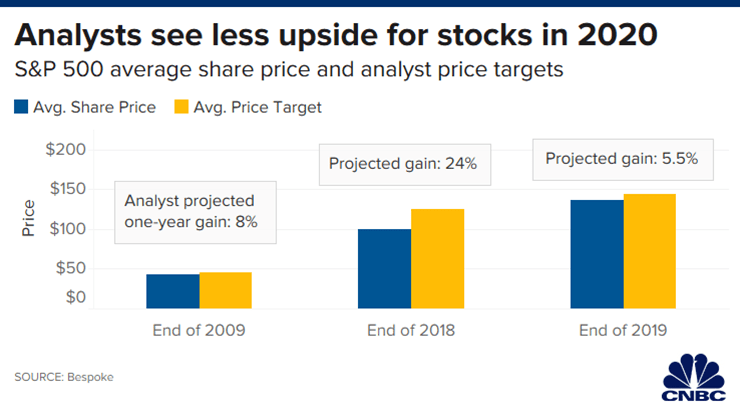

U.S. equities were sitting on top of the throne in 2019 like King Midas with a golden year of gains, but 2020 could be the year where stocks turn into King Modest. An analysis by Bespoke Investment Group compiled projections from various market analysts and the results show less bullishness for 2020 compared to years before.

Average price projections for various companies revealed in the analysis that a 5.5% upside is expected for 2020. This forecast spanned across various sectors.

“Tech, Health Care, Utilities, Financials, and Consumer Staples are all less than 5% below their price targets, which is a stark difference from last year when stocks were anywhere from 10 to 20% below their price targets,” Bespoke said in a note to clients.

Overseas Options in 2020

Sometimes the only way up is out and that means looking beyond U.S. equities if investors want to not only diversify their portfolios with international equities, but to also generate higher gains. Moreover, investors can also trade the macro trend of international over U.S. equities with relative value ETFs.

The Direxion FTSE International Over US ETF (NYSEArca: RWIU) gives investors the opportunity to capitalize on their hunch that international equities will outdo U.S. equities. RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex US/Russell 1000 150/50 Net Spread Index–the FTSE All-World ex US/Russell 1000® 150/50 Net Spread Index (R1AWXUNC) measures the performance of a portfolio that has 150 percent long exposure to the FTSE All-World ex US Index and 50 percent short exposure to the Russell 1000® Index.

On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150 percent and the weight of the Short Component is equal to 50 percent of the Index value. In tracking the Index, the Fund seeks to provide a vehicle for investors looking to efficiently express an international over domestic investment view by overweighting exposure to the Long Component and shorting exposure to the Short Component.

On the flip side, for investors sensing continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

RWUI features:

- Seeks investment results, before fees and expenses, that track the Russell 1000®/FTSE All-World ex-US 150/50 Net Spread Index (the “index”).

- The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in securities that comprise the Long Component of the index or shares of ETFs on the Long Component of the index.

- The index measures the performance of a portfolio that has 150% long exposure to the Russell 1000® Index (the “Long Component”) and 50% short exposure to the FTSE All-World ex-US Index (the “Short Component”).

For more relative market trends, visit our Relative Value Channel.