While risks rise in an extended bull market run, international markets may provide greater opportunities, and investors can look to smart beta or alternative index-based exchange traded fund strategies as a way to capture the opportunities and limit the potential risks.

On the recent webcast, Smart ETF Strategies for Building Stronger Portfolios, Samantha Azzarello, Vice President and Global Market Strategist at J.P. Morgan Asset Management, highlighted the increasing risks in an extended bull run. Specifically, the U.S. has experienced a 93-month expansion, assuming the current bull run started in July 2009, whereas the length of an average expansion since 1900 lasted 47 months.

Growth may also begin to slow as the Federal Reserve embarks on a tighter monetary policy. Since the 1980s across five rate hike cycles, the Federal Reserve has raised rates an average 9 times across an average 14 month period. Over these five rate hike cycles, the S&P 500 returned an average 3.1%.

On the other hand, investors may turn to international markets to find greater growth potential. For instance, according to International Monetary Fund projections, nominal GDP global growth is expected to rise to 5.6% in 2017, compared to 4.3% in 2016.

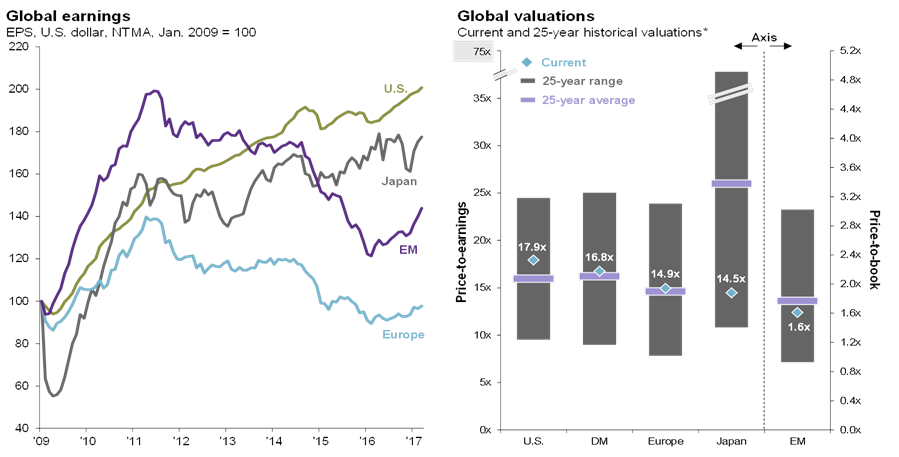

International markets also look relatively cheap, compared to U.S. equities. Specifically, U.S. current valuations of about 17.9x earnings-per-share out stripes the broader developed market’s 16.8x earnings, Europe’s 14.9x, Japan’s 14.5x and emerging market’s 11.6x. Moreover, Japan and the emerging markets are currently trading at valuations below their 25-year historical average.

Considering the ongoing economic growth and momentum in the equities market, Taylor Ranney, Client Portfolio Manager at J.P. Morgan Asset Management, pointed out that J.P. Morgan prefers stocks over bonds. Ranney argued that the U.S. appears poised for trend-like growth with low near-term risk of recession, regional equity markets are supported by today’s more upbeat global growth environment and expects to see stock markets to perform well over 2017.