U.S. markets and stock ETFs jumped Tuesday as Congress and the Trump Administration works on the final details of an enormous stimulus package to diminish the economic fallout from the coronavirus pandemic.

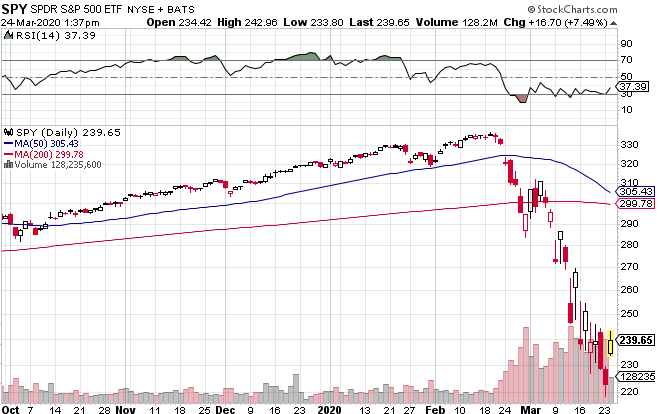

On Tuesday, the Invesco QQQ Trust (NASDAQ: QQQ) increased 6.3%, SPDR Dow Jones Industrial Average ETF (NYSEArca: DIA) rose 8.7%, and SPDR S&P 500 ETF (NYSEArca: SPY) gained 7.5%.

“Fiscal stimulus is absolutely necessary because it directly effects the consumer and consumer spending and consumer confidence is what’s driving the U.S. economy,” Nancy Perez, senior portfolio manager at Boston Private Wealth, told Reuters.

Treasury Secretary Steven Mnuchin and Senate Minority Leader Chuck Schumer (D., N.Y.) revealed they were within closing in on a deal potentially worth $2 trillion in economic aid, the Wall Street Journal reports.

“Markets are definitely reacting to the prospects of a stimulus deal,” Jason Pride, chief investment officer for private wealth at Glenmede, told the WSJ.

Meanwhile, the economy is already finding support from the Federal Reserve after the central bank enacted a number of emergency measures to support credit markets and ensure funding for American businesses and homeowners in face of rising liquidity issues.

The global economy, though, remains gripped by a spreading coronavirus or COVID-19 pandemic. Many are still concerned about the breadth and depth of a pending recession.

“This is classic bear-market moves,” David Coombs, head of multiasset investments at Rathbones Investment Management, told the WSJ. “It doesn’t feel like there’s massive relief and confidence out there.”

Credit Suisse has argued that the markets could bounce back, but there will have to be tangible progress in battling the coronavirus pandemic.

“Markets should quickly regain their footing once newly reported cases peak,” Credit Suisse analysts said. “While entirely necessary, government relief efforts alone will not be enough to establish a market floor.”

SPDR S&P 500 ETF

For more information on the markets, visit our current affairs category.