A recent article by McKinsey & Company argues that there are times when cost cutting and higher prices can hinder a company’s growth and harm its value.

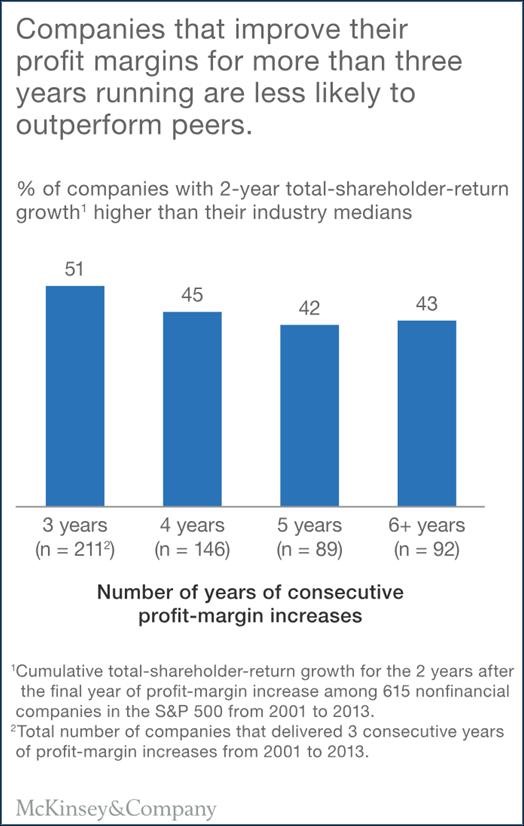

Offering several examples, the article argues how cost cutting can be “counterproductive, starving a company of new sources of growth and undermining performance over the long term.” Offering data from a recent study of 615 of the largest nonfinancial companies (from 2001 to 2013), the article reports that only about half of the companies were able to sustain a margin increase for four or more years, which it says suggests a “low success rate for the total number of potential four-year or longer time periods.” It adds that, the longer companies increased their profit margins, the more likely they were to fall behind their peers in terms of total return to shareholders (TRS).

![]()

The article emphasizes that these results are averages and don’t necessarily apply to all companies, but suggests the following guidelines to help managers “avoid taking margin improvements too far,” including:

- Customer focus: companies should cut costs only when it doesn’t affect customers negatively. It suggests activities such as expediting the closing of the books at the end of each month, streamlining production processes, and upgrading fulfillment tools as examples.

- Competitor focus: Cost cutting that affects a company’s ability to market and sell and meet changing customer needs will “generally hurt performance in the medium to long term.”

- Industry focus: “Before raising prices, managers should conduct a thorough review of their industry-, product- and transaction-level strategies. Finding ways to capture more of the price you already charge by examining discounts, allowances, rebates and other deductions is probably less risky than outright increases in list prices.”

For more investment strategies, visit the Rising Rates Channel.