By Tyler Wilton, DWS

Rising wages and worries over a trade war are pushing many investors to reconsider their stance on inflation. Many are now concerned with how asset classes will hold up if inflation levels rise in the near term, and it may be appropriate to consider sectors which can quickly—and positively—respond if, and when, prices rise.

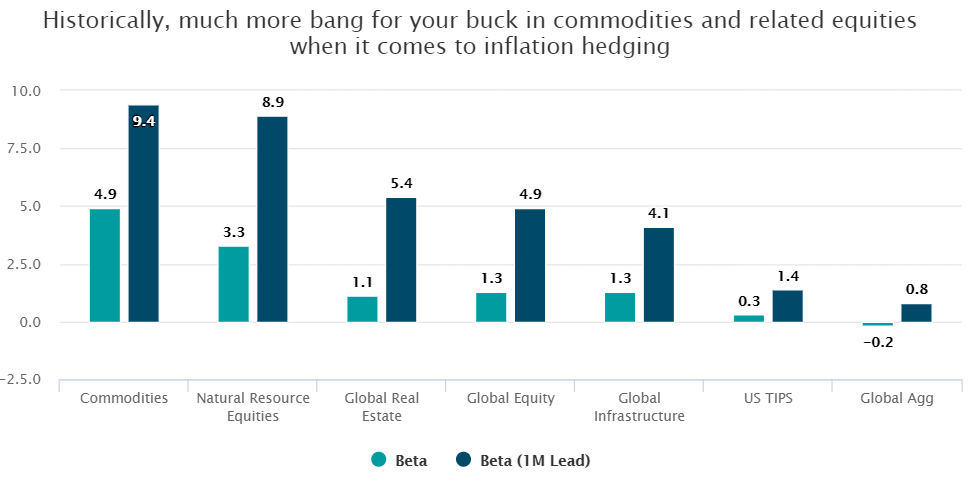

An easy way to do this is to look at the historical ‘inflation beta’ of various asset classes. In other words, how sensitive an asset class is to changes in inflation.

A higher inflation beta means the asset class has historically responded more quickly to changes in inflation. Meanwhile, a negative inflation beta suggests that, historically, a given asset class has moved in the opposite direction as inflation has increased.

Consider the chart below which summarizes how a variety of market segments have historically performed when compared against the Consumer Price Index (CPI):