![]() By Kostya Etus, CFA, CLS Investments

By Kostya Etus, CFA, CLS Investments

Values-based investing has been making headlines and growing a lot of assets recently. What is it? There are many definitions, and it can mean something different to everyone. But, I believe the following are some unifying classifications:

- Socially Responsible Investing (SRI) is the “old school” or “traditional” values-based investing strategy. It is referred to as “exclusionary” screening, as the methodology is to exclude stocks from an index. These are typically “sin stocks,” such as those in the tobacco, alcohol, and firearms industries. The strategy dates back decades and really became popular in the 1980s as investors wanted to divest from the South African economy to pressure the government to end apartheid.

- Environmental, Social, and Governance (ESG) is the “new school” values-based investing strategy. It is referred to as “inclusionary” screening, as the methodology is to include companies that exhibit favorable traits, including:

- Environmental — reducing fossil footprint, managing resources wisely, etc.

- Social — respecting human rights, culture, workplace equality, product safety, etc.

- Governance — stewardship for shareholders, transparent, accountable, etc.

- Impact investing is the “future school.” It is the investment in companies that specifically benefit the world, environment, communities, etc. For example, working towards the United Nations Sustainable Development Goals. These goals include, but are not limited to, eradicating poverty and hunger, promoting good health, quality educations, gender equality, clean water, and clean energy.

Since impact investing is a relatively new concept, and there are not many publicly traded investment options, my comparison will be between SRI and ESG.

SRI has received a bad reputation over the years. One negative connotation is that investors pay a higher expense for a screen that still leaves them with market-like exposure, and thus, consistent underperformance versus the broad market. The second belief is that SRI investments tend to be negatively correlated with the energy sector (since many oil companies are screened out). So, much of the performance can be explained by moves in oil prices.

ESG looks to address these issues through its inclusionary process. The thesis is that ESG is a risk factor attributable to historic returns. This factor is a component of quality within companies. More stable and profitable companies:

- Have money to spend on bettering the environment,

- Care about their employees,

- And, have diversified boards of directors that keep their shareholders in mind.

Therefore, these companies should perform better over time. Specifically, they should have more confident management that could be able to weather market downturns and potentially avoid lawsuits from financial and environmental wrongdoing.

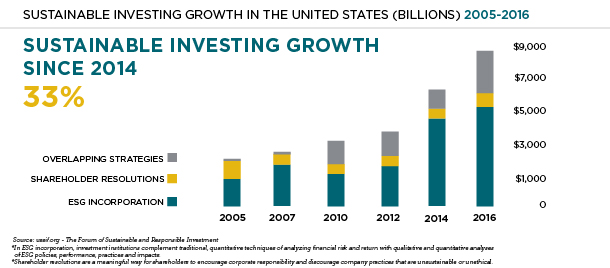

As you can see in the chart above, sustainable investing has shown strong growth of 33% since 2014. We believe this growth may continue as more values-conscious millennials begin saving for retirement. And, we believe ESG will be increasingly important to financial advisors and asset managers. Please stay tuned as CLS is currently working on a new white paper on ESG investing that will summarize current published research and include our own research showing the benefits and evolution of ESG.

Kostya Etus is a Portfolio Manager at CLS Investments, a participant in the ETF Strategist Channel.