Until March of this year, credit investors had ten years’ worth of strong returns and low risk. Corporate fundamentals had largely remained resilient in the face of the COVID-19 pandemic. That Corporations have demonstrated capital discipline while investors provided technical support amid a low yield environment, and dovish monetary policy allowed for corporate refinancing.

In a report from DWS, “The Opportunities and Risks of Fallen Angels Investing,” it is said that while strong demand for new issuance has helped corporates navigate this economic downturn, downgrade potential remains a key risk for the investment-grade corporate bond market. More notably, the relevance of “Fallen Angels,” or corporate bonds that are issued with investment-grade ratings but are then downgraded to high yield (below BBB-), remains a high-profile topic. In the first half of 2020 alone, Fallen Angels U.S. debt has totaled $206 billion versus $38 billion for the full year of 2019.

In a report from DWS, “The Opportunities and Risks of Fallen Angels Investing,” it is said that while strong demand for new issuance has helped corporates navigate this economic downturn, downgrade potential remains a key risk for the investment-grade corporate bond market. More notably, the relevance of “Fallen Angels,” or corporate bonds that are issued with investment-grade ratings but are then downgraded to high yield (below BBB-), remains a high-profile topic. In the first half of 2020 alone, Fallen Angels U.S. debt has totaled $206 billion versus $38 billion for the full year of 2019.

Historically, Fallen Angels have provided intriguing opportunities for investors who can be flexible with their portfolios. Thanks to a combination of rules, regulations, and other factors, Fallen Angles have provided selective investors with opportunities to purchase corporate bonds at attractive levels.

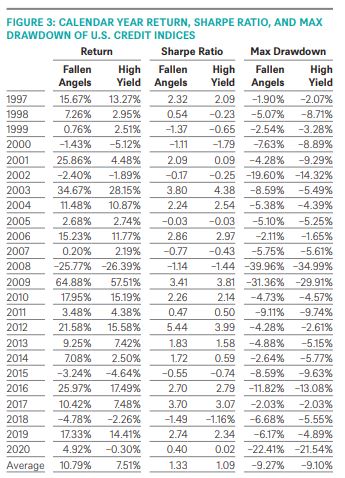

Knowing this, when looking at calendar-year returns (based on information from the report), one can see that Fallen Angels outperformed broad High Yield in 18 of the 24 years (including 2020 through the end of May) and generated a higher Sharpe ratio in 15 of the 24 years. In terms of max drawdown, Fallen Angels only experienced greater maximum return drawdowns in 11 of the 24 months.

In calmer markets, Fallen Angels’ spreads remain tight to broaden U.S. High Yield. This relative spread tightness is consistent with the higher average rating. However, during periods of turmoil, Fallen Angels spreads have, at times, widened to levels higher than the broader High Yield universe despite having markedly higher average credit quality.

Another way of explaining these spikes in relative risk is to look at rolling spread volatility. The next chart shows higher levels of spread volatility for U.S. Fallen Angels in periods of idiosyncratic industry stress such as 2002, 2006, 2008, and 2016.

Another way of explaining these spikes in relative risk is to look at rolling spread volatility. The next chart shows higher levels of spread volatility for U.S. Fallen Angels in periods of idiosyncratic industry stress such as 2002, 2006, 2008, and 2016.

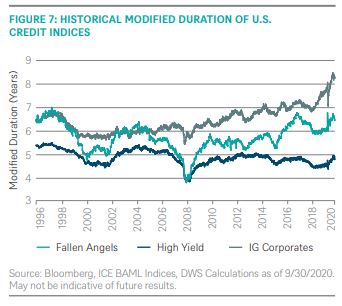

Making these moves challenging is that Fallen Angels’ issues, due to having been issued with investment-grade ratings, are typically longer-dated maturity and therefore longer duration credits than are bonds issued with High Yield ratings. Historically, the index duration of the index has shortened during periods of strong credit fundamentals due to the lack of new “issues” (downgrades, in this case) and the increasing number of bonds trading to call as prices rise. During periods of market stress, however, the index duration has, at times, extended as a function of significant downgrade activity.

Throughout the early and mid-2000s, Fallen Angels have grown to make up nearly 30% of the aggregate high yield market. Considering that history and where things are, the clustered nature of Fallen Angels downgrades results in more dynamic shifts in the industry composition of the Fallen Angels universe. So, investors looking to purchase the Fallen Angels index in its entirety should be aware of this industry concentration risk that has historically been exacerbated in periods of credit stress.

Due to Fallen Angels being downgraded legacy Investment Grade issues, the index’s characteristics will vary from the broader High Yield index in a few noticeable ways. Most obviously, the average credit rating for the Fallen Angels Index will skew heavily toward upper tier high yield as a function of migration from investment grade. As a result of investment-grade issuance, the average duration of a Fallen Angel typically sits somewhere between U.S. High Yield and U.S. IG.

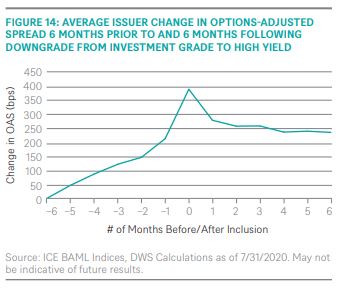

The report suggests a sign of behavioral biases or forced-selling by stricter investment mandates, the month preceding downgrade on average fare very poorly for Fallen Angels corporate bonds.

As the figure below illustrates, the average spread widening for an issuer in this period leading up to downgrade was a whopping 384bps. For investors willing to either hold or buy recently downgraded issues, recovery in Fallen Angel OAS was sharpest in the first month following index inclusion at roughly 110bps. This suggests that despite spread widening leading up to the downgrade, ratings-agnostic, opportunistic buyers of credit are quick to enter the market.

As with any asset experiencing significant price pressure and fundamental weakness, buying Fallen Angels does not come without its own risks. While the average spread recovery immediately following the downgrade has been generally positive for buyers, the potential for buying “falling knives” remains a risk for indiscriminate buyers of these credits. This can be demonstrated through the dispersion in spread activity across the universe of Fallen Angels issuers.

Avoiding exposure to deteriorating credits—either through fundamental investing or through a more systematic approach—can help opportunistic investors invest in Fallen Angels while mitigating the risk of significant drawdown risk and default loss potential.