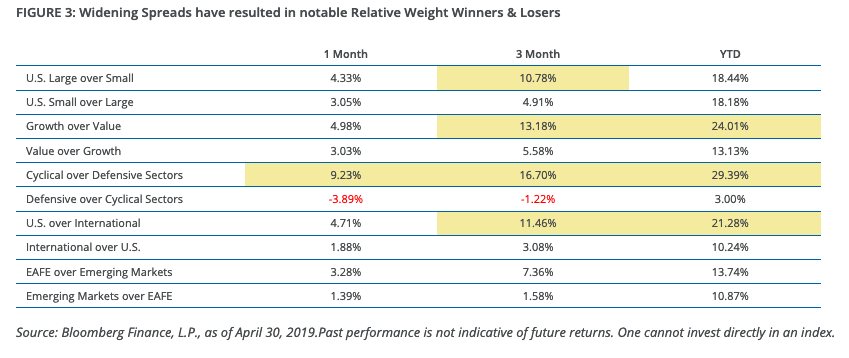

Even before a volatile climate in May, large cap equities were already outperforming small cap equities, according to the latest “Relative Weight Spotlight” by Direxion Investments.

“While Large Cap and Small Cap stocks show very similar returns through the close of business on April 30, leadership shifted from Small Caps to Large Caps in a noticeable way,” noted the Direxion Investments post. “Through the month of January, Small Caps provided almost 3% in outperformance relative to Large Caps. Whether it was driven by a flight to quality, or simply market leadership from Large Cap Technology names, Small Caps gave all of this outperformance back over the trailing three months.”

For investors looking for ideal safe haven assets during the U.S.-China trade war are better off looking at large cap equities over small cap equities, according to Jill Carey Hall, the resident small cap stock expert at Bank of America. Hall said that small cap fundamentals are suspect and as such, should be avoided if a prolonged trade war continues.

“A lot of these companies are suppliers to the big multinationals. Many of them have been highlighting the impact of trade on calls this earnings season,” said Hall. “A lot of these companies might not be able to be as nimble about shifting their supply chains or pricing that through.”

The Russell 2000–the index primarily associated with small cap equities–is up 21 percent since December’s sell-off during a volatile fourth quarter in 2018. However, the index is in correction mode with a drop of 12 percent after hitting a high last summer.

“Small cap earnings have been coming in in-line with expectations. You’ve seen much fewer beats. You’ve seen negative earnings growth,” said Hall. “Typically, you would think of small caps as higher growth companies, but expectations have been really ratcheted down.”

Small cap equities were practically neck and neck with large cap equities during the month of April. Year-to-date performance for U.S. equities have been fueling both large cap and small cap stocks, as both jockeyed for position during that month.

From a year-to-date standpoint, it’s the S&P 500 edging the Russell 2000 with the edge, but can this trend sustain itself?

For investors looking for continued upside in large cap equities over small caps, the Direxion Russell Large Over Small Cap ETF (NYSEArca: RWLS) offers them the ability to benefit not only from large cap equities potentially performing well, but from their outperformance compared to their small cap brethren.

Conversely, if investors believe that small cap equities will outperform large cap equities, the Direxion Russell Small Over Large Cap ETF (NYSEArca: RWSL) provides a means to not only see small cap stocks perform well, but a way to capitalize on their outperformance versus their large cap brethren.

For more relative market trends, visit our Relative Value Channel.