Many investors have heard of cryptocurrencies and bitcoin, and behind the new development is the blockchain technology that has made it all happen. As companies look for new ways to employ blockchains, exchange traded fund investors can also capture the growth potential through a targeted investment strategy.

During the recent ETF Trends Virtual Summit, an online virtual conference environment where financial advisors learned about current ETF issues, Eric Ervin, President and CEO of Reality Shares, helped explain what the nascent blockchain technology is all about and a way for financial advisors and investors to capitalize on the new development.

Ervin first explained that investors should not confuse blockchain as another name for bitcoins. Bitcoin and other cryptocurrencies are built on the foundation of blockchain, which serves as their shared ledger.

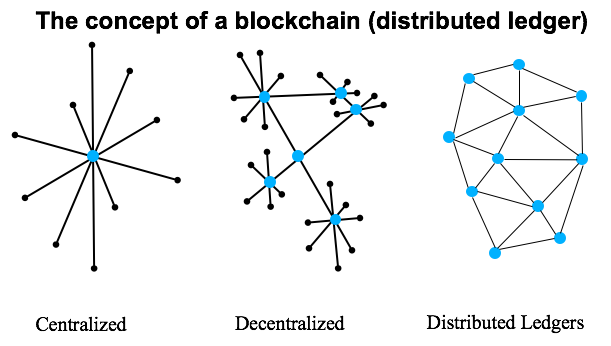

Blockchain technology provides a transparent and secure process to transfer and digitally record information on a shared transaction database through a secure, decentralized, peer-to-peer distributed ledger, which negates the transactional challenges of counterparty trust and the need for a central repository or ledger. It is designed to facilitate the transfer of information or property between users such that the transfer is guaranteed to be secure and known to all participants and shared across a distributed network where the legitimacy of the transfer cannot be challenged.

![]()

Many companies in software services, infrastructure, hardware and financial services, among others, are looking into the blockchain ledger as a means to enhance their businesses.

The blockchain ecosystem potentially presents a long-term investment opportunity in the market today. The technology is still in its infancy, and it could have far-reaching, disruptive effects in nearly every industry.