Income is increasingly hard to find for today’s investor.

With the Federal Reserve seemingly returning to rate cut mode and worries over an economic slowdown ahead, there looks to be little help on the government bond front, even for those willing to bump up their duration. In fact, a 30-year U.S. Treasury bond yields just over 2%, while comparable Treasury Inflation Protected Securities (TIPS) offer just under 0.50%.[1]

Income troubles aren’t just in U.S. bonds

This isn’t just a U.S. phenomenon. Many global markets are in negative territory for their benchmark government debt yields. Even countries such as Spain and Portugal—which were seeing their government bond yields in the 10% range a few years ago—can no longer be seen as income destinations today thanks to yields below half a percent for 10-year maturities.[1]

Run-of-the-mill equities, such as domestic large caps (as represented by the S&P 500) also offer little relief, though at least they have some capital appreciation potential. Seemingly, many traditional options for investors seeking yield are approaching zero, or at least, barely keeping up with inflation. In this kind of climate, what can an investor do?

Where the yields are

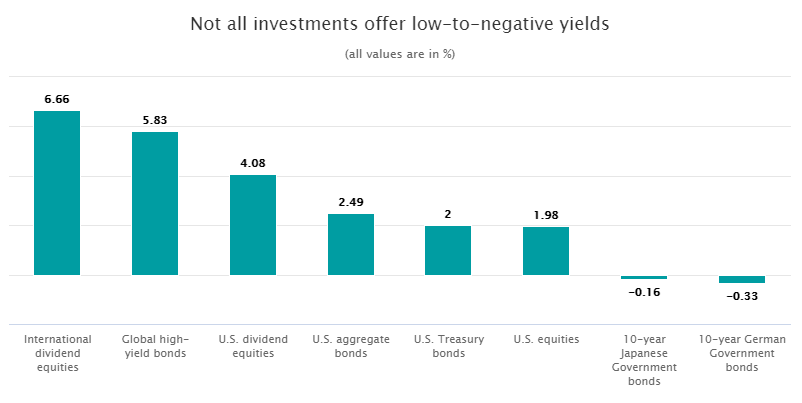

While slumping yields are a global problem, it is by no means a universal issue. Some types of securities have managed to buck the trend and still offer a solid income stream. As shown in the chart below, sovereign bonds no longer appear to be a way for investors to achieve their income goals. If anything, seem to be moving in the opposite direction. However, that is only part of the story, as there are still options for investors seeking yield:

Source: Bloomberg, Barclays and DowJones.com current yields as of 6/30/2019. Past performance is historical and does not guarantee future results and it is not possible to invest in an index. This chart is for illustrative purposes only. Asset-class representation is as follows: Global high-yield bonds, Bloomberg Barclays Global High Yield U.S. hedged index (tracks the performance of the U.S. High Yield, the Pan-European High Yield and Emerging Markets Hard Currency High Yield indices); U.S. dividend equities, Dow Jones U.S. Select Dividend Index (represents the country’s leading stocks by dividend yield); U.S. equities, S&P 500 index (tracks the performance of 500 leading U.S. stocks and is widely considered representative of the U.S. equity market); International dividend equities, Dow Jones EPAC Select Dividend Index (represents non-U.S. developed markets’ leading stocks by dividend yield); U.S. aggregate bonds, Bloomberg Barclays U.S. aggregate index (tracks the performance of the broad U.S. investment-grade, fixed-rate bond market, including both government and corporate bonds); U.S. Treasury bonds, 10-year U.S. Treasury bond; 10-year German bonds, Germany Bond 10 Year Yield which is the government-issued 10-year bond of Germany;10-year Japanese Treasury bonds, Japan 10 Year Treasury which is the government-issued 10-year bond of Japan. Yield is the income generated by an investment divided by its current price.

The other end of the spectrum remains robust, as several categories are offering yields in excess of 4%. There are even options that pay out yields triple what is currently offered by U.S. Treasury securities, to say nothing of other developed market government debt.

Bottom line

Slumping bond yields and a more dovish Fed are putting pressure on investors focused on income. And with little help—and arguably harm—from international sovereign markets, prospects may initially appear dim for those on the hunt for yield.

However, while the seemingly tried and true income destinations may be sluggish, investors aren’t necessarily out of options. If yield-starved investors are willing to consider categories such as international dividend leaders or global high-yield bonds, there may be additional opportunities to capture yield in today’s low rate world.

For additional investing insights and our unique perspective, check out our CIO View to learn more.

1. Source: Bloomberg, as of 8/19/19