Guggenheim Investments released a new report entitled “10 Macro Themes to Watch in 2019,” which suggests that a rate pause could help push the S&P 500 to new highs this year.

Without the fear of rising rates, investors can refocus on company fundamentals. Much of the market declines in 2018 were also heavily fueled by news, such as trade wars.

“With a Fed pause helping to alleviate monetary policy concerns, the market will likely turn its focus to fundamentals,” the report noted.

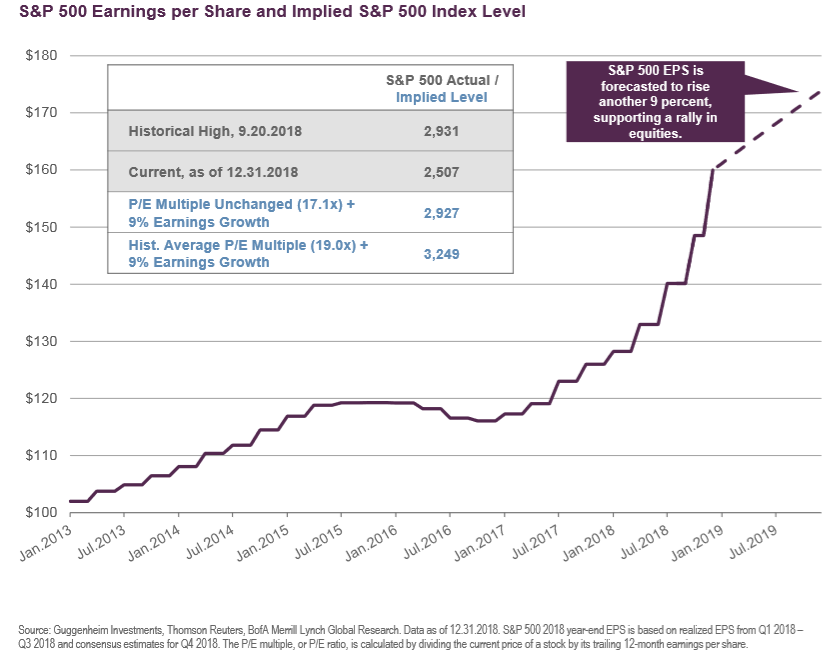

With banks kicking off fourth-quarter earnings this week, investors can also refocus on locating value as opposed to the growth-fueled investments that drove the extended bull run. Additionally, analysts at Guggenheim are expecting earnings to rise by 9 percent in 2019, which is less than the 27 percent in 2018, but still above the historical average.

“The combination of decent earnings growth and a modest recovery in price/earnings multiples will likely push the S&P 500 index to new highs,” the report said.

The S&P 500 went above 2,900 just prior to the volatility-laden months towards the end of 2018. It’s currently trading just over 100 points away from its 200-day moving average.

Fed Patience is Key

A rate pause will certainly rely on a more patient Fed. After four definitive rate hikes in 2018, the Fed is now taking a wait-and-see approach for 2019.