Stocks offer great potential for growth over time. However, not all stocks move in lock step. Different categories of stocks move in cycles, each reacting to different economic environments in different ways. Value stocks can perform differently than growth stocks.

Emerging markets may behave differently than developed markets. Investors are constantly looking for ways to take advantage of these cycles, based on certain fundamental views of themes that take place over certain periods, which cause some groups of stocks to outperform relative to others. After all, a traditional asset allocation approach is prudent, and over full market cycles, is certainly a sound approach for the long term. But what if you could do more for your portfolio? What if you could take full advantage of cyclicality in the markets?

Why Use Relative Value Strategies?

WHAT’S THE DIFFERENCE?

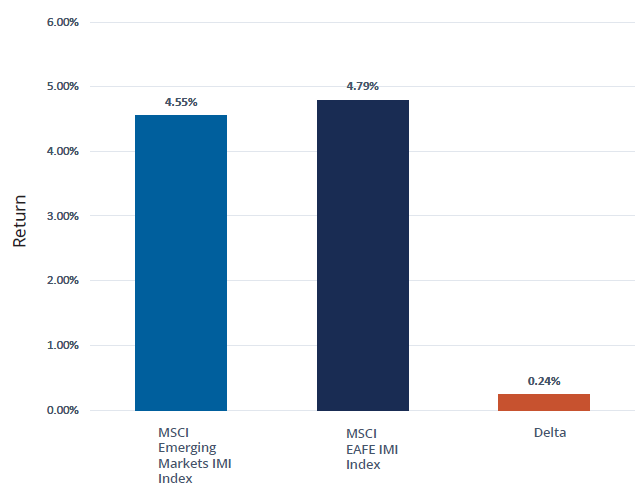

Consider this example of the annualized returns for developed market stocks versus emerging markets stocks from the period of February 1995 through December 2018. On the surface the difference in returns is just under a quarter percent.

Annualized Returns since 1/31/1995 – MSCI Emerging Markets IMI vs. MSCI EAFE

Source: Bloomberg. Date: 1/31/1995 – 12/31/2018. Past performance is not indicative of future results. One cannot invest directly in an index.

Definitions

- Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative.

- Basis point (BPS) refers to a common unit of measure for interest rates and other percentages in finance. Past performance is not indicative of future results. One cannot invest directly in an index.

After nearly 24 years, 24 basis points may seem like a minor difference. So minor perhaps, that it may seem inconsequential to a long-term, asset allocation portfolio whether you choose one over another, especially before considering volatility.

DETAILS CREATE THE BIG PICTURE.

The legendary John Wooden is quoted as saying “…Little things make big things happen”. This may hold weight in the case of relative value investing. This bar chart represents the exact same period as the previous chart (2/95-12/18). The difference is that it details the annual returns, painting a very different picture.

Over time, the more you’re able to take advantage of cyclical relationships between different categories of securities, the more opportunity you’re able to seek. Investors that make the most of these opportunities may be more likely to outperform the market.

The Challenge: Capturing Cyclical Differences in Performance Between Securities

Source: Bloomberg. 1/31/95 – 12/31/18. Past performance is not indicative of future results. One cannot invest directly in an index.

The Challenge: Long-only Limitations

Investors continually consider which group of securities may be poised to move higher or lower, based on any number of economic or capital markets forces. For example, conditions may arise where large cap stocks may benefit from international trade conditions that would create headwinds for small caps, or vice versa. Another scenario may be when currency markets favor one group of economies over others.

But herein lies the conundrum: One of the best ways to take advantage of cyclicality is not only to invest in stocks on the upside, but the ability to access returns from shorting stocks on the downside in order to seek to maximize returns by benefitting from the spread, that is the difference in returns. But for practical or firm-policy reasons, the only options for most advisors are long-only constrained investments.

Challenge Accepted: Access the Short Side.

Introducing Direxion’s Relative Weight ETFs, a suite of exchange traded funds that may provide a simple, cost-efficient, transparent way to potentially profit from specific relative-value investment strategies.

These ETFs track indexes that overweight exposure to a favored group of securities while short selling those in an unfavored group. This allows investors to seek to realize additional return from the favored asset class, while maximizing returns from the performance spread between both asset classes to try to take advantage of the differences in their returns.

How Does Direxion Do It?

FUND OBJECTIVES

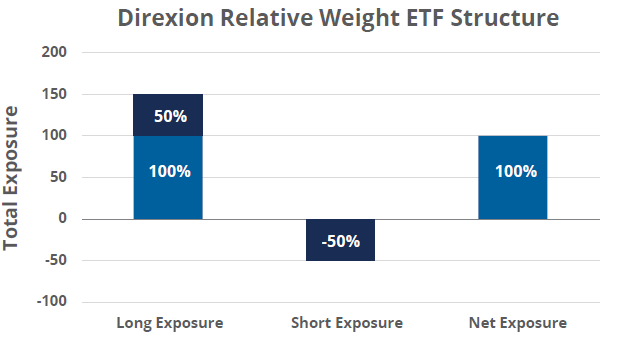

Each Relative Weight ETF is designed to seek investment results, before fees and expenses, which track its benchmark index. Each index tracks the performance of a portfolio that has 150% exposure to the long component, and 50% exposure to the short component. There is no guarantee that the funds will achieve their investment objectives.

On a monthly basis, each index will rebalance such that the weight for the long component will be 150% and the short component will be 50%. To obtain the necessary long and short exposure, Relative Weight ETFs will invest at least 80% of their net assets in the securities that comprise the long component, and in derivatives – typically swaps or futures that provide long and short exposure.

- Long exposure component: 80-100% in physical securities, 50-70% in long total return swap or futures; 150% total long exposure.

- Short exposure component: 50% in short asset class total return swap or futures

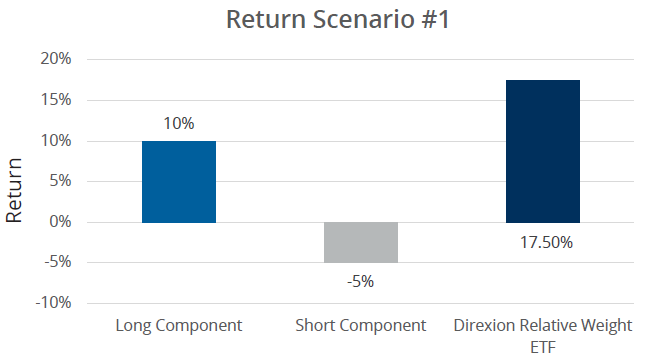

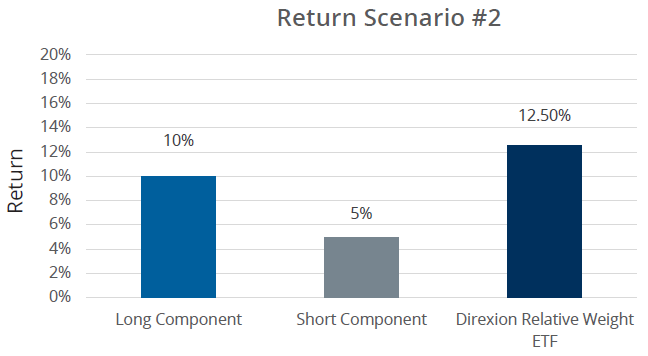

Hypothetical Return Scenarios

Each Relative Weight ETF and its benchmark index has an oppositely-weighted counterpart, i.e. you can take a position in Growth over Value or Value over Growth.

Returns are calculated by the following simple formula, before fees and expenses:

Targeted Fund Return = Long Component Return + (Long Component Return – Short Component Return) x 0.5)

Direxion’s Relative Weight ETFs provide relative outperformance as long as the long component outperforms the short component. When your macro view is correct, the strategy rewards you compared to only implementing the long side of the trade.

Direxion’s Relative Weight ETFs seek to outperform traditional long only strategies by taking advantage of spreads in various asset classes. Market conditions which favor one asset class over another may lead to outperformance by utilizing a relative weight strategy as compared to a long only strategy.

These charts are hypothetical in nature, do not reflect the daily operating expenses and financing charges, and are not representative of actual Relative Weight ETFs returns. They reflect just two potential scenarios out of many.

Direxion Relative Weight ETFs.

For investors constrained to long-only investment parameters – by practicality or by policy – Relative Weight ETFs potentially deliver access to greater return:

- from both long and short return streams,

- without the need for additional capital,

- in a cost-effective, transparent, liquid structure

- within a 100% net exposure structure

- without the need for a margin account.

Investors can apply these products to their existing asset allocation strategies to seek to potentially profit during a variety of market conditions.

Relative Weight ETFs provide:

- Single-product efficiency for relative value investment strategies

- Higher return potential from exposure to performance of both long and short return streams

- A way to take advantage of an overweight position without being exposed to restrictions associated with products that have a greater than 100% net exposure

- Greater capital efficiency to fine tune desired allocation to the relative value point of view

Relative Weight ETFs: Another Breakthrough from Direxion.

Direxion equips investors who are driven by conviction with ETF solutions built for purpose, and fine-tuned for precision. These solutions are available for a broad spectrum of investors, whether executing short-term tactical trades, investing in macro themes, or building long-term asset allocation strategies. Direxion’s reputation is founded on developing products that precisely express market perspective and allow investors to manage their risk exposure.

Fund List:

- Direxion Russell 1000® Value Over Growth ETF

- Direxion Russell 1000® Growth Over Value ETF

- Direxion Russell Large Over Small Cap ETF

- Direxion Russell Small Over Large Cap ETF

- Direxion MSCI Cyclicals Over Defensives ETF

- Direxion MSCI Defensives Over Cyclicals ETF

- Direxion MSCI Emerging Over Developed Markets ETF

- Direxion MSCI Developed Over Emerging Markets ETF

- Direxion FTSE Russell US Over International ETF

- Direxion FTSE Russell International Over US ETF

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Relative Weight ETFs Risks – Investing involves risk including possible loss of principal. The ETFs’ investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in or shorting securities or other investments. There is no guarantee that the returns on an ETF’s long or short positions will produce high, or even positive returns and the ETF could lose money if either or both of the ETF’s long and short positions produce negative returns. Please see the summary and full prospectuses for a more complete description of these and other risks of the ETFs.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 646-569-9363 or click here. A Fund’s prospectus and summary prospectus should be read carefully before investing.