There is clear retail trader euphoric sentiment but they are trend-followers so their behavior is not as interesting to me for contrarian signals. When talking to Financial Advisors, the only fear I see currently is FOMO, the fear of missing out. Their clients are locked in static balanced portfolio’s that are underweight growth and cyclical equities and overweight interest sensitive bonds and stocks at a time when rates have been rising. NOT an ideal combination from my perch. So there’s a decent chance we still have the last inning “chase” to keep up with Indices as they run higher. Then and only then will it really feel like a full 1999 experience.

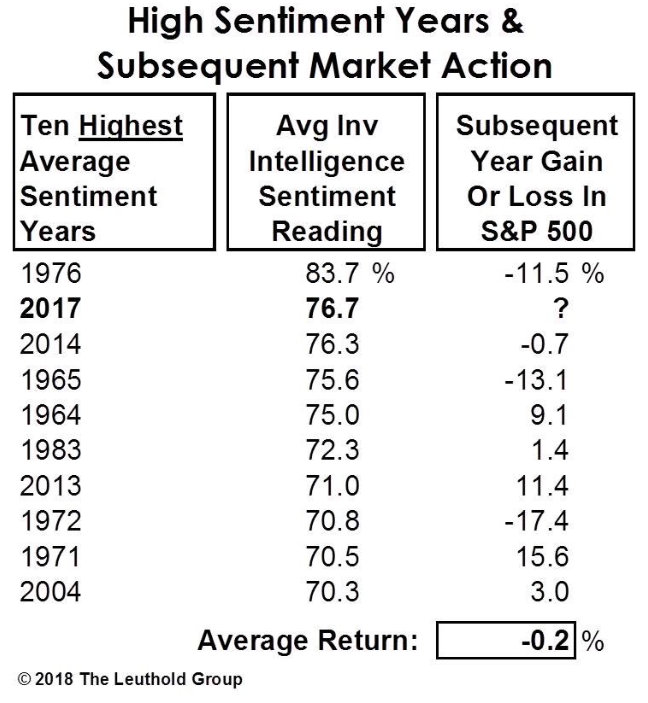

Here’s what the Leuthold Group has to say:

![]()

Bottom line:

Stocks are expensive and as long as sales and earnings are accelerating, they can and should get more expensive. Valuations are rarely a catalyst. Investor sentiment as measured by Leuthold highlights past periods when sentiment was this high. The forward average 12 months gain or loss was basically flat. Who knows what happens for the rest of 2018 but I continue to have a sneaking suspicion that this year’s gains will be achieved by July 4 as earnings expectations get more difficult to beat. Expensive stocks that do not meet expectations often set off a cycle of estimate reductions which is typically NOT bullish for stock prices.

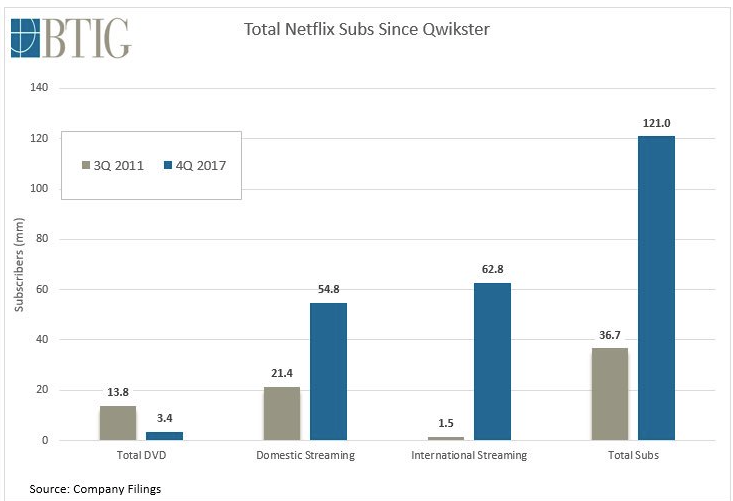

Here’s what REAL growth looks like from a BTIG report: Netflix

Netflix is the top digital entertainment Brand. Netlfix’s subscriber growth is truly breathtaking and the total addressable market opportunity around the globe is enormous. Yes,, the stock is expensive and they have massive content spending commitments but as long as subscriber growth continues, the market seems willing to look-through the current valuation. How dominant has Netflix become in media? Netflix now has more subscribers than all of the cable subscribers in the U.S. Now you see why Disney is buying 21th Century Fox assets for >~$54B? Catch-up can be a very expensive game!

For now, party-on like it’s 1999!

This article was written by Eric M. Clark, Portfolio Manager – Brands suite of investments at Accuvest, a participant in the ETF Strategist Channel.