By Jason Chen, Member of the DWS Research Institute

In a previous blog post, “Emerging markets now and always (Part 1)”, we highlighted a few qualitative and quantitative reasons as to why Emerging Marketsequities may be less risky than often perceived by market participants. Investing in a basket of well-diversified countries has historically resulted in lower average risk (in terms of volatility) for the MSCI Emerging Markets Local index than some of its developed markets peers. The benefits of investing across countries could potentially be demonstrated when measuring the riskiness of an Emerging Markets equity portfolio as more and more countries are added.

In emerging markets now and always (Part 2), we will expand on some of these ideas as well as lay out the case for Emerging Markets as a potential strong portfolio diversifier. Portfolio diversification is foundational to building robust strategic asset allocations, which are the primary building blocks of long term risk adjusted returns for some investors. The case for maintaining allocations to Emerging Markets equities in an appropriate size is tantamount to strategic investing.

Portfolio diversification

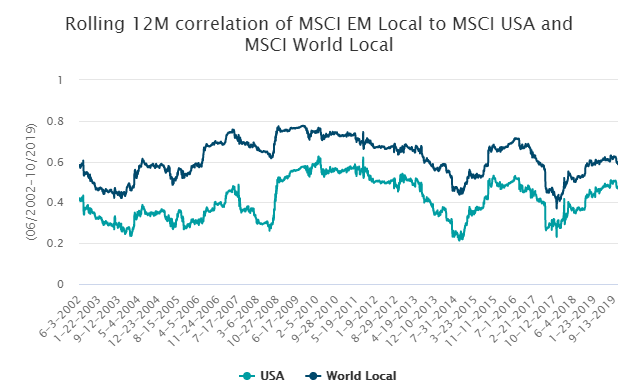

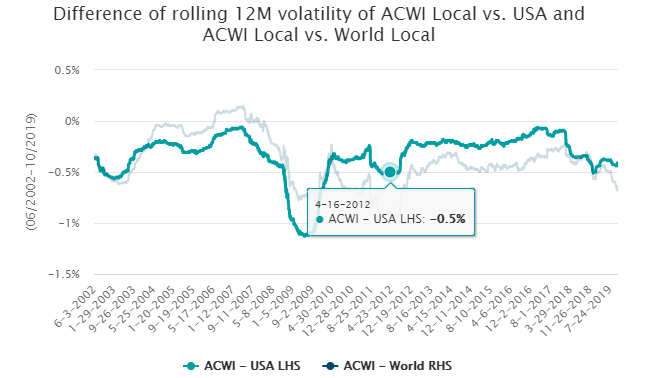

A foundational principle of modern portfolio theory is that diversification can reduce risk. In other words, under certain conditions, adding assets with lower correlations to an unlevered portfolio may reduce the volatility of that portfolio. On a rolling 12-month basis, the correlation of MSCI Emerging Markets Local Index to either MSCI USA Index or MSCI World Local Index demonstrates the diversification of EM against developed equity markets (see Figure 1). As a result, Figures 2 and 3 show that since 2001, MSCI All Country World Local Index—which includes EM—has experienced lower volatility than MSCI USA Index 100% of the time over the same timeframe, and has been less volatile than developed markets (MSCI World Local) 92% of the time over the same period. While the volatility reduction of including EM (ACWI – World) was small, the risk reductive effect appears relatively stable. We believe the smaller scale may also be symptomatic of the small 12% weighting of EM within ACWI.

Source: Bloomberg. MSCI as of October 2019. May not be indicative of future results. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. It is not possible to invest directly in an index.

Source: Bloomberg. MSCI as of October 2019. May not be indicative of future results. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. It is not possible to invest directly in an index.

Source: Bloomberg. MSCI as of October 2019. May not be indicative of future results. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. It is not possible to invest directly in an index.

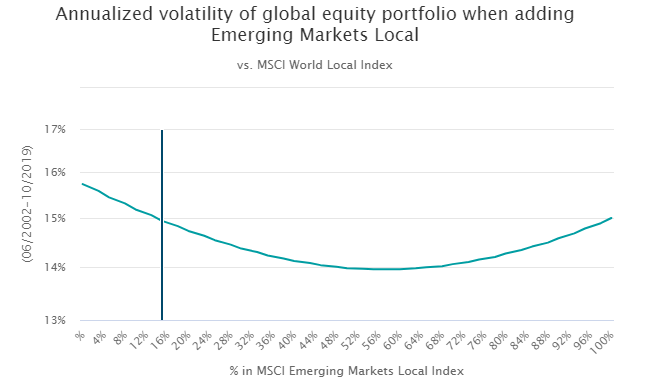

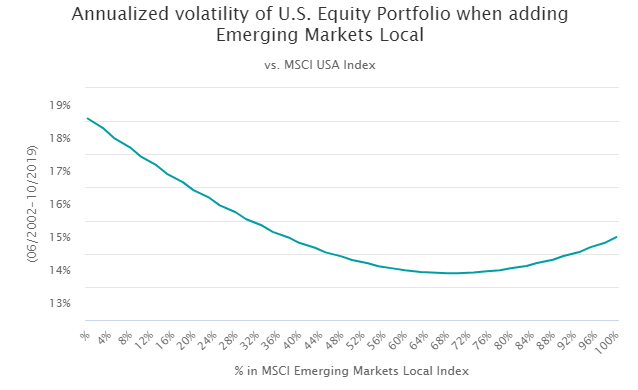

In principle, though there are no guarantees, increasing the weighting of EM within an equity portfolio from the 12% weighting in ACWI may help to increase the potential power of EM diversification in reducing risk. To observe the potential risk reductive effect, we have added, for illustrative purposes, EM to a Global Developed Market equity portfolio, and constructed 41 two asset portfolios consisting of MSCI Emerging Markets Local and MSCI World. The portfolios range from 0% allocation to EM (100% in MSCI World) to 100% EM (0% MSCI World), increasing by 2.5% increments. Figure 4 shows that, using empirical returns, adding EM to an MSCI World portfolio reduces the volatility of the portfolio from nearly 17% to just under 15%. In fact, we can observe the potential risk reductive effects of increasing EM allocations up to 60% of a global equity portfolio or 70% of a US equity portfolio (see Figure 5). This exercise is not intended to argue for a 60% allocation to EM solely on the basis of risk optimization. It is intended to demonstrate the notable potential diversification benefit to be achieved when adding EM to traditional portfolios.

Source: Bloomberg. MSCI as of October 2019. May not be indicative of future results. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. It is not possible to invest directly in an index.

Source: Bloomberg. MSCI as of October 2019. May not be indicative of future results. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. It is not possible to invest directly in an index.