Whether an ETF investor is looking for a short-term play or a buy-and-hold fund, ETFs with momentum can be an investor’s best friend. Here are three ETFs from provider DWS that are seeing strong momentum now, which could carry them through the remainder of 2021.

Broad Emerging Markets Exposure

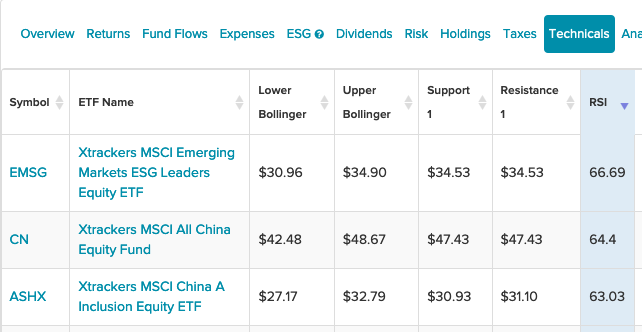

ETF investors looking for broad emerging markets exposure can opt for the Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF (EMSG). EMSG seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI Emerging Markets ESG Leaders Index (the “underlying index”).

The fund will invest at least 80% of its total assets (but typically far more) in component securities (including depositary receipts in respect of such securities) of the underlying index. Using its 3-month chart and a stochastic relative strength index (StochRSI), while the fund is up over 200% from its 50-day moving average, the StochRSI is close to oversold levels, making this a buy based on that indicator.

Riding China’s Recovery Momentum

Chinese equities will be riding a wave of momentum as the country recovers from the Covid-19 pandemic and one strong fund to consider is the Xtrackers MSCI All China Equity ETF (CN). CN seeks investment results that correspond to the performance, before fees and expenses, of the MSCI China All Shares Index.

The fund will normally invest at least 80% of its total assets in securities of issuers that comprise either directly or indirectly the underlying index or securities with economic characteristics similar to those included in the underlying index. Its StochRSI on its 3-month chart confirms its strong momentum at 0.784.

Another fund to look at for Chinese equities exposure in A-Shares is the Xtrackers MSCI China A Inclusion Equity ETF (ASHX). ASHX seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI China A Inclusion Index.

The fund will normally invest at least 80% of its total assets in securities (including depositary receipts in respect of such securities) of issuers that comprise the underlying index. The underlying index is designed to track the equity market performance of China A-Shares that are accessible through the Shanghai-Hong Kong Stock Connect program or the Shenzhen-Hong Kong Stock Connect program.

With a StochRSI at 0.211, this is a fund worth watching as a value-based play. Even at overbought levels over the last three months, the fund has been moving above its 50-day moving average.

For more news and information, visit the Smart Beta Channel.