Value’s lead over growth in 2021 is helping ETFs like the Vanguard S&P 500 Value Index Fund ETF Shares (VOOV), which boasts just a 0.10% expense ratio.

VOOV seeks to track the performance of a benchmark index that measures the investment return of large-capitalization value stocks in the United States. The fund employs an indexing investment approach designed to track the performance of the S&P 500® Value Index, which represents the value companies, as determined by the index sponsor, of the S&P 500 Index.

The index measures the performance of large-capitalization value companies in the United States. The fund’s top names include familiar ones, such as Berkshire Hathaway, JP Morgan Chase, Walt Disney, and Bank of America.

“Investors with a longer-term horizon should consider the importance of large cap value stocks and the benefits they can add to any well-balanced portfolio including dividends and rock solid stability,” an ETF Database analysis said.

- Invests in stocks in the S&P 500 Value Index, composed of the value companies in the S&P 500.

- Focuses on closely tracking the index’s return, which is considered a gauge of overall U.S. value stock returns.

- Offers high potential for investment growth; share value rises and falls more sharply than that of funds holding bonds.

- More appropriate for long-term goals where your money’s growth is essential.

The value over growth story has been evident when looking at the S&P 500 indexes for both factors. The S&P 500 Value index is up about 12% in 2021, while the S&P 500 Growth index is up 5.39%.

Leaning On Financials and Health Care

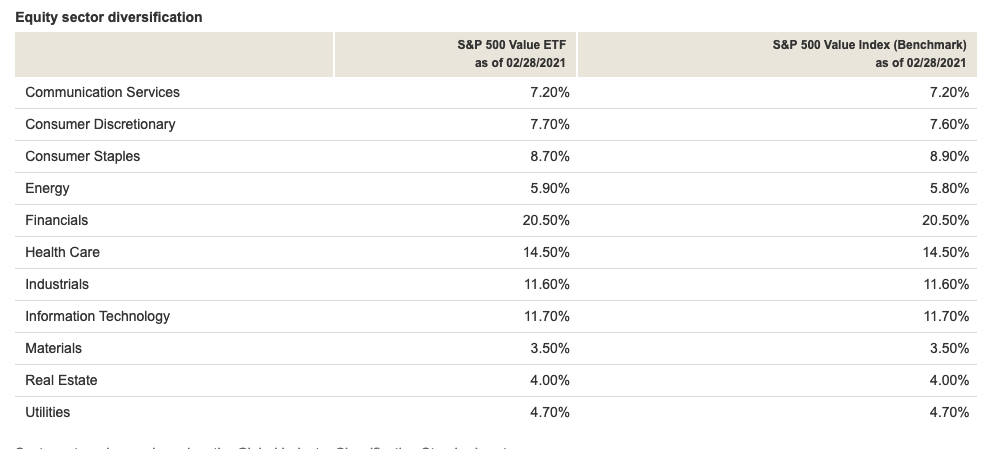

VOOV leans on financials and health care, with about 35% of its assets allocated toward those two sectors. Financials could gain strength, especially with interest rates starting to tick higher.

Inflation fears have been permeating the markets as of late, especially if the economy bounces back quicker than anticipated amid a vaccination rollout. The Federal Reserve, despite their vow to keep rates low, have hinted that rates could rise should the economic climate warrant the change.

A rise in rates could help profits for financials when it comes to loan products. As for healthcare, it’s a tried and true sector that can withstand the ups and downs of most economic environments.

The S&P 500 Health Care index is up about 30% the last 12 months. Financials have been doing twice as well, with the S&P 500 Financial index up about 65% the past year.

For more news and information, visit the Smart Beta Channel.