Excerpt from Stanphyl Capital’s letter for the month of November 2018, discussing the higher rates are already killing the U.S. housing market.

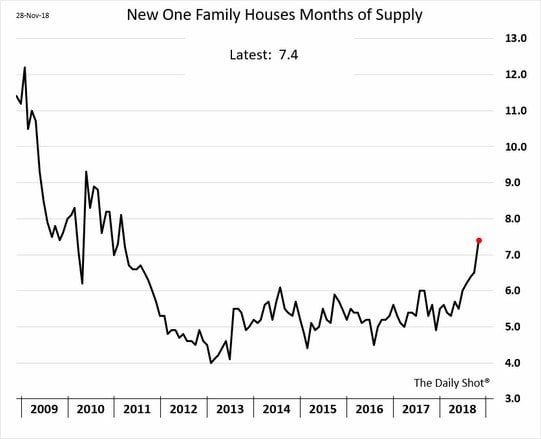

As noted in recent letters, through this entire bull market low interest rates were used to justify egregious earnings multiples on stocks, as well as creating those earnings via cheap mortgages, auto loans, debt-financed stock buybacks, etc., and yet now those rates have stabilized at considerably higher levels and a soaring budget deficit leading to a record amount of issuance combined with $50 billion/month in quantitative tightening and U.S. CPI inflation that now consistently hits or exceeds 2% implies those rates will remain elevated. The 10-year U.S. treasury yield has definitively broken its long-term downtrend and sits at over 3% while the 2-year yield of 2.8% handily bests the S&P 500’s 1.8%, thereby presenting an attractive alternative to an index priced at nearly 22x trailing GAAP earnings. While these higher rates are already killing the U.S. housing market…

…a nearly flat 2-10 curve…