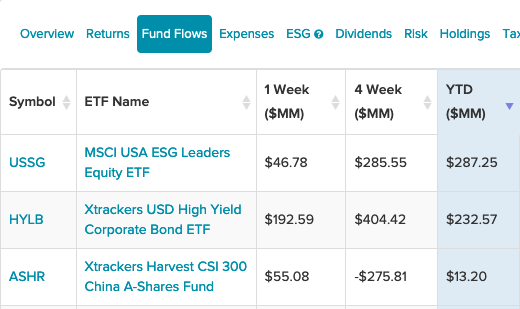

ETF investors can uncover some of the latest investing themes by looking closely at fund flows. ETF issuer DWS is enjoying strong inflows in areas such as ESG, high yield, and China A-Shares investing.

Here are the top three:

MSCI USA ESG Leaders Equity ETF (USSG): USSG was developed in collaboration with Ilmarinen, Finland’s largest pension insurance company. The underlying MSCI USA ESG Leaders Index provides exposure to large- and medium-cap U.S. companies with high ESG performance relative to their sector peers.

USSG includes companies that score in the top 50% of scores in each sector — and so will own about half as many companies as the parent index — then weights those stocks to keep the sector allocation in line with the parent index. The fund excludes companies involved in alcohol, tobacco, gambling, controversial and conventional weapons, nuclear power, and civilian firearms.

Xtrackers USD High Yield Corporate Bond ETF (HYLB): offers broad exposure to “junk” bonds — debt issued by borrowers with a higher risk of default. For taking on the added risk, investors are rewarded with higher yields than those offered on ultra-safe U.S. Treasuries or investment-grade debt issued by the most creditworthy companies. ETFs offer quite a few high-yield options, including active management, so-called “smart” indexing, and even an ETF that screens junk debt based on environmental, social, and government criteria.

At a 0.15% expense ratio, HYLB is competitively priced. In fact, it is much cheaper than its largest rivals: the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and the SPDR Bloomberg Barclays High Yield Bond ETF (JNK). HYLB has also raised significant assets since its 2016 debut and has decent daily liquidity.

Xtrackers CSI 300 China A-Shares ETF (ASHR): ASHR seeks investment results that correspond to the CSI 300 Index. The underlying index is designed to reflect the price fluctuation and performance of the China A-Share market and is composed of the 300 largest and most liquid stocks in the China A-Share market.

The Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) was the first U.S.-listed ETF to offer direct exposure stocks listed in mainland Chinese markets in Shenzhen and Shanghai. Unlike some other ETFs that use derivatives to mimic A-shares, ASHR buys the stocks directly.

ASHR has been the best-performing fund of the trio, with a 17% gain within the last 3 months:

For more news and information, visit the Smart Beta Channel.