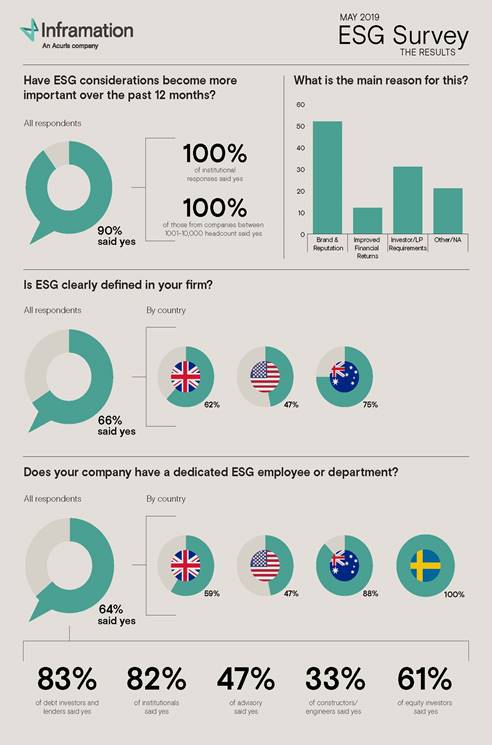

According to a survey of subscribers to Inframation, an Acuris company, nine out of ten responding agreed that in the past 12 months, Environmental, Social and Governance (ESG) criteria has become a more important part of their investment decision-making.

Poor governance and environmental problems present themselves as roadblocks to profitability, but research finds no direct link between better ESG credentials and the improved financial performance of private infrastructure companies. In the survey, about 25 percent of respondents cited investor or LP requirements as the reason for increasing ESG consideration.

Furthermore, about 50 percent of respondents said “improved brand and reputation” was the main reason for the shift. In addition, larger often institutional or pension-based LPs are responding to changes in society.

ESG ETF Plays to Consider

One ETF to consider is the Xtrackers MSCI USA ESG Leaders Equity ETF (NYSE Arca: USSG), which was developed in collaboration with Ilmarinen, Finland’s largest pension insurance company. The expense ratio for USSG is 0.10%, which is well below the average cost of 0.39% for ESG funds, making it ideal for investors who are also seeking a low-cost solution to add ESG to their portfolios.

“With USSG, we now bring the ability for investors to access domestic equity,” Fiona Bassett, Global Co-Head of Passive Asset Management and Global Co-Head of Product, DWS Group, told ETF Trends. “Critically, it will be the most cost-effective ESG ETF in the marketplace.”

“We would like for our clients to do well and do good, but not pay a premium for that,” added Bassett.

Although the idea of socially responsible ETFs that focus on environmental, social and governance (ESG) is not relatively new, it’s still struggling to break into the investment mainstream, particularly within the U.S. Socially-responsible investing may be turning a corner, however, as demand for ESG fixed income products exceeded supply in Europe, according to new research by Cerulli Associates.

The report revealed that inflows into ESG fixed-income products surpassed $11.4 billion the last two years, but a shortage of benchmark indexes that measure ESG-focused criteria makes it difficult for its inclusion in the asset class. However, an influx of new ESG products into the market over the next few years like USSG could help appease increased demand in the U.S.

Furthermore, while ESG ETFs are still vying for market share in the ETF space, it appears to be progressing with the advent of new products meeting demand. In fact, sustainability is one DWS’s four core values, not only from an investment perspective, but also as a financial market participant.

USSG is an expansion of the Xtrackers suite of ESG ETFs, which also includes the Xtrackers MSCI ACWI ex USA ESG Leaders Equity ETF (NYSE Arca: ACSG), the Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF (NYSE Arca: EMSG) and the Xtrackers MSCI EAFE ESG Leaders Equity ETF (NYSEArca: EASG).

USSG seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI USA ESG Leaders Index. In order for companies to be included in the fund, the methodology includes a comprehensive screener that filters out alcohol, weapons, gambling, and other controversial products or activities.

For more market trends, visit ETF Trends.