Unemployment data keeps on taking the wind out of the sails of a market rally as U.S. equities couldn’t build off the strength of the most recent run. The number of unemployment filings continues to reflect the economic impact of the coronavirus.

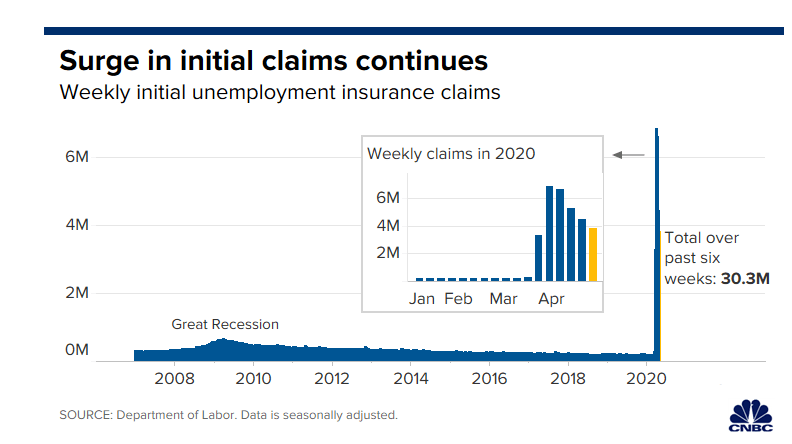

“First-time filings for unemployment insurance hit 3.84 million last week as the wave of economic pain continues, though the worst appears to be in the past, according to Labor Department figures Thursday. Economists surveyed by Dow Jones had been looking for 3.5 million” a CNBC report noted.

“Jobless claims for the week ended April 25 came in at the lowest level since March 21 but bring the rolling six-week total to 30.3 million as part of the worst employment crisis in U.S. history. Claims hit a record 6.87 million for the week of March 28 and have declined each week since then,” the report said further. “Last week’s initially reported figure was revised up by 15,000 to 4.4 million, meaning that the most recent total is a decrease of 603,000.”

The rise in claims comes as the gross domestic product contracted 4.8% during the first quarter, according to a government report on Wednesday. As the equities market tries to rebound, more data could tamp down any further gains moving forward.

Can the U.S. equities market slough off the latest unemployment data as businesses reopen and a sense of normalcy returns? If so, this all this creates an opportunity for investors to capitalize on the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI).

RWUI features:

- Seeks investment results, before fees and expenses, that track the Russell 1000®/FTSE All-World ex-US 150/50 Net Spread Index (the “index”).

- The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in securities that comprise the Long Component of the index or shares of ETFs on the Long Component of the index.

- The index measures the performance of a portfolio that has 150% long exposure to the Russell 1000® Index (the “Long Component”) and 50% short exposure to the FTSE All-World ex-US Index (the “Short Component”).

Investors looking to play the other side with weakness in the U.S. equities market can use the Direxion FTSE International Over US ETF (NYSEArca: RWIU) to capitalize on international equities will outdoing U.S. equities. RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex-US/Russell 1000 150/50 Net Spread Index, which measures the performance of a portfolio that has 150 percent long exposure to the FTSE All-World ex-US Index and 50 percent short exposure to the Russell 1000® Index.

For more market trends, visit ETF Trends.