The S&P 500 Real Estate Index is up 16 percent year-to-date after coming off a challenging 2018 environment that saw four rate hikes and housing prices skyrocket out of the reach of many would-be home buyers.

Like most U.S. equities, 2019 thus far is a year of retribution for the sector. However, heading into spring home buying season, steady interest rate activity could buoy the housing market over the next quarter.

Furthermore, homebuilders’ confidence in the market for new single-family homes rose higher, according to the National Association of Home Builders’ housing market index. The index rose to 63 in April versus 62 in March.

“Builders report solid demand for new single-family homes but they are also grappling with affordability concerns stemming from a chronic shortage of construction workers and buildable lots,” NAHB Chairman Greg Ugalde said.

“Ongoing job growth, favorable demographics and a low-interest rate environment will help to modestly spark sales growth in the near term,” according to NAHB Chief Economist Robert Dietz. “However, supply-side headwinds that are putting upward pressure on housing costs will limit more robust growth in the housing market.”

Using Lease Duration

A confluence of rising interest rates and low affordability have made the housing market a challenging space in 2018, but that could all be changing with the NAHB/Wells Fargo Housing Market Index holding steady.

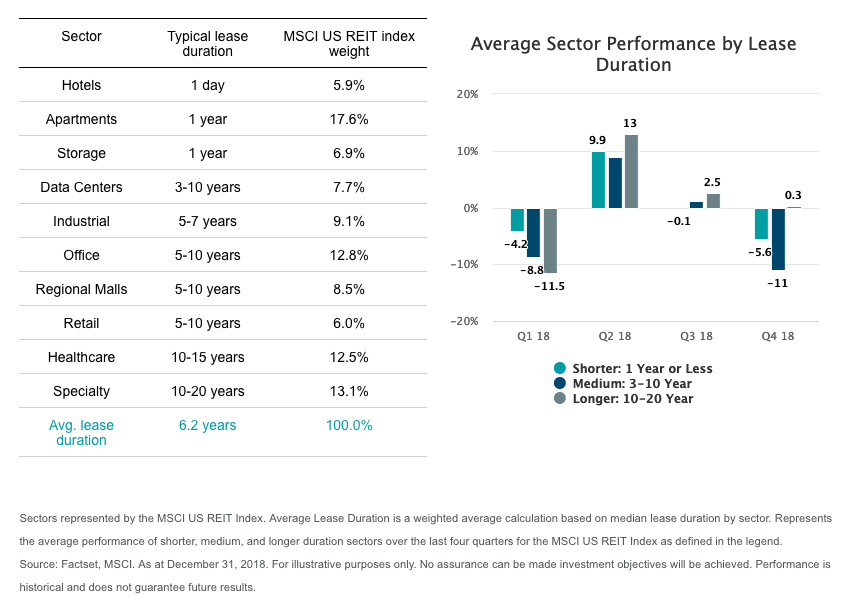

Another key metric is using lease duration to measure the health of real estate.

“This metric represents the typical amount of time that a tenant is contractually obligated to pay rent before either a new tenant leases the property or the contract can be renegotiated with the existing tenant,” wrote Eric Dutram, a member of the Thought Leadership Team at DWS. “Some leases are extremely short—such as a one night “lease”, typical for a night’s stay at a hotel—while on the other end of the spectrum, it is common to see lease terms in excess of 10 years for sectors like healthcare and specialty.

Dutram likens the use of lease duration as the way fixed-income experts use duration for the bond markets.

“While this may appear to be a minor detail, its impact cannot be overstated, similar to how bond managers adjust duration exposure based on interest rate expectations,” noted Dutram. “Lease terms go hand-in-hand with both inflation and economic growth projections, which can have a meaningful impact on stock and sector returns within the REIT market.

“For example, in times of rising inflation or growth, it can be advantageous to increase exposure to shorter-lease duration sectors, as one might see with apartments or storage facilities. However, in more sluggish growth conditions or when inflation isn’t a worry, it can make sense to increase exposure to longer-lease duration sectors (i.e. have tenants locked-in for years, if not decades) such as the healthcare or retail sectors.”

For more market trends, visit ETF Trends