It’s no secret that yield is hard to come by nowadays, which is causing fixed income investors to search for alternate sources beyond stocks and bonds. However, in a recent MarketWatch article, Nick Maggiulli, COO for Ritholtz Wealth Management LLC, cited other opportunities that investors should consider in their search for income.

“Most investors rarely venture past stocks and bonds when creating an investment portfolio. And I don’t blame them. These two asset classes are quite popular and are great candidates for building wealth,” Maggiulli wrote in a blog post.

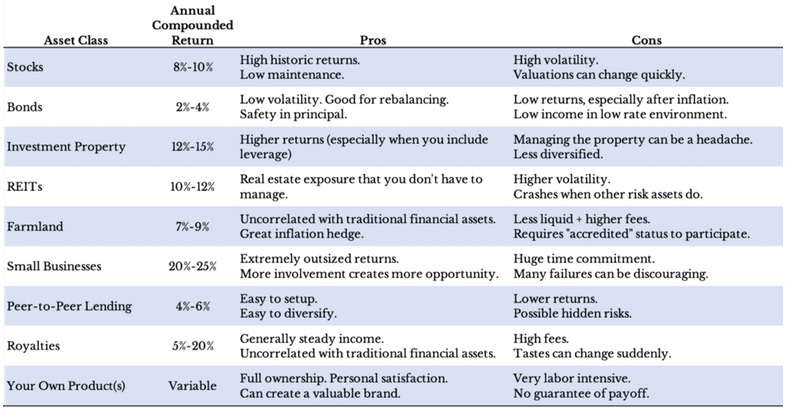

Maggiulli came up with seven other options where investors can look for income sources, such as investment property, small businesses and real estate investment trusts (REITs):

“If I had to pick one asset class to rule them all, stocks would definitely be it,” Maggiulli wrote in his post on Tuesday. ” Of course, is it possible that the 20th Century was a fluke and future equity returns are doomed? Yes, but I wouldn’t bet on it.”

In times of low yields like today’s bond landscape, it can help to tilt your allocation towards fixed income exchange-traded funds with longer durations like the iShares 20+ Year Treasury Bond ETF (NasdaqGS: TLT).

Advantages of adding TLT to your portfolio:

- Exposure to long-term U.S. Treasury bonds

- Targeted access to a specific segment of the U.S. Treasury market

- Use to customize your exposure to Treasuries

As for the fund itself, TLT seeks to track the investment results of the ICE U.S. Treasury 20+ Year Bond Index (the “underlying index”). The underlying index measures the performance of public obligations of the U.S. Treasury that have a remaining maturity greater than or equal to twenty years.

Another fund to consider for long duration exposure is the actively managed First Trust Long Duration Opportunities ETF (NYSEArca: LGOV). LGOV’s portfolio is managed using a disciplined, rigorous and repeatable combination of top-down macro-economic views coupled with bottom-up security selection.

LGOV seeks to generate current income with a focus on the preservation of capital by investing at least 80% of its net assets, including investment borrowings, in investment grade fixed-income securities that are issued or guaranteed by the U.S. government. With heightened interest rate and equity market volatility, the portfolio managers believe mortgage-backed securities (MBS) are an important piece of a diversified portfolio due to their low correlation to other core asset classes and positive credit quality trends.

For more market trends, visit ETF Trends.