As trade war fears racked U.S. equities the past week, a move to safe-haven assets was abound, which benefited fixed income securities and bond-focused exchange-traded funds (ETFs). While investors can get core exposure via broad-based bond funds, they shouldn’t forget to add municipal bonds (munis) as part of their fixed income strategy.

It’s not as if munis-focused ETFs were in need of more capital inflows. Of course, they’ll gladly take the money, but 2019 was already a good start for these funds.

“Munis are having a great year in terms of performance and flows,” wrote Brandon Matsui, Fixed Income ETF. Portfolio Manager at DWS. “As high net worth individuals realized that they face higher tax bills as a result of TCJA (Tax Cuts and Jobs Act of 2017), retail demand increased significantly. Year-to-date municipal mutual fund flows are the highest on record since 2009. Many municipal strategy analysts believe this increased demand may persist well after tax day.”

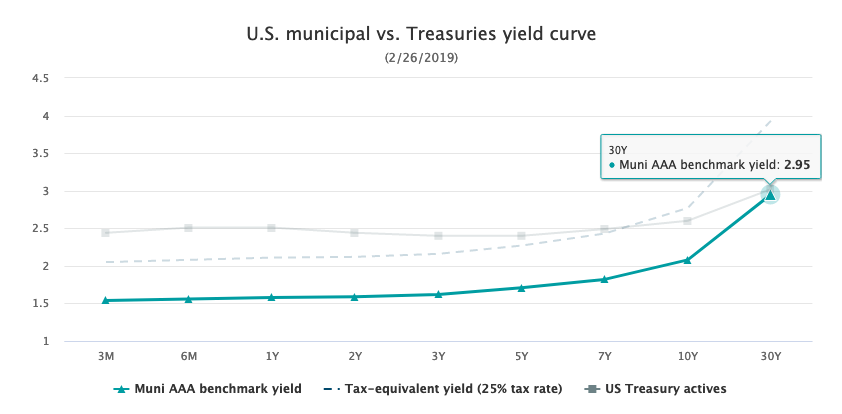

In addition to the tax benefits offered by munis, they’ve been outpacing other bonds like Treasuries at the long end of the yield curve.

“While the Treasury curve is extremely flat, the muni curve is actually quite steep on the longer end. Simply put – longer maturity bonds are offering higher yields,” Matsui noted.

Municipal bonds are a specific corner of the bond market that has its own nuances to be wary of, such as costs and tracking errors. With bond market mavens warning investors of headwinds in the fixed income space like an inverted yield curve, rising rates and BBB debt sliding out of investment-grade, investors need to be keen on where to look for opportunities.

One area is within the municipal bond space, which may have gotten a boost following last November’s midterm elections. In particular, with respect to infrastructure spending—it’s one of the few things, if any, that Democrats and Republicans can agree on, but with the newly-divided Congress, this could fuel municipal bond ETFs.

Still, investors need to be aware of the costs associated with investing in this fixed income space, as well as certain tracking errors that could arise with respect to their prices.

A pair of municipal bond ETFs to consider are the Vanguard Tax-Exempt Bond ETF (NYSEArca: VTEB) and iShares National Muni Bond ETF (NYSEArca: MUB). Another is the Xtrackers Municipal Infrastructure Revenue Bond Fund (NYSEArca: RVNU), which seeks investment results that correspond generally to the performance of the Solactive Municipal Infrastructure Revenue Bond Index comprised of tax-exempt municipal securities issued by states, cities, counties, districts, their respective agencies, and other tax-exempt issuers.

With bond market mavens warning investors of headwinds in the fixed income space like the possibility of an inverted yield curve, rising rates and BBB debt sliding out of investment-grade, investors need to be keen on where to look for opportunities.

For more educational information on municipal bonds, check out the Top 5 Municipal Market Insights, which will cover:

- 2019 municipal market insights from the award-winning team MacKay Municipal Managers

- Potential opportunities for active management in the municipal space

- A closer look at a municipal bond asset allocation strategy

- How financial advisors can incorporate munis into a diversified fixed-income portfolio

- Advantages of an ETF vehicle in the municipal bond space

For more market trends, visit ETF Trends