Thus far, the performance between small cap equities versus large cap equities is seeing a larger gap than ever before, which could be signaling that something is awry in the economy. However, something could be brewing that could may make investors want to take a second look at small caps for a potential value play in the works.

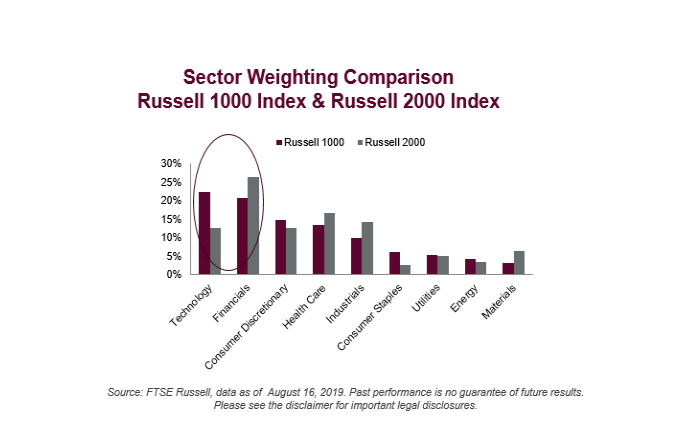

“While many factors impact size performance, sector exposures tell a big part of the story,” wrote Alec Young, FTSE Russell’s managing director of global markets research. “A detailed look at industry weights helps explain recent small-cap underperformance. It’s no secret technology has been strongly outperforming the financial sector as a flattening yield curve and unprecedented declines in interest rates squeeze bank profits. The small cap benchmark sports for a hefty 27% financial industry weight vs. only 21% for its large-cap counterpart. What’s more, large caps also have greater exposure to technology performance leadership with a 22% weight versus only 13% for the Russell 2000 Index (see chart).”

However, with the Federal Reserve recently cutting interest rates, it may bode well for the performance of small caps moving forward.

“But interest rates have recently stabilized reflecting US consumer strength in the face of global growth weakness,” Young added. “Consider that the yield on the 10-year treasury bond has declined from 2% in early July to a low of 1.55% last week. A move of such magnitude in such a short period of time has few historical precedents. The financial sector has had a very strong correlation with the direction of US treasury yields for several years and has begun to perk up as rates have stabilized. As for technology, the sector’s valuation premium is now well above its historical average reflecting structural growth tailwinds that are now widely appreciated. All this means that it may be time to re-evaluate small cap allocations.”

One ETF to consider that can give investors small cap exposure while taking the latest market volatility into account is the VictoryShares US Small Cap Volatility Weighted ETF (Nasdaq GM: CSA). Despite the latest doses of market volatility investors have been consuming the recent weeks, CSA is up 9.34 percent year-to-date.

CSA seeks to provide investment results that track the performance of the Nasdaq Victory US Small Cap 500 Volatility Weighted Index, which is an unmanaged, volatility weighted index. The index identifies the 500 largest, profitable U.S. companies with market capitalizations of less than $3 billion measured at the time the index’s constituent securities are determined.

For more market trends, visit ETF Trends.