The majority of the capital market is looking for an interest rate cut by the Federal Reserve to propel the major U.S. indexes, but a sluggish showing in earnings could mean that U.S. equities could be overvalued. Would a less-than-stellar second-quarter earnings showing put international equities over U.S. equities?

“The Fed’s recent signals of an interest rate cut later this month should not be celebrated if it’s accompanied by an earnings–-and possibly an economic–-recession in the U.S.,” Mike Wilson, Morgan Stanley’s chief equity strategist and one of Wall Street’s most bearish analysts, said in a podcast this week.

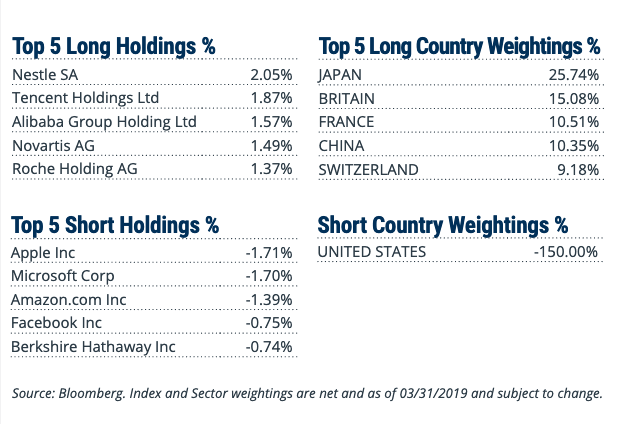

For investors looking to play the international equities over U.S. equities angle, the Direxion FTSE International Over US ETF (NYSEArca: RWIU) gives investors the opportunity to capitalize on this hunch. RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex US/Russell 1000 150/50 Net Spread Index. The FTSE All-World ex US/Russell 1000® 150/50 Net Spread Index (R1AWXUNC) measures the performance of a portfolio that has 150 percent long exposure to the FTSE All-World ex US Index and 50 percent short exposure to the Russell 1000® Index.

On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150 percent and the weight of the Short Component is equal to 50 percent of the Index value. In tracking the Index, the Fund seeks to provide a vehicle for investors looking to efficiently express an international over domestic investment view by overweighting exposure to the Long Component and shorting exposure to the Short Component.

It’s not all doom and gloom for U.S equities with some analysts noting that of all the companies that have reported second-quarter earnings thus far, 79 percent are beating estimates and even notched 4.1 percent in growth. As such, for investors sensing continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

According to a USA Today article, “Even a sharp second-quarter earnings fall would not necessarily mean a recession is in the cards. Earnings slumps in 1998 and 2015-2016 weren’t followed by economic downturns. In the latter, a slide in commodity prices and a rising dollar hurt corporate profits but aided consumer spending – which makes up about 70% of economic activity, says Jim O’Sullivan, chief US economist of High Frequency Economics.”

For more relative market trends, visit our Relative Value Channel.