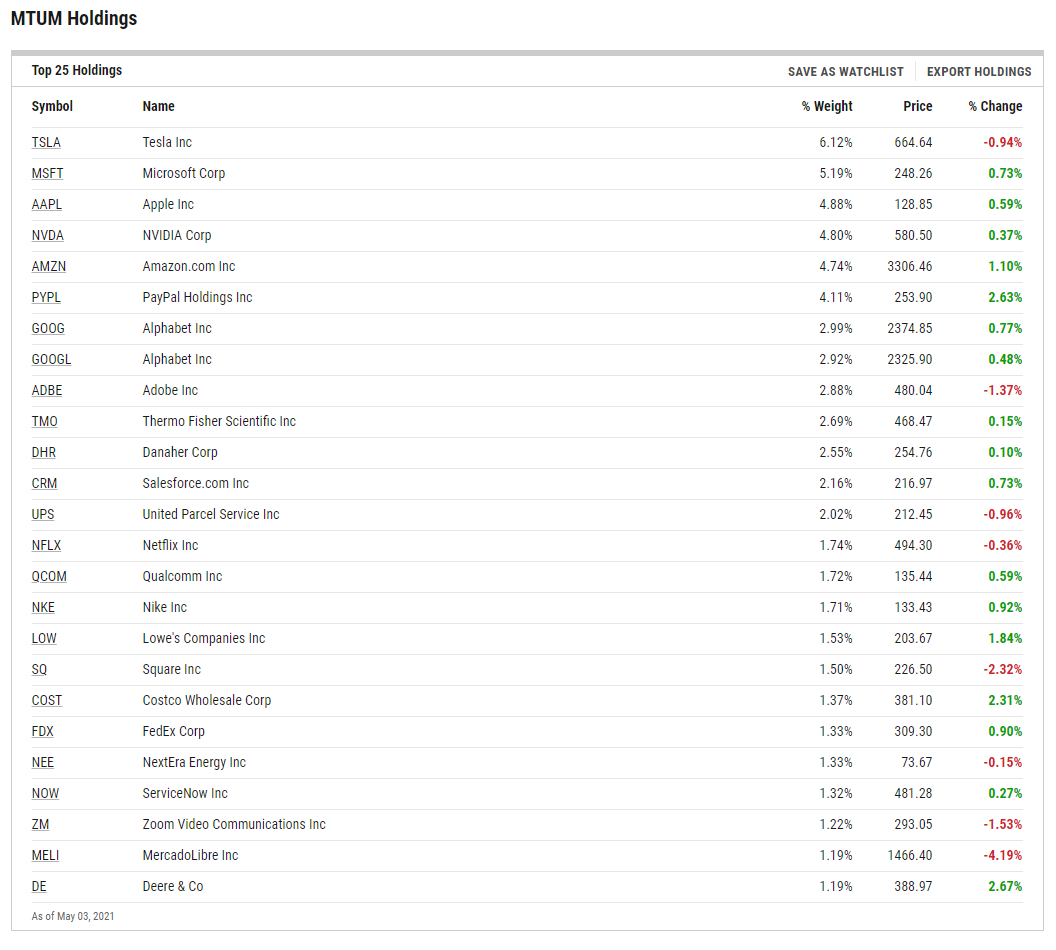

As far as the index goes, it consists of stocks exhibiting relatively higher momentum characteristics than the traditional market capitalization-weighted parent index, the MSCI USA Index, which includes U.S. large- and mid-capitalization stocks. As of May 4, the fund’s holdings are primarily in big tech names like Microsoft and Apple, but that’s changing as the fund is set to undergo its semiannual re-balancing at the end of this month.

Energy has seen a momentous rally as of late, riding the back of higher oil prices. Additionally, financials have also been strong performers and are expected to increase their earnings this year.

“The last six months have been really strong for financials, which is little to no exposure within MTUM, and energy, where there is no exposure,” said Todd Rosenbluth, senior director of ETF and mutual fund research at CFRA Research. “We believe that we’re going to see an increase in exposure in financials and we’re going to see a reinitiation of energy companies.”

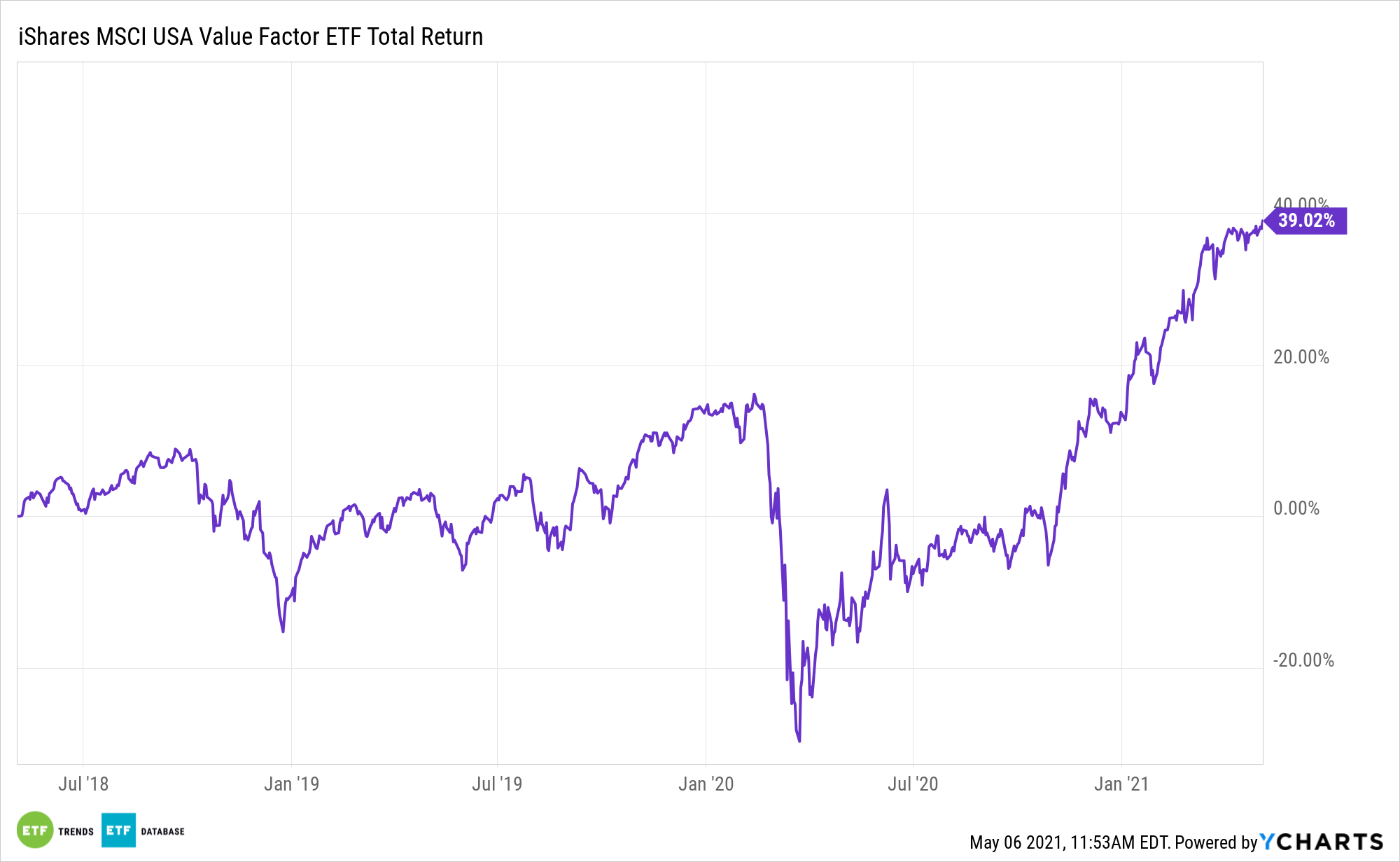

A Value Proposition

Value has been another factor that has been on the rise in 2021. One way investors can play value strength is the iShares Edge MSCI USA Value Factor ETF (VLUE), which is also set to re-balance at the end of the month, and move to higher growth names.

“In technology, some of the more deeper-value stocks have risen and … some of the higher-growth stocks have fallen,” said Rosenbluth. “We could actually see VLUE owning more of the traditional growth stocks within the technology sector among other sectors.”

Whether it’s momentum or value, factor-based strategies have been garnering more interest.

“In factors, which lately … don’t get a lot of attention, we’re seeing some of the strongest flows on the back of the reopening trade into our value portfolio and other single-factor offerings that we have,” said BlackRock’s head of iShares Americas, Armando Senra. “So, factors is something that investors are really utilizing in 2021. We didn’t see a lot of flow in 2020. That is also changing in 2021.”

For more news and information, visit the Smart Beta Channel.