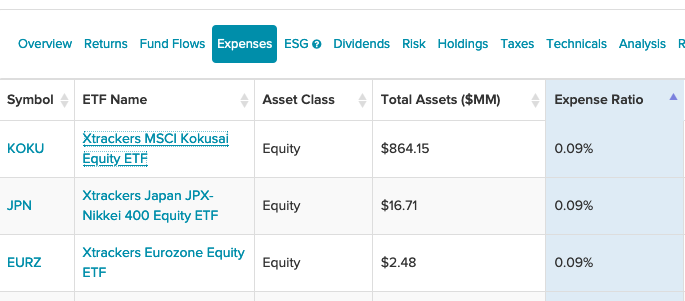

ETF investors looking for international exposure may leery of the price of admission for funds around the globe. DWS offers ETFs with international exposure and extremely low cost.

Xtrackers MSCI Kokusai Equity ETF (KOKU): tracks an index of large- and mid-cap stocks in developed markets outside of Japan. KOKU could be used as a core global equity holding for investors who believe Japanese equities will underperform. Many EAFE funds make sizable allocations to Japan. While Japan is one of the world’s largest economies, it has also had extended periods of low growth rates and rising debt burdens. Some investors would rather avoid this potential drag on their portfolio.

KOKU’s management fee is extraordinarily low and the fund is up almost 40% the past year.

Xtrackers Japan JPX-Nikkei 400 Equity ETF (JPN): tracks an index of 400 companies screened for return on equity, operating profit, and market capitalization in an effort to identify high-quality Japanese companies.

The fund offers broadly similar exposure as the iShares JPX-Nikkei 400 ETF (JPXN) for a smaller management fee. It’s worth nothing that JPXN is older and has more assets, though neither fund is a juggernaut when it comes to assets or daily trading volume. For those who need to trade in size, the best bet is likely the iShares MSCI Japan ETF (EWJ).

JPN invests in a broader universe of Japanese equities and is by far the largest Japan-focused fund, though it charges an above-average management fee. The fund is up about 14% the past year.

Xtrackers Eurozone Equity ETF (EURZ): seeks investment results that correspond generally to the performance, before fees and expenses, of the NASDAQ Eurozone Large Mid Cap Index (the “underlying index”). The underlying index is designed to track the performance of equity securities of large- and mid-capitalization companies based in the countries in the Economic and Monetary Union of the European Union (“EU”).

For more news and information, visit the Smart Beta Channel.