For most investors, two key factors are likely at the forefront of any portfolio discussion: long-term health and proper risk management.

While methods for monitoring these important aspects of the investment process have been around for decades, traditional metrics may be missing some of the surging risks in the market as of late. In particular, climate issues threaten to upend decades of risk modeling and potentially leave investors woefully underprepared for the future.

Climate change in focus

Climate risks may currently be overlooked, or at least thought of as a future concern that can be dismissed for now. That may not be the case anymore, given some of the recent history and data from NOAA’s National Centers for Environmental Information.

Their research showed that the U.S. sustained 14 separate billion-dollar disasters in 2018, giving the country a five-year average of 12.6 billion-dollar disasters a year. This represents a sizable uptick from the long-term average (1980-2018) which came in at just 6.2 events per year (CPI-adjusted).1

It isn’t just a question of frequency; events have also arguably become more potent. At least, that is a potential takeaway from NOAA and the National Centers for Environmental Information’s research on average annual event costs. For 1980-2018, the CPI-adjusted figure came in around $42.8 billion, while the last five years saw a $99 billion per year average. This suggests that recent weather events have been roughly twice as damaging—from an economic perspective—than they have been on average over the past few decades.

Global impact

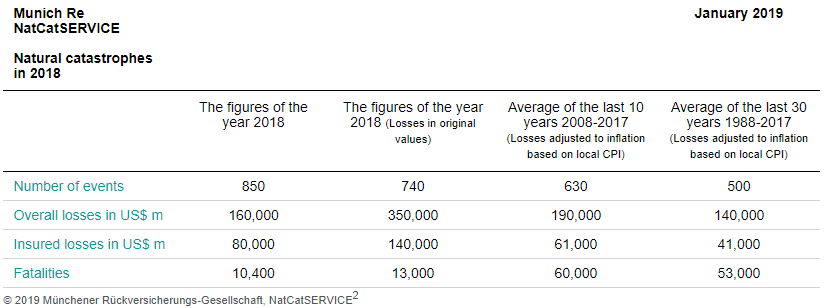

Global numbers are hardly more encouraging, as they arguably show a similar trend. According to MunichRe, global losses approached $160 billion and there were close to 850 natural catastrophes in 2018. It may be helpful to compare the near term and long run averages in their data below to get a better sense of this troubling trend:

2018 was severe when compared to the long-term average, both from a number of events and insured losses (CPI-adjusted) perspective, and it comes on the heels of a stunning 2017 which saw $350 billion in damages. This was due in large part to the year being the costliest in U.S. history.3 In some respects, this makes 2018 seem like a “down year”, but that may be the real troubling part of the trend.

A “good year” in the future—one with seemingly lower relative levels of damage—might be on par with some of the most damaging years of past decades. That was the case for the past two years, and it could be a sign of what is to come if climate change continues, or even intensifies, in the years ahead.

Enter a new way to potentially mitigate risks: ESG

More frequent and violent weather events are becoming the norm and this may be putting an increasingly large burden on those tasked with risk management. This isn’t just a worry for those in the insurance industry either, as climate issues can cascade into a variety of sectors. Plant shutdowns, energy disruptions and consumer impacts must be considered under this new type of risk, particularly if trends continue.

This suggests that, if climate risk remains a problem, a lack of consideration of threats on this front could be doing investors of all backgrounds a disservice, but especially those who have extremely long time horizons. This reality might be part of the reason more institutional investors are starting to think about sustainability and ESG from an investing perspective.

In a recent survey of institutional investors and consultants by RBC Global Asset Management, 67% of respondents believed that integrating ESG factors can help mitigate risk.4 This impressive number also represents a dramatic increase from just a year ago when the same figure was below 50%. It is possible that recent events are shaping perceptions on ESG investing and demonstrating that these kinds of factors may need to be considered for today’s investing world.

ESG may be necessary for modern portfolio management

In the same RBC survey, 72% of respondents said that they somewhat or significantly use ESG principles as part of their investment approach and decision making process. With such high buy-in from many institutional investors already—and not to mention the increased importance of sustainability in today’s more volatile world—it is hard to argue that consideration of ESG is a choice and not a necessity any more.

To prepare for this reality, it may be time to think of ESG as a risk-mitigation tool for the 21st century. While it is unlikely to insulate a portfolio from all of the effects of climate change, it could offer a more accurate risk picture. And with climate issues becoming increasingly inseparable from broad portfolio risk, any risk-aware investor may need to take it into consideration to build a portfolio ready for the challenges that may come from a changing climate.

1. NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2019). https://www.climate.gov/news-features/blogs/beyond-data/2018s-billion-dollar-disasters-context

2. https://www.munichre.com/site/corporate/get/params_E1716525033_Dattachment/1707976/munichre-natural-catastrophes-in-2018.pdf

3. https://qz.com/1181319/disasters-2017/

4. http://global.rbcgam.com/resources/documents/cgri/esg-executive-summary-2018.pdf