Wall Street prediction season is upon us. It is the time of year when all the major investment banks and market pundits will issue their 2019 market outlooks. They will tell you what they think will happen in the next year and will even by nice enough to give you exact price targets they think the S&P 500 will reach by year end. Unfortunately for all of us, those predictions won’t be worth that much.

We all would like to be able to predict the future. In an uncertain world, we are hungry for certainty because it brings us comfort. It reduces the anxiety that uncertainty can bring into our lives. This is true in many aspects of our lives, but it is particularly true in the stock market. The stock market is in many ways a perfect storm of uncertainty because it is very unpredictable in the short to medium term and it has a major impact on our future. That combination of impact and uncertainty creates a natural inclination to find ways to mitigate that risk. We yearn for someone to tell us what is going to happen so we can sleep better at night.

And there is no shortage of “experts” who are happy to help us with that. These experts are happy to tell us where the stock market is going in the next year, or what is going to happen to interest rates, or whether now is the time to start buying value stocks. They will not only tell you those things, they will tell you them with a level of conviction that suggests there is no possible outcome other than what they espouse.

The problem, of course, is that more often than not, they will be wrong. Our desire to have certainly when it doesn’t exist leads us to follow the advice of those who claim they can provide it, even if the reality is that they are selling a product they are incapable of delivering.

In his book “Superforecasting”, Philip Tetlock explains it this way:

Open any newspaper, watch any TV news show, and you find experts who forecast what’s coming. Some are cautious. More are bold and confident. A handful claim to be Olympian visionaries able to see decades into the future. With few exceptions, they are not in front of the cameras because they possess any proven skill at forecasting. Accuracy is seldom even mentioned. Old forecasts are like old news–soon forgotten–and pundits are almost never asked to reconcile what they said with what actually happened. The one undeniable talent that talking heads have is their skill at telling a compelling story with conviction, and that is enough. Many have become wealthy peddling forecasting of untested value to corporate executives, government officials, and ordinary people who would never think of swallowing medicine of unknown efficacy and safety but who routinely pay for forecasts that are as dubious as elixirs sold from the back of a wagon.

When the Past is Your Best Guide to the Future

Despite the fact that most short term predictions about the future of the stock market are a waste of your time, that doesn’t mean that the future is completely uncertain. Although we can never predict the future of the market with certainty, we can use the past to help us figure out the odds of what the future might bring.

The concept of using the actual outcomes of the past to understand the odds of events occurring in the future is often referred to as base rate analysis. For example, if I was trying to figure out what stocks have done historically during periods of high inflation, I could look at all the previous periods of high inflation and then look at the range of stock returns during them.

Base rates can be helpful in many areas of investing, but before you use them, it is important to understand what they will not tell you. They will not tell you with certainty what will happen in the future. The past may be the most useful tool in predicting the future, but it is far from perfect. The future doesn’t always repeat the past, so past outcomes are most useful as a guide to understanding the range of possible future outcomes. As the saying goes, history doesn’t repeat itself, but it often rhymes.

Base rates also work much better with more data. That means the more data points you have in the sample you are using and the longer the period of time it covers, the more information base rates will provide you. They are not valuable with small sample sizes. For example, using base rates to try to analyze what happens in bear markets where losses exceed 50% is not very useful because there haven’t been very many of them.

With that out of the way, here are a few examples of where I think base rates can be valuable in investing.

1 – Understanding What You Cannot Predict

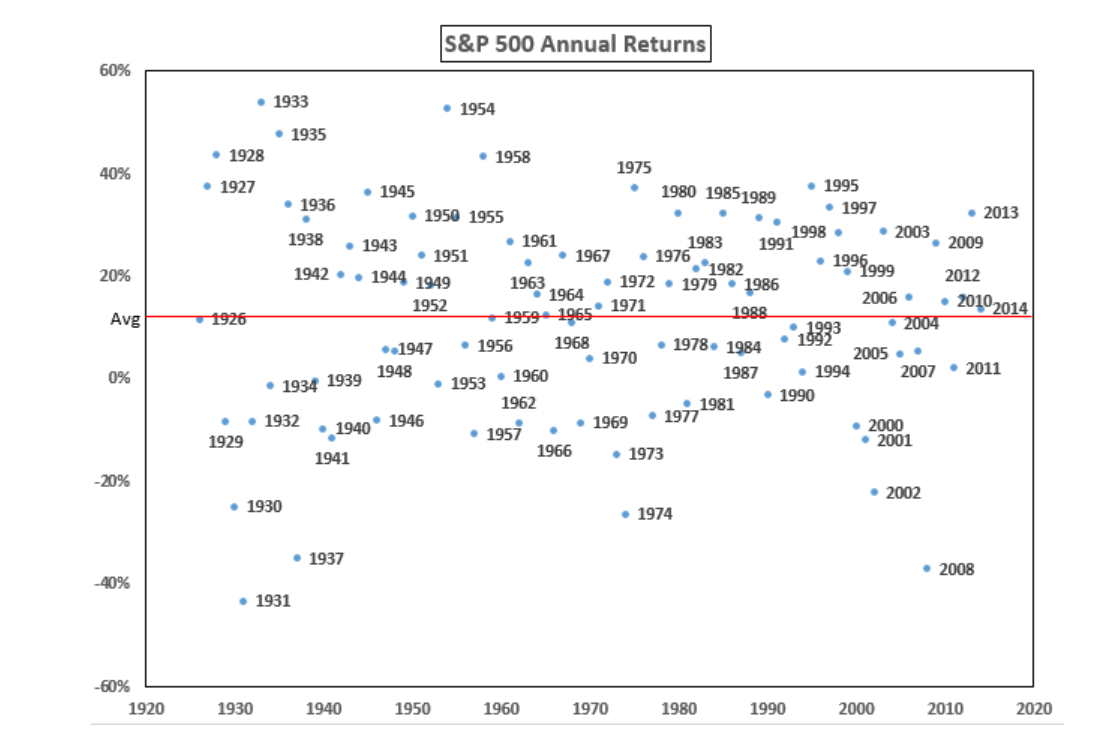

Going back to our initial example of Wall Street predictions for the S&P 500’s return in any given year, base rates will tell us why those predictions offer little value.

Take a look at the following chart: