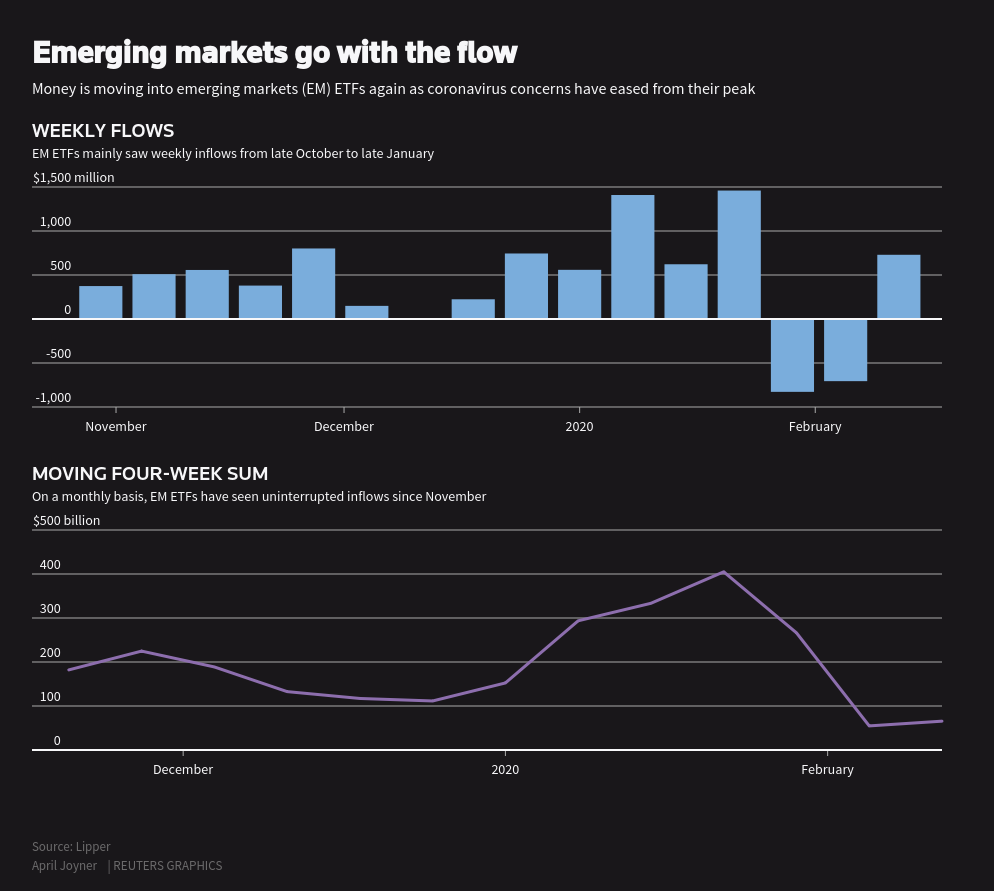

Confidence restored in emerging markets (EM) assets could be well on its way as the effects of the coronavirus stark to weaken. After weeks of significant outflows in EM ETFs, the pendulum could be swinging in EM’s favor.

Per a Reuters report, “nearly $730 million flowed back into emerging markets exchange-traded funds (ETFs) in the past week, according to Lipper, after two straight weeks of outflows that accompanied sharp declines in the stocks and currencies of developing countries.”

“The MSCI Emerging Markets Index .MSCIEF, which measures stock performance, has rebounded 4% from its early February low, though it remains down on the year,” the report added. “Another index measuring emerging markets currency performance .MIEM00000CUS was still sharply lower, reflecting the slide in a range of currencies from Asia to Latin America.”

“The valuations are really compelling, and we were seeing signs of an economic recovery,” said Robert Phipps, director at Per Stirling Capital Management. “Once the coronavirus is put on pause, I think that will become the primary trend again.”

For investors looking for the continued upside in emerging market assets as the effects of the coronavirus weaken, the Direxion MSCI Emerging Over Developed Markets ETF (NYSEArca: RWED) offers them the ability to benefit not only from emerging markets potentially performing well, but from emerging markets outperforming developed markets.

RWED seeks investment results that track the MSCI Emerging Markets IMI – EAFE IMI 150/50 Return Spread Index. The Index measures the performance of a portfolio that has 150 percent long exposure to the MSCI Emerging Markets IMI Index and 50 percent short exposure to the MSCI EAFE IMI Index.

Getting Broad Exposure to EM

Investors who want broad exposure to EM can look at funds like the Vanguard FTSE Emerging Markets ETF (NYSEArca: VWO). VWO employs an indexing investment approach designed to track the performance of the FTSE Emerging Markets All Cap China A Inclusion Index. It invests by sampling the index, meaning that it holds a broadly diversified collection of securities that, in the aggregate, approximates the index in terms of key characteristics.

Another fund to consider is the iShares MSCI Emerging Markets ETF (NYSEArca: EEM). EEM seeks to track the investment results of the MSCI Emerging Markets Index. The fund generally invests at least 90% of its assets in the securities of its underlying index and in depositary receipts representing securities in its underlying index. The index is designed to measure equity market performance in the global emerging markets. The underlying index will include large- and mid-capitalization companies and may change over time.

For more relative market trends, visit our Relative Value Channel.