By New York Life Investments

The following is a summary of our recent “Global Risk Trend & Analysis” report.

Strategic disengagement of the U.S. and Chinese economies, the uncertainties surrounding Brexit, and disruptive risk―which seems permanent in the Middle East―weigh heavily on macroeconomic risks.

U.S. and Chinese economies

On a global scale, the U.S.-China relationship is transforming into a bitter geostrategic competition between the world’s top two economies, strained by a protracted trade war and growing rivalry over security and technology. This strategic disengagement is occurring across multiple dimensions involving trade, data, and geopolitical power projection. Washington grapples with what the Economist describes as “America’s most daunting strategic rival, its biggest economic challenger, and a giant trade partner,” as China undermines established norms and institutions of the open, rules-based, global economic order upon which it has also achieved astonishing economic success for thirty years.

Uncertainty surrounding Brexit

With British Prime Minister Boris Johnson determined to secure an exit deal with the European Union (EU) more than three years after the referendum vote, much of the global business sector has decided that Brexit is underway, however clumsily. The political, economic, and financial uncertainties will only intensify, even as thousands of banking and finance service jobs have left London, and more than $1 trillion in assets have been shifted to Milan, Amsterdam, and other European financial centers. The EU awaits clear commitments from London regarding citizens’ rights, Ireland’s security and stability, EU single market protection, fair competition, and the future of EU-UK security and defense, though the British Parliament remains unable to decide on any single exit option.

Beyond Brexit, long-term trends point to growing national identity movements, which most European political leaders prefer to spurn. Beginning in Germany, many trade-reliant European economies suffer from lowered exports to China, atop years of laggard domestic investment and stagnant productivity leading to prospective recession.

Disruptive risk in the Middle East

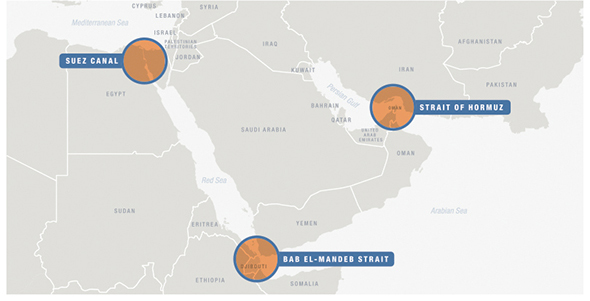

Iran continues to directly challenge the regional order—attacking Saudi oil facilities in that country’s heartland, boarding ships in international waters, and escalating proxy wars in the Persian Gulf and the wider region, directly threatening political stability and global oil and natural gas markets amid three of the world’s most critical strategic chokepoints. As Iran continues to push their agenda forward, we see this type of disruptive risk becoming permanent in the Middle East.

The Iran-Saudi Conflict Impacts Some of the Most Important Transit Choke Points in the World

Source: U.S. Energy Information Administration & Heritage Foundation (based on 2016 data).

Iran’s daring September attack on Saudi Arabia will ultimately fail, given the abundant resilience of global hydrocarbon markets. But increased skepticism in Riyadh and other Sunni Arab capitals about U.S. military reliability in the face of future Iranian assaults may undermine the current regional order—Teheran’s ultimate political objective towards achieving dominance in the Middle East.

The daring and spectacular Iranian-backed missile and drone attacks on Saudi facilities temporarily shocked global energy markets, but Riyadh quickly demonstrated its ability to recover much of the lost production rapidly.

Sluggish global growth

From a broader perspective, the International Monetary Fund (IMF) in September cited rising trade uncertainty as a driving factor for the “sluggish global growth” that describes the state of the world economy. The IMF had earlier lowered its global economic growth forecast by 0.3%, due mostly to the prolonged U.S.-China trade disputes and political uncertainty in Europe. Now, “trade tensions are not only a threat, but are actually beginning to weigh down the dynamism in the global economy.” Adding U.S.-China tariffs “could potentially reduce the level of global GDP by 0.8% in 2020, with additional losses in future years.”

So, what’s next?

The contest for world leadership in the 21st century is underway. Even against the backdrop of China’s astonishing economic rise, ambitious technological reach, and expansive military power, the U.S. enters this contest with enormous advantages. The American people support sustained and strong political institutions, adhere to the Constitution as the legal binding framework for the rule of law, and enjoy an innovative and dynamic economy, abundant and resilient in energy supplies, food security, and natural resources. The U.S. possesses a massive and affluent domestic consumer market, powerful labor and financials markets, and the most powerful military in the history of mankind—sustained by Washington’s deep and enduring alliances and partnerships worldwide.

The contest for world leadership in the 21st century is underway. Even against the backdrop of China’s astonishing economic rise, ambitious technological reach, and expansive military power, the U.S. enters this contest with enormous advantages.

Despite the relative turbulence across the international landscape, these U.S. economic, financial, industrial, political, social, and military advantages are now built into the American system over the past one hundred years of extraordinary achievement and success. But we take no advantage for granted, and we recognize that the international order is quite fragile. America’s success in the U.S.-China relationship will shape not only the economic, political, and military course of China’s future, but also reshape and rebuild the global economic and geopolitical order—direction unknown.

This material represents an assessment of the market environment as of a specific date; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any particular issuer/security. The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

“New York Life Investments” is both a service mark, and the common trade name, of the investment advisors affiliated with New York Life Insurance Company. The MainStay Funds® are managed by New York Life Investment Management LLC and distributed by NYLIFE Distributors LLC, 30 Hudson Street, Jersey City, NJ 07302, a wholly owned subsidiary of New York Life Insurance Company. NYLIFE Distributors LLC is a Member FINRA/SIPC.