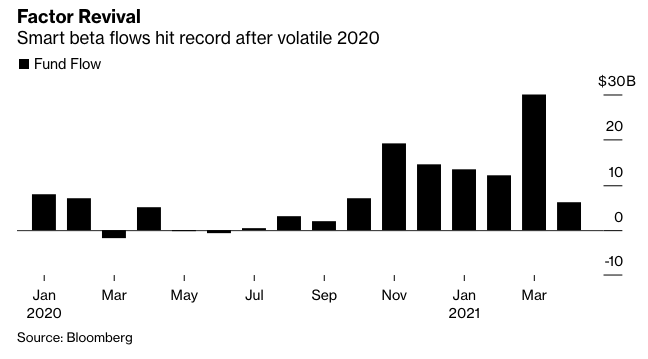

Exchange traded fund (ETF) investors wised up to smart beta funds during the month of March, as risk appetites grew and the factor mindset switched from growth to value.

“Systematic strategies wrapped up in exchange-traded funds — known as smart-beta products — took in a record $28 billion in March, according to Bloomberg data,” a Bloomberg article said. “After luring almost $7 billion so far this month, total assets are at the highest ever.”

As a global vaccine deployment continued in the first quarter of 2021, investors were brimming with optimism on an economic rebound. As mentioned, investors’ penchant for risk grew accordingly.

“Investors betting on a post-pandemic world are sending cash to riskier companies acutely sensitive to the economic cycle — led by the famed resurgence in the value factor,” the article said. “And as the safety trade in Big Tech eases, equity gains are broadening and popular allocation styles like momentum are rebounding.”

“All that means the smart-beta industry, which touts the virtues of diversification, is looking particularly smart.”

A Revitalized Factor Investing Landscape

A revitalized factor investing landscape has also been apparent in the capital markets as of late. Growth-fueled stocks that powered the majority of the last decade’s bull run have been scrapped in favor of more value-oriented equities.

“Investors have rotated away from mega-cap growth stocks that dominate the broader index-based ETFs toward more economically sensitive styles including value and equal weighted,” said Todd Rosenbluth, director of ETF research for CFRA Research.

Overall, however, most investors have warmed up to factor investing again.

“Quality, low volatility and momentum — which sold off when risk appetite bounced back in early November — have also stabilized of late,” the article mentioned. “Meanwhile dividend ETFs — with outsize exposure to value shares — added a record $5.9 billion in March, followed by $1.9 billion so far this month.”

Of course, there’s no denying the popularity spike in environmental, social, and governance investing. The pandemic only fanned the flames for ESG in 2020. Not much has changed in 2021.

“At the same time the famous boom in all things ESG and thematic — from clean energy and robotics to automation — continues with those categories taking in $11.5 billion and $34.4 billion in the first quarter, respectively,” the article added.

For more news and information, visit the Smart Beta Channel.