An exchange traded fund that tracks dry bulk freight shipping rates surged Thursday after a ship logjam in the Suez Canal halted global commerce.

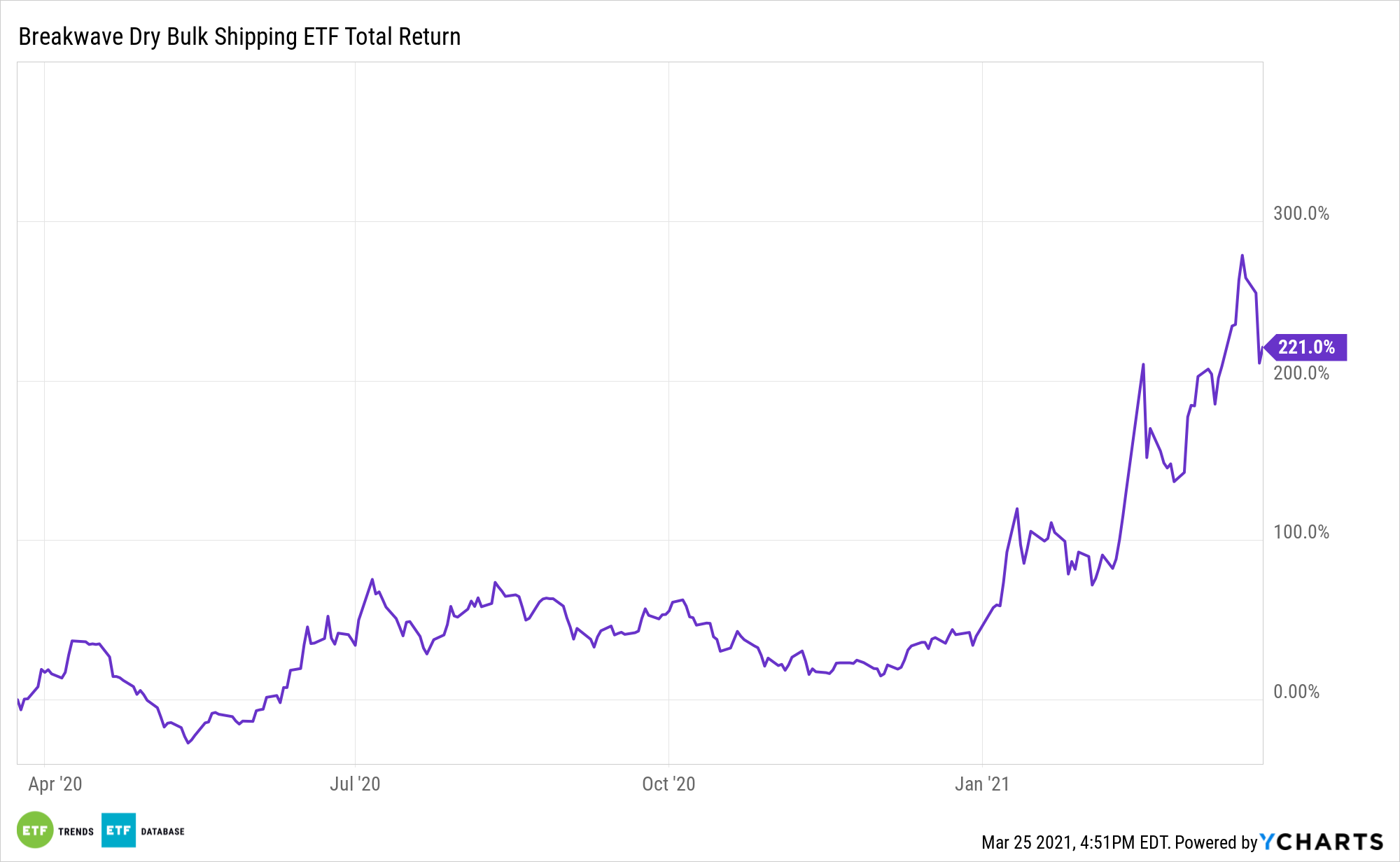

Among the best performing non-leveraged ETFs of Thursday, the Breakwave Dry Bulk Shipping ETF (NYSEArca: BDRY) jumped 10.2%. BDRY has already increased 123.9% so far in 2021.

BDRY tries to provide exposure to the daily changes in the price of dry bulk freight futures by tracking a three-month strip of the nearest calendar quarter of futures contracts on specified indexes that measure rates for shipping dry bulk freight.

Container shipper continued to block all traffic on one of the world’s busiest shipping arteries, the Wall Street Journal reports. The 120-mile Suez Canal connects the Red Sea to the Mediterranean and is a key route for oil and gas tankers. Around one-tenth of the all seaborne oil trade around the world goes through the canal and the associated Sumed—or Suez-Mediterranean—pipeline in 2018.

“The Suez Canal is obviously a very significant part of the global shipping market, as it reduces the distance that ships have to travel between Asia and Europe/N America,” John Kartsonas, Founder and Managing Partner of Breakwave Advisors LLC, said in a note.

The blockage added another setback for global supply chain, which has already been strained by the coronavirus pandemic. Consequently, two of the world’s largest container carriers were considering rerouting ships around the tip of Africa.

“A closure of the Suez Canal, for any reason, is causing a major issue in the logistics of shipping, causing ships to divert, wait longer, or get stuck,” Kartsonas said.

“All of the above are positive for shipping rates, cause disruptions in shipping tend to push shipping rates higher.”

Kartsonas warned that if the flow across the canal stops for weeks then the ships that need to divert themselves or are stuck too would need to be replaced, probably at a higher price.

“For BDRY, such a potential upward movement in rates would be positive,” Kartsonas added. “Fundamentals for dry bulk shipping are already favorable, so this adds further boost to shipping rates.”

For more information on the market sectors, visit our sector ETFs category.