Smart beta ETF adoption has grown in recent years as the space begins to gain more attention from investors and particularly, advisors who must advise clients on the use of these funds in their respective portfolios. However, one of the challenges they’re still facing is the complexity in explaining how these funds work and what their strategies entail.

Ignites Research, a sister company of Financial Advisor IQ in the Financial Times stable, conducted a study that entailed speaking to 895 financial advisors from across the U.S. for research conducted in January and March 2019. The top challenge identified was the complexity of strategies these funds employ.

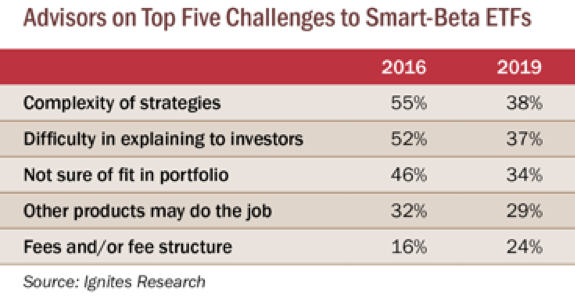

“While some advisors may believe they’ve reached their limits on these products, another element slowing sales is the host of problems that advisors associate with the products — problems that fuel advisors’ skepticism,” a Financial Advisor IQ article noted. “Chief among these are the complexity of the strategies (cited by 38% of advisors), difficulty in explaining smart beta to investors (37%), and uncertainty in how to fit them into portfolios (34%). These three obstacles are connected as they can compound each other.”

Furthermore, a participating advisor in the Ignites Research study noted: “Multifactor ETFs can be impressive, but sometimes they’re so complicated that I can’t find a place for them in portfolios.”

“Smart beta is the new moniker for market timing based on a back-tested algorithm that may or may not work in the future,” said David Haraway, a financial advisor with LPL in Colorado Springs, CO. “The more complex, the better, because your target market may not recognize it for what it is.”

Education and Low Costs to the Rescue

Smart beta is gaining more traction in the capital markets and in order for that to continue, it will have to be a two-punch combination of lower fees and education that will drive more awareness moving forward.

“There are probably several drivers behind increased adoption, but I think the elephant in the room is lower fees,” said Bernie Nelson, chief research advisor at Style Analytics, in Pensions & Investments. “Most smart beta and factor products are being positioned between traditional active and very low-cost, nondiscretionary passive, in terms of fees as well as active risk. From a fiduciary perspective, there has to be an obligation to examine whether a lower-fee product could provide an appropriate investment solution.”

Fees, alone, don’t represent the sole driver for smart beta adoption. More education on these smart beta strategies is making investors more aware of what their uses are in a portfolio.

For more market trends, visit ETF Trends.